In recent months, the stock market has experienced turbulence, especially with tech stocks showing weakness throughout July and August. The initial excitement surrounding the artificial intelligence (AI) revolution dwindled as the shares of major chipmakers took a post-earnings hit, leaving Wall Street without a solid driving force.

The decline in chip stocks since mid-July, triggered by concerns over their inflated valuations and their ability to sustain tangible revenue growth, drew comparisons to the dot-com bubble of the late 1990s and early 2000s.

AI Development: More Substance, Less Hype

Unlike the speculative business models of dot-com companies, the foundation of AI rests on practical applications. Various industries, from technology to healthcare, transportation, agriculture, and finance, are embracing AI, mitigating the risks of sector-specific bubbles.

Companies across sectors employ AI for product innovation, efficiency, and cost savings, offering more concrete economic benefits compared to the abstract nature of the dot-com era. The existing infrastructure, such as cloud computing platforms, supports the seamless integration of AI technologies—a luxury that was absent during the dot-com frenzy.

AI Market Growth Propelling Chip Stocks

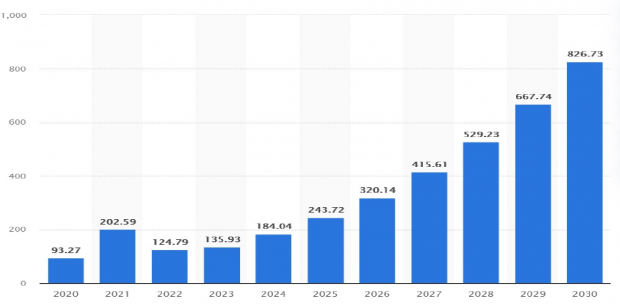

The global AI industry exceeded $184 billion in 2024, marking a nearly $50 billion surge from the previous year. Projections indicate sustained growth, with the AI market expected to surpass $826 billion by 2030.

Key players like NVIDIA, Broadcom, and Taiwan Semiconductor are poised to benefit significantly from this boom. NVIDIA, renowned for its crucial hardware and technologies essential for AI applications, anchors the computer server infrastructure with its GPUs, vital for training large language models and powering AI interfaces.

Meanwhile, Broadcom contributes significantly to the AI ecosystem through products utilized in data centers, critical for AI applications. The company foresees a substantial increase in AI revenues driven by growing demand for custom accelerators in AI data centers.

Taiwan Semiconductor, as a chip manufacturer catering to AI hardware developers, stands to gain from the flourishing AI landscape. Its manufacturing capabilities are indispensable for GPUs—an essential component in data centers fueling the demand for AI applications.

Optimistic Projections for Chip Stocks

NVIDIA, Broadcom, and Taiwan Semiconductor have all shown remarkable stock growth this year—soaring 140.6%, 47.4%, and 64.8%, respectively. The future looks even brighter, with brokers forecasting significant price upsides for each.

All three stocks currently hold a Zacks Rank #3 (Hold), indicating the market’s cautious optimism amidst the exciting AI-driven developments.

The Semiconductor Stock Surge: A Closer Look

Unveiling the Top Semiconductor Stock

Embark on a journey beyond the shadows of NVIDIA, a colossus that has mesmerized investors with an astonishing surge of over 800%. The spotlight now shifts to a new player in the semiconductor realm, a stock merely 1/9,000th of the size of NVIDIA, poised to unleash an eruption of growth. Decked with robust earnings expansion and a flourishing clientele, this underdog is ready to satiate the insatiable hunger for Artificial Intelligence, Machine Learning, and the Internet of Things.

The horizons of global semiconductor manufacturing are stretching beyond the horizon, with a trajectory set to propel from $452 billion in 2021 to a staggering $803 billion by 2028.

Seizing the Opportunity

Let’s seize the reins of opportunity and delve into the promising realm of semiconductor stocks. As the world clamors for innovation in AI, Machine Learning, and IoT, investors are presented with a golden gateway to potential riches. The allure of this nascent stock transcends the bounds of mere investment – it embodies a beacon of hope for those seeking to ride the waves of technological progress.

Unraveling the Fabric of Growth

Amidst the whirlwind of market volatility and uncertainty, the semiconductor sector stands as a bastion of growth and stability. The fabric of this industry is woven with threads of resilience, adaptability, and unyielding progress. As we gaze upon the tapestry of semiconductor stocks, we witness a mosaic of potential, ready to blossom in the fertile soil of technological advancement.