Passive income is not just a dream but a journey, a never-ending quest to grow one’s wealth effortlessly. It’s a pursuit I’ve been navigating with fervor, exploring diverse avenues like dividend stocks, real estate ventures, and bonds. Among these, one vehicle shines like a beacon in the fog – exchange-traded funds (ETFs).

I’ve welcomed several income-focused assets into my portfolio, chief among them being the JPMorgan Equity Premium Income ETF (NYSEMKT: JEPI). This ETF, with its promise of a bountiful monthly income stream, continues to capture my interest and investment. Let’s delve into what makes this ETF a standout choice for passive income enthusiasts.

A Beacon of Premium Income Generation

The JPMorgan Equity Premium Income ETF is no ordinary fund; it’s a beacon of active management in the passive income landscape. Designed to offer both monthly income and equity market exposure with lower volatility than the broader market, this ETF has proven its mettle over time. It has consistently outperformed other yield-focused asset classes, delivering premium income to investors.

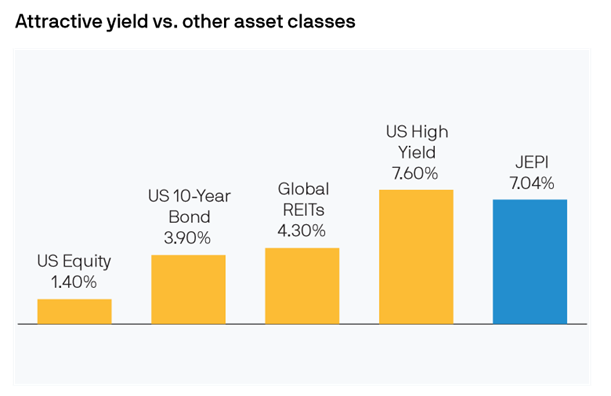

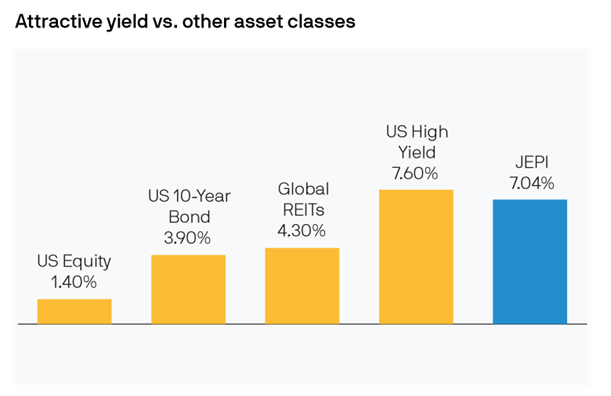

Image source: JPMorgan Asset Management.

As illustrated in the chart, JEPI has rivaled the income yield of the average U.S. high-yield bond over the past 30 days and surpassed it over the last 12 months with an impressive 8.5% yield – more than double that of a 10-year treasury or a real estate investment trust (REIT).

The fund ensures a steady income flow by making monthly distributions to investors, although these payments can fluctuate month by month. Despite this variability, the fund’s overall annual yield since inception has remained enticing.

Despite its active management approach, the ETF boasts a modest expense ratio of 0.35%, ensuring investors retain a significant portion of the generated income.

The Engine Behind Premium Income Production

The JPMorgan Equity Premium Income ETF employs a dual strategy to mint income for its investors:

- A Defensive Equity Portfolio: The fund’s managers meticulously select high-quality dividend-paying stocks through a bottom-up fundamental research process, forming the core of its income generation strategy.

- A Disciplined Options Overlay Strategy: By writing out-of-the-money call options on the S&P 500 Index, the fund generates monthly distributable income, adding a lucrative dimension to its revenue stream.

The ETF’s defensive equity portfolio boasts over 100 holdings, with notable positions including:

- Progressive: This insurance stalwart accounts for 1.7% of the fund’s net assets, offering a dividend yield of 0.5%.

- Trane Technologies: The HVAC manufacturer holds a 1.7% share in the portfolio and currently yields 1.1% in dividends.

- Microsoft Corporation: The tech juggernaut represents 1.7% of the fund’s assets and pays a dividend yielding 0.7%.

- Amazon: Another heavyweight in the portfolio, contributing significantly to its composition.

- Amazon: The e-commerce giant comprised 1.7% of the fund’s net assets. It doesn’t currently pay a dividend.

- Meta Platforms: The social media behemoth comprised 1.6% of the fund’s holdings. It recently initiated a dividend and currently yields 0.4%.

The fund also holds a few higher-yielding dividend stocks, including top-10 holdings ExxonMobil (3.2%) and AbbVie (3.8%). These holdings provide the fund with dividend income and price appreciation potential.

The other piece of its portfolio is out-of-the-money call options written on the S&P 500. These options generate premium income as they expire each month, which the fund distributes to investors. Option premiums are higher when volatility spikes, so the fund can generate more call option premium income during periods of market volatility. That also helps offset the equity portfolio’s volatility.

The fund aims to outperform the S&P 500 total return index by delivering high income returns from the monthly cash distributions and solid value appreciation as the stocks in the portfolio rise. It also aims to achieve those returns with less volatility than the broader market.

An exemplary Choice for Passive Income Seekers

The JPMorgan Equity Premium Income ETF has done an exceptional job delivering a premium passive income stream to fund investors. While the monthly payment ebbs and flows with the income generated by options and dividends, it has produced a higher yield than most income-focused investments over the past year. Furthermore, it does that while reducing risk and volatility. Those aspects make it a remarkable addition to my passive income portfolio, which is why I keep acquiring shares of this high-yielding ETF.

Is JPMorgan Equity Premium Income ETF a Worthwhile Investment?

Before delving into stock investments in JPMorgan Equity Premium Income ETF, ponder upon this:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks for investors to consider now… and JPMorgan Equity Premium Income ETF didn’t make the cut. The 10 selected stocks have the potential to yield substantial returns in the forthcoming years.

Stock Advisor furnishes investors with an easy-to-follow roadmap for success, offering guidance on constructing a portfolio, regular updates from analysts, and two new stock picks monthly. Since 2002, the Stock Advisor service has tripled the return of the S&P 500*

*Stock Advisor returns as of April 15, 2024