The Unlikely Leader: Walmart Surges as Amazon Lags

It seems like a tale of David and Goliath unfolding in the stock market realm, with Walmart (NYSE:) emerging as the unlikely leader, soaring to new all-time highs even before the e-commerce behemoth Amazon (NASDAQ:) could achieve the same feat. In a surprising turn of events, Walmart has surged past its previous peak, hitting around $59 after a recent 3-for-1 stock split and surpassing its previous high-water mark of $56 set in November ’23. On the other hand, Amazon finds itself struggling to reclaim its glory days, having peaked at $188 in both July and November of ’21, and yet to revisit those heights 27 months later.

A Tale of Earnings Reports: Walmart vs. Amazon

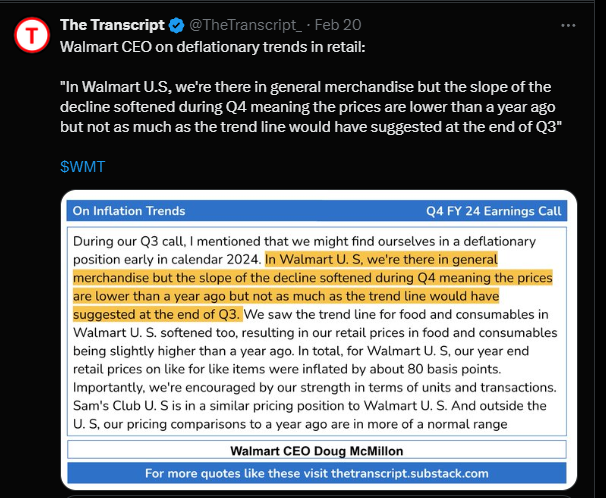

Delving into the earnings reports of these retail giants, it becomes apparent that Walmart’s recent performance has been nothing short of stellar. With a focus on margins, Walmart’s gross margin witnessed a significant boost, increasing by 122 basis points year-over-year to 23.97% in fiscal Q4 ’24. Interestingly, advertising played a crucial role in fattening Walmart’s margins, with advertising revenue surging by 28% year-over-year to $3.8 billion. The company’s trajectory is on an upward trend, evident by the steady rise in revenue estimates, showcasing analysts’ confidence in Walmart’s future prospects.

Walmart’s Road to Redemption

Having navigated through inventory challenges in 2021 and 2022, Walmart is finally finding its footing and returning to a position of strength in terms of balance sheet and cash-flow metrics. Positioned as a mid-single-digit revenue grower and high-single-digit achiever in operating income and EPS growth, Walmart’s focus on grocery sales, which saw mid-single-digit growth in the Jan ’24 quarter, underscores its commitment to driving further expansion through improved margins.

Amazon’s Struggle Amid Growth

In contrast, Amazon’s journey has been marked by a slowdown in revenue growth rates, shifting from the double-digit increases seen from 2000 to 2021 to a more tempered pace. Despite this, Amazon has reoriented its focus towards enhancing margins, with advertising and AWS playing pivotal roles in driving its performance. Noteworthy is Amazon’s operating income in Q4 ’23, which surpassed expectations by 26%, showcasing the company’s ability to deliver, culminating in its best 4th-quarter operating margin in a decade as highlighted by Morningstar.

The Verdict and Looking Ahead

As we reflect on the contrasting paths of Walmart and Amazon, it raises questions about the evolving landscape of the retail sector. With Amazon still maintaining an edge in efficiency due to its asset base, Walmart is steadily narrowing the gap in the e-commerce arena. The million-dollar question remains: Are we witnessing a shift where tech giants like Amazon, Alphabet, and Apple are reaching maturity, paving the way for newer sectors such as AI to take the mantle of growth leaders?

One intriguing comparison surfaces when examining the revenue and cash flow figures of Amazon and Walmart. Despite Amazon’s more streamlined asset base, Walmart’s fiscal strength in generating revenue and cash flow is undeniable, indicating a tightening of the competition in the digital retail space.

In conclusion, this analysis is not financial advice but a contemplation on the current state of two retail juggernauts. As history has shown, past performance is not indicative of future outcomes, and investing always carries inherent risks. Nevertheless, the intricate dance between Walmart and Amazon in the market arena provides a riveting narrative for investors and observers alike.

Thank you for your time.