Today witnessed a further decline in Chinese stocks’ performance as bleak economic updates exerted pressure on the sector. An unexpected dip in China’s exports during March cast a dark shadow on hopes for a revival in the world’s second-largest economy.

The significance of exports in the Chinese economic landscape cannot be overstated, contributing approximately 19% to the nation’s overall Gross Domestic Product (GDP). Regarded as a beacon of hope in light of a struggling Chinese consumer base and a frail domestic economy, downturns in exports pose significant concerns.

The latest data revealed a 7.5% plunge in exports last month, coupled with a 1.9% dip in imports – figures that markedly fell short of economists’ predictions.

This disappointing news cast a pall over Chinese stocks, with Alibaba (NYSE: BABA) sliding 4%, JD.com (NASDAQ: JD) shedding 5%, and PDD Holdings (NASDAQ: PDD) witnessing a 3.8% decline by 2:23 p.m. ET.

Image source: Getty Images.

Continued Economic Struggles in China

Since the onset of the pandemic, the Chinese economy has grappled with challenges stemming from stringent COVID-19 restrictions curtailing consumer spending, sluggish vaccine distribution, and unmet expectations of a rapid recovery as China relaxed its zero-COVID restrictions early last year.

The recent export report further underscores the prevailing weaknesses in China, dampening the prospects of a swift economic rebound. Meanwhile, a downturn in U.S. stocks accompanied this, as major banks reported mixed quarterly results and hinted at potential adverse impacts from high interest rates.

Comparatively, Alibaba boasts a more extensive international presence than many Chinese companies, catering to Southeast Asia via Lazada and other global markets through AliExpress. Nevertheless, the firm’s fortunes remain closely tied to consumer and enterprise demands in China, with its domestic e-commerce platforms, Tmall and Taobao, contributing roughly half of its revenue.

JD.com faces a situation akin to Alibaba’s. Its once-robust growth has been stifled since the pandemic, struggling to compete against agile online platforms like Pinduoduo (PDD) and Bytedance, which aggressively discount and seize market share from JD.com.

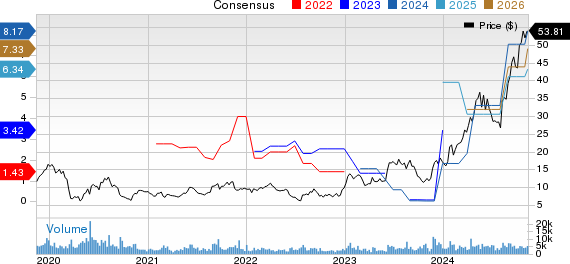

Lastly, PDD stands out within the trio, with its revenues soaring due to impressive growth at Pinduoduo and the standout performance of Temu, rapidly garnering market share in the U.S. and other international markets with enticing pricing strategies.

Assessing Chinese Stock Viability

Investors in Chinese stocks have endured setbacks in recent years, and although valuations appear attractive, lingering risks persist as evidenced by the bleak export figures. In fact, some risks may be exacerbating. Notably, China’s instruction to telecoms to phase out foreign-made chips signals a potential escalation in the tech rivalry with the U.S. following America’s embargo on tech exports to China.

While this directive may not directly impact e-commerce platforms, they are likely to experience the repercussions of any economic headwinds resulting from the developments. In considering investments in Chinese stocks, PDD seems the most promising among the trio, given its rapid growth and ability to snatch market share from competitors. Nonetheless, given the recent hurdles faced by Chinese stocks, adopting a cautious strategy by taking limited positions appears judicious.

Should PDD Holdings Be Your Investment of Choice?

Prior to committing funds to PDD Holdings, it’s prudent to weigh the advice of the Motley Fool Stock Advisor analyst team, who have pinpointed what they believe are the 10 best stocks for investors presently – PDD Holdings not among them. These selected stocks hold the potential for significant returns in the forthcoming years.

Stock Advisor equips investors with a clear roadmap for success, offering guidance on portfolio construction, analyst updates, and two fresh stock picks monthly. Since 2002, the Stock Advisor service has outperformed the S&P 500 by over threefold.*

*Stock Advisor returns as of April 8, 2024