There’s one stock that everyone wants to talk about: Nvidia (NASDAQ: NVDA). And for good reason. The stock has gained nearly 1,000% in less than two years, meaning a $10,000 investment in late 2022 would be worth almost $100,000 today.

While nobody can predict what will happen, there are two paths forward for Nvidia. One path is promising; the other is downright terrifying. Let’s dive in and see which is more likely.

Image source: Getty Images.

A Glimpse into the Future: Nvidia Could Be the Next Apple

The bull case for Nvidia goes something like this: Artificial intelligence (AI) is the story of the next 20 years. It will bring changes to the way people interact on a level equal to or exceeding those brought on by the smartphone in the mid-2000s. Therefore, the best historical comparison for Nvidia is Apple in 2004.

Back then, Apple’s hot new product was — wait for it — the iPod. Remember that? The company wouldn’t debut its first iPhone for another three years.

Nevertheless, Apple was already well on its way to becoming the world’s largest company. In 2004, its stock grew by more than 200%, making it the top performer in the S&P 500.

From 2004 until today, its market cap has surged at a compound annual growth rate (CAGR) of 36%. A $10,000 investment made 20 years ago would be worth $4.8 million today.

AAPL total return level data by YCharts.

It would be incredibly difficult for Nvidia to repeat that performance, but it is possible. AI is a fascinating new technology, and 20 years is a very long time, giving the company plenty of runway to live up to the lofty expectations surrounding its stock.

But what about the bear case?

Challenges Ahead: Nvidia Faces Comparison to Oracle in the Dot-Com Era

This is the bear case for Nvidia: AI is a promising technology but overhyped. Due to elevated valuations in AI stocks, a stock market bubble has formed, and when it pops, Nvidia’s stock will feel the pain. In short, Nvidia today is like Oracle in 2000.

To recap, the 1990s were full of hope for the internet. In particular, the stock market went gaga for internet stocks. Valuations soared, not just for brand-new companies but also for legacy tech companies that were cashing in on the internet craze.

In particular, Oracle, whose business revolved around facilitating the transition from mid-century mainframe computers to modern servers for enterprise clients, saw its stock skyrocket in the late 1990s.

Unfortunately for Oracle, expectations ran far ahead of actual sales. At its peak in 2000, its stock traded with a price-to-sales (P/S) multiple of 24, far above its lifetime average of 5.

ORCL PS ratio data by YCharts.

When the dot-com bubble burst in 2001, Oracle experienced an 85% drawdown. The stock has taken over 20 years to recover its pre-bubble high. Those who bought in the summer of 2000 and held through 2020 would have made almost no money on their investment.

The Verdict: A Crossroads for Nvidia’s Future

On the one hand, Nvidia’s P/S ratio has a scary resemblance to Oracle’s in the run-up to its crash in 2001.

ORCL PS ratio; data by YCharts.

That should give pause to any Nvidia bull. Simply put, the stock is so expensive now that some moderation must occur.

The Future of Nvidia Stock: A Cautionary Tale

Nvidia’s Sales Growth and Stock Price

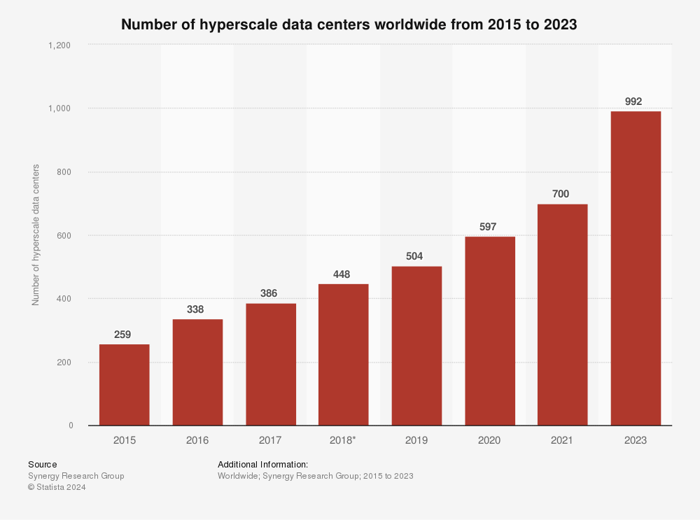

As sales for Nvidia continue to soar, there is a looming question on whether the trajectory is sustainable. Should the ratio stay elevated, or will the stock price take a nosedive? Factors like escalating competition, market saturation, or a slowdown in AI and semiconductor spending could potentially drive down Nvidia’s P/S ratio.

My hunch tells me it’s the latter scenario that might unfold, even though the high-flying party could persist for a considerable period. In any case, exercising prudence with Nvidia stock seems judicious.

When juxtaposed against its mega-cap counterparts, Nvidia lacks a robustly diversified business model. The stock’s robust performance stems from the stratospheric rise in AI and semiconductor expenditure. However, this trend might wane, especially if the economic landscape degenerates or plunges into a recession.

Furthermore, if the demand for AI and semiconductor technologies experiences a slump, Nvidia’s stock might encounter turbulence comparable to Oracle’s tumultuous ride 23 years ago.

Investing in Nvidia: A Tread of Caution

Before plunging into Nvidia shares, it behooves investors to ponder this:

The renowned Motley Fool Stock Advisor analysts have recently pinpointed what they deem as the best 10 stocks for investors to snag presently – with Nvidia not clinching a spot. The 10 handpicked stocks hold the promise of yielding gargantuan returns in the years ahead.

Contemplate a bygone era when Nvidia was heralded on this prestigious list on April 15, 2005… The theoretical scenario envisions investing $1,000 upon the recommendation, translating to a staggering $722,626*!

The Stock Advisor furnishes investors with a straightforward blueprint for success, including counsel on portfolio construction, periodic updates from analysts, and two fresh stock selections each month. The Stock Advisor service has witnessed a whopping quadrupling in returns compared to the S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024