Last week, Nvidia (NVDA) announced a highly anticipated stock split. This news, in combination with another stellar earnings report, propelled NVDA stock to soar past $1,000 per share. In discussions following this development, the focus has shifted to identifying the next member of the ‘Magnificent 7’ that could potentially follow suit with a stock split.

Big Tech Companies Following Peer Actions

Historically, tech companies have displayed a tendency to emulate each other in various corporate actions. Tesla (TSLA) and Apple (AAPL) both underwent share splits in August 2020, while Amazon (AMZN) and Alphabet (GOOG) executed stock splits in close succession in 2022. This mimetic trend dates back to the dot-com era of the 1990s when technological firms frequently engaged in stock splits amidst remarkable market upswings.

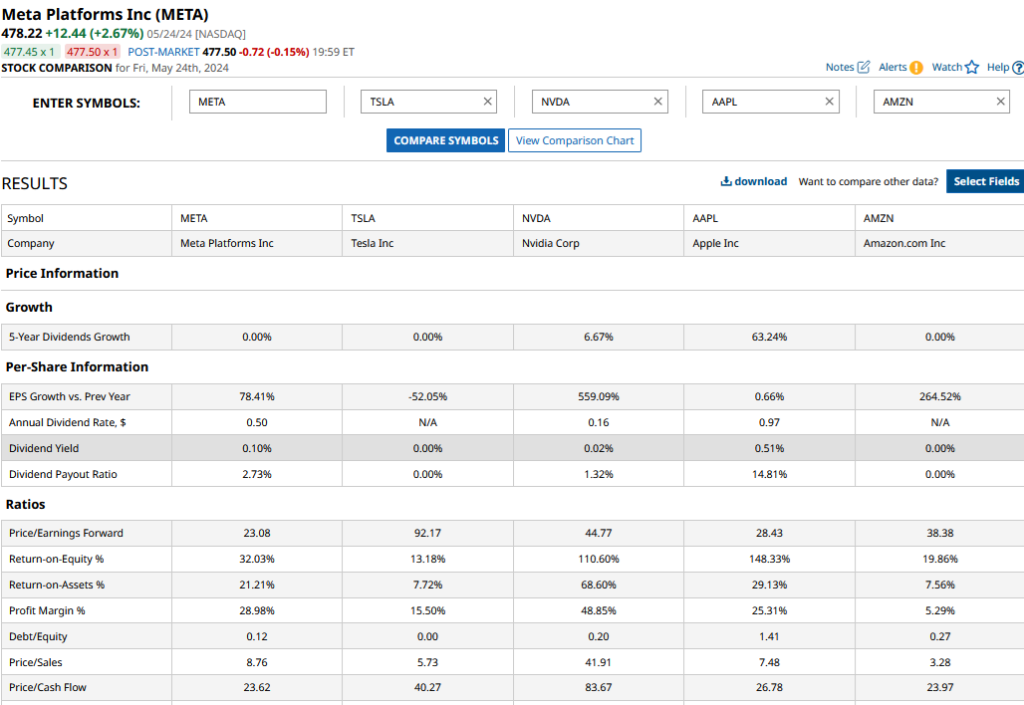

Magnificent 7 companies, including Meta Platforms (META) and Alphabet, have initiated dividends or stock splits following cues from their industry peers. Alibaba (BABA), often dubbed as the “Amazon of China,” also ventured into dividend payments in late 2023. The initiation of dividends has been a topic of discussion within Amazon’s Q1 2024 earnings call, underscoring the industry trend.

Stock Splits: Strategy and Impact

Stock splits typically occur when share prices escalate to levels deemed unaffordable by retail investors. By splitting shares, companies enhance liquidity, enabling wider participation from retail traders. While stock splits do not impact a stock’s fundamental value, sentiments in the market often respond positively to such announcements, driving prices upward. In a market where emotions intertwine with fundamentals, stock splits serve as a strategic move for companies.

Potential Candidates for Future Stock Splits

Among the Magnificent 7, Tesla’s current stock valuation and recent performance likely preclude it from immediate consideration for a stock split. Amazon and Alphabet’s recent 20-for-1 splits in 2022 make them less probable candidates for another split. Similarly, Apple’s 2020 split and current stock price trajectory suggest a stock split may not be imminent.

This analysis leaves Meta Platforms and Microsoft as strong contenders for future stock splits among the Magnificent 7. Microsoft, known for its frequent share splits totaling nine times since its IPO in 1986, stands out as a company potentially poised for another split given its current market cap and stock price.

Microsoft, with a robust market cap exceeding $3 trillion, has proven itself as a top player in the industry. Considering its market standing and share price trajectory, a stock split could be a strategic move to enhance accessibility for retail investors.

Meta Platforms: An Emerging Contender

As the sole member of the Magnificent 7 yet to undergo a stock split, Meta Platforms presents an intriguing case. Despite being a relative newcomer to public markets, having listed only in 2012, Meta Platforms has evolved into a trillion-dollar market cap entity. With its stock price climbing and dividend initiation in progress, a future stock split may be on the horizon as its shares approach the $500 mark.