Drawing inspiration from the elites of any industry is a common practice. Athletes seek advice from pros, students lean in when professors speak, and investors take notes whenever a billionaire discusses money matters, especially when those billions come from astute investment decisions.

While billionaires may operate with different risk appetites and financial means compared to the average individual, there’s no harm in peeking at their investment choices for a dose of inspiration. These three high-flying stocks frequently grace the portfolios of billionaires and could add allure to your collection, particularly if you have an eye for tech stocks.

1. Alphabet: Soaring to New Heights

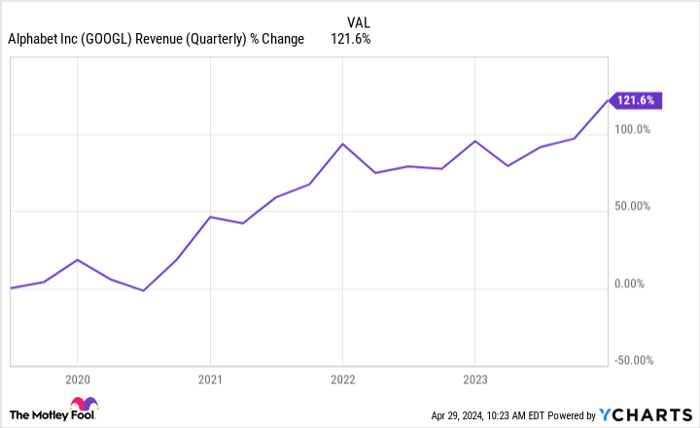

Following the release of its first-quarter earnings report, the Google parent company, Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), witnessed a remarkable surge of over 10% in a single day, propelling the company into the prestigious $2 trillion club and setting a new record high.

One notable catalyst for Alphabet’s stock surge was its announcement of its inaugural dividend – $0.20 per share quarterly. While the dividend yield may not be extraordinary, it does indicate the company’s fresh approach of rewarding shareholders through dividends rather than solely relying on stock buybacks.

Furthermore, Alphabet declared a plan to repurchase approximately $70 billion worth of shares, showcasing management’s confidence in the company’s trajectory. This move is crucial, especially after Alphabet faced scrutiny for trailing in the recent AI race – a field it significantly contributed to laying the groundwork for.

Regardless of sentiments surrounding Alphabet’s AI positioning, the company continues to rake in substantial cash. In the first quarter, its revenue reached around $80.5 billion, marking a 15% year-over-year growth, with operating margins expanding by 7% to 32%.

Ever since its inception, Alphabet has been a trailblazer in numerous tech innovations, and there seems to be no imminent halt in sight. With top-tier tech talent, deep pockets, and arguably the most pertinent data among tech firms with AI ambitions, Alphabet appears primed for enduring success.

2. Apple: Weathering the Storm

Despite the S&P 500 and other prominent tech stocks basking in the glow of positive gains in 2024, Apple (NASDAQ: AAPL) has charted a contrary course.

One silver lining of Apple’s recent stock price downturn is that it presents a more enticing entry point for investors. With a price-to-earnings (P/E) ratio hovering around 26, Apple is trading below its average over the past five years. This factor alone doesn’t mandate an automatic buy, but when considering Apple’s status as a premier blue-chip firm, the case becomes rather compelling.

While concerns linger over the deceleration of iPhone sales, such worries appear myopic in the grand scheme. Yes, iPhone sales have moderated (as has the broader smartphone market), but Apple boasts a staggering 2 billion active iPhones, providing a robust foundation for expanding into diverse services.

Few companies can match Apple’s financial prowess. With over $73 billion in cash reserves (including cash, cash equivalents, and marketable securities), Apple enjoys substantial breathing space to navigate downturns and pursue expansion through acquisitions, if it so desires.

Similar to Alphabet, Apple has been fond of stock buybacks as a means of enhancing shareholder value. This strategy also contributes to keeping its earnings per share (EPS) at healthy levels, even amid modest revenue growth.

3. Meta Platforms: Navigating the Road Ahead

Evaluating Meta Platforms(NASDAQ: META)‘s first-quarter earnings release elicits a mixed reception. While some investors expressed discontent upon learning of Meta’s 2024 spending blueprint, leading to a single-day stock plunge of over 17%, others viewed the expenditure as crucial for fortifying Meta’s AI infrastructure in the future.

Moreover, considering that Meta concluded Q1 with $58.1 billion in cash and marketable securities, the spending spree shouldn’t translate into long-term financial strain for the tech giant.

Exploring Meta Platforms Financial Growth and Investment Potential

Positive Growth Trends for Meta Platforms

Amidst its spending plans, Meta Platforms has showcased robust growth across key business metrics, particularly in user expansion and revenue generation strategies. The company’s noteworthy achievement of reaching 3.24 billion family daily active users by March 2024 reflects a significant 7% increase year over year. Additionally, elevating its average revenue per user from $9.47 in Q1 2023 to $11.20 demonstrates a commendable monetization strategy.

Meta Platforms as a Value Investment

When evaluating forward price-to-earnings (P/E) ratios, Meta Platforms emerges as an attractive investment opportunity within the realm of top-performing stocks like the “Magnificent Seven.” A comparison of financial data hints at Meta’s favorable valuation metrics, positioning it as a potential value gem in the market.

Financial Revitalization and Investor Incentives

Meta Platforms’ financial trajectory is on a positive course, evidenced by recent developments such as the introduction of a quarterly dividend payout of $0.50 per share. This dividend offering is poised to allure investors towards adopting a long-term perspective when considering Meta Platforms as an investment option.

Insights for Potential Apple Investors

Before committing to an investment in Apple, investors should ponder the insights provided by the Motley Fool Stock Advisor team. Their analysis spotlights the ten best-performing stocks for future growth prospects, omitting Apple from the list. This discerning evaluation aims to guide investors towards opportunities that could yield substantial returns in the foreseeable future.

A Historical Perspective on Market Success Stories

Reflecting on past market triumphs, consider the case of Nvidia’s inclusion in a similar list on April 15, 2005. An investment of $1,000 during that period, in alignment with the recommendation, would have burgeoned to an astounding $544,015. This historical testament underscores the potential of timely and well-informed investment decisions to garner remarkable profits.