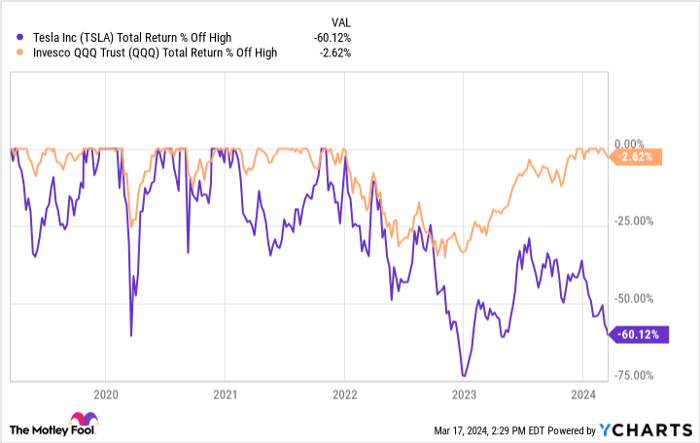

The stock market is currently ablaze with fervor, yet, atypical of its past demeanor, Tesla, the torchbearer of the electric vehicle (EV) domain, stands at an unusual juncture. Tesla’s shares have plummeted by a staggering 34% year-to-date, diverging from the ascent of the Nasdaq-100. The company finds itself 60% adrift from its all-time zenith, juxtaposed against a broad market poised near its pinnacle.

This juncture serves as a crossroads for Tesla’s stock. The optimists contend that this plunge marks an opportune moment for purchase as the company readies itself for its forthcoming growth spurt. Conversely, the skeptics posit that Tesla is inching towards a normalized valuation befitting a manufacturing-centric enterprise.

So, which faction holds sway? Where could Tesla’s stock trajectory lead us to in three years?

TSLA Total Return Level data by YCharts

Expanding Volumes, Constricting Margins

In the realm of volumes, Tesla has continued its upward trajectory in 2023. The company furnished 1.8 million vehicles to patrons globally, a leap from 1.3 million in 2022 and 936,000 in 2021. Such expansive growth, executed at scale, solidifies Tesla’s position as a premier manufacturer not just in the EV segment but within the automobile industry at large. For perspective, the largest auto manufacturer globally, Toyota, crafts slightly over 10 million vehicles annually.

However, this surge in volume has necessitated a price reduction by Tesla. The emphasis has transitioned towards the more economical Model 3 and Y models, priced below the veteran X and S variants. Concurrently, Tesla has opted—perhaps under duress—to slash prices on the Model 3 and Y to bolster volumes. This maneuver is unmistakably evident in the used Tesla market, wherein prices have undergone a precipitous 50% plunge since an earlier peak in early 2022.

Lower prices are echoing into dwindling revenue growth and shrinking margins. In 2023, Tesla witnessed a 19% increase in revenue to $97 billion, which regressed to a mere 3% uptick in the fourth quarter. Gross margins nosedived from 25.6% in 2022 to 18.2% in 2023, with operating income plummeting by 35% over the year. Margins are eroding as Tesla navigates towards amplified global expansion.

TSLA Operating Margin (TTM) data by YCharts

A New Vehicle: The Potential Game Changer?

To tap into a broader customer base, Tesla is likely to unveil a more cost-effective vehicle in the near future. The sales potential of vehicles priced at $40,000 and above seems capped, even with continuous price reductions on the Model 3 and Y across the global spectrum. The global populace with purchasing power for premium EVs remains limited.

The company is gearing up to introduce a new budget-friendly vehicle within the next few years, reportedly slated for 2025 as per an approximate timeline divulged by CEO Elon Musk in a recent earnings discourse. A note of caution: Musk’s timelines tend to be fluid, leaving room for uncertainty regarding the actual arrival of the product in 2025. Nonetheless, it’s plausible to anticipate a fresh Tesla offering hitting the market within the near future.

The introduction of a new vehicle could catapult Tesla’s volumes. However, if this entails a price tag hovering around $25,000, revenue growth may lag behind volume upsurges, as the average selling price of Tesla vehicles continues its downward trajectory. Investors must factor this in whilst projecting Tesla’s revenue potential in the forthcoming years.

Valuation Musings: The Stock’s Persisting Expensiveness

Savvy investors understand that the present earnings of a stock hold little significance compared to its future earning potential. To gauge Tesla’s probable trajectory in the coming years, we must conjecture its financial path. Let’s paint an optimistic scenario—tripling volumes relative to 2023 within three years post the successful launch of its mainstream economical vehicle. With volumes expanded threefold, revenue is likely to double owing to reduced average selling prices.

Lastly, presuming Tesla sustains akin profit margins to 2023 at 9.2%, analogous to Toyota’s operating margins, doubling Tesla’s 2023 revenue to $194 billion with a 9.2% profit margin could yield $17.8 billion in earnings in three years.

Currently, Tesla boasts a market capitalization of $512 billion. Quotienting this by $17.8 billion, we arrive at a price-to-earnings ratio of 29, marginally surpassing the market average. From my vantage point, this suggests that Tesla’s stock might tread water over the forthcoming years. Its valuation, even post this recent retreat, doesn’t veer towards the cheap end and might ensnare investors in a value trap for an extended duration.

If considering a dip purchase, it mandates an exceedingly sanguine outlook on the company’s prospective growth. Should that not materialize, Tesla’s stock risks languishing in subdued waters.

Where to invest $1,000 right now

When our analyst team vouches for a stock, prudence dictates lending an ear. Notably, their two-decade-spanning newsletter, Motley Fool Stock Advisor, has outstripped the market thricefold.*

They’ve unveiled what they perceive as the 10 best stocks for investors to acquire now, with Tesla securing a spot on the list—albeit, there exist nine other stocks that might have eluded your radar.

*Stock Advisor returns as of March 18, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.