Pinterest stock (PINS) rose more than 4% on Monday after analysts at Wedbush, led by five-star analyst Scott Devitt, upgraded the social media company from Hold to Buy and set a price target of $38. This was due to the firm’s solid progress in improving user engagement and monetization following its recent earnings report. Wedbush believes the company is on the right track with its strategies, which include partnerships and innovative ad options that are expected to increase revenue and profitability.

The investment firm forecasts steady growth from Pinterest thanks to its third-party partnerships with major platforms like Amazon (AMZN) and Google (GOOGL), along with the rollout of new ad formats and the broader adoption of ad tools that drive stronger conversions for advertisers. Additionally, Wedbush highlighted Pinterest’s expansion with resellers in under-monetized markets as a smart move to unlock more revenue potential in regions that haven’t yet reached full profitability.

According to Wedbush, Pinterest’s recent price drop presents a valuable opportunity for investors. This is especially true since the stock is currently trading at approximately 11.6 times its estimated 2026 EBITDA despite an annual EBITDA growth rate of 27% over the next three years. It’s worth noting that, so far, Devitt has enjoyed a 53% success rate on his ratings, with an average return of 13.5% per rating.

Is PINS Stock a Buy?

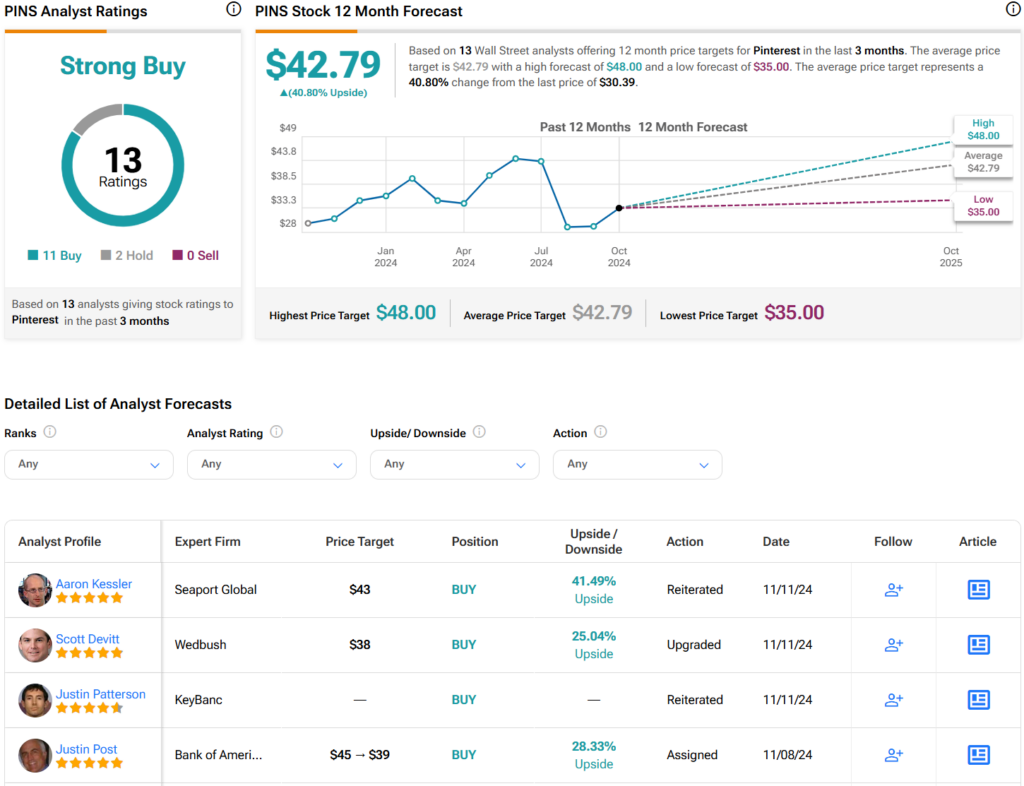

Turning to Wall Street, analysts have a Strong Buy consensus rating on PINS stock based on 11 Buys, two Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 3% decline in its share price over the past year, the average PINS price target of $42.79 per share implies 40.8% upside potential.