Chip stocks including Nvidia Corp NVDA, Broadcom Inc AVGO, Intel Corp INTC, Arm Holdings plc ARM, Advanced Micro Devices, Inc AMD Credo Technology Group Holding CRDO, Lattice Semiconductor Corp LSCC, Microchip Technology Inc MCHP, Marvell Technology, Inc MRVL, MACOM Technology Solutions Holdings MTSI, Micron Technology, Inc MU, Qualcomm Inc QCOM, Qorvo, Inc QRVO, United Microelectronics Corp UMC are trading lower Monday in sympathy with contract chipmaker Taiwan Semiconductor Manufacturing Co TSM.

Taiwan Semiconductor stock took a hit after the U.S. Department of Commerce instructed the chipmaker to cease supplying China with sophisticated chips—of 7 nanometers or more advanced designs—that support AI and graphics processing capabilities.

The U.S. move sent jitters across the sector, anticipating further actions from President-elect Donald Trump’s administration, which had previously attacked the U.S. Chips Act and Taiwan, the hometown of Taiwan Semiconductor.

Also Read: Monday.com Stock Tanks Despite Q3 Beat, Raised Outlook

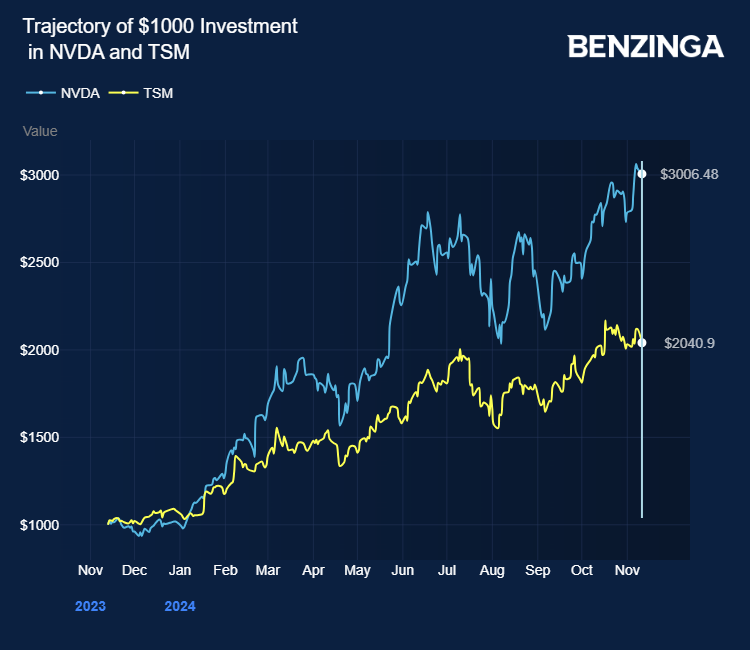

Taiwan Semiconductor is a crucial supplier to tech giants like Apple Inc AAPL and Nvidia.

The semiconductor stocks also got a hit from Edgewater Research analysts, flagging Monolithic Power Systems MPWR, which faced a significant setback and sent its stock plunging on Monday.

The analysts noted Monolithic’s allocation to Nvidia’s Blackwell GPUs is in jeopardy due to performance problems with its Power Management ICs.

The analysts highlighted that Japanese company Renesas and German firm Infineon have stepped in, receiving rush orders, potentially replacing Monolithic in Nvidia’s B200 and GB200 SKUs.

Edgewater expressed concern that supply chain partners perceived Monolithic’s temporary solution as a stopgap measure rather than a complete fix.

Investors can gain exposure to semiconductor stocks through VanEck Semiconductor ETF SMH and iShares Semiconductor ETF SOXX.

Price Action: At the last check on Monday, NVDA stock was trading lower by 1.67% to $145.19, INTC was down 4.16%, and ARM was down 4.07%.

Also Read:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs