As the financial world gears up for October 17, the day TSMC (NYSE:TSM) unveils its Q3 results, the anticipation is palpable. Analysts are riding high on expectations, foreseeing a remarkable 40% profit surge for the AI chip giant, propelled by the soaring demand for artificial intelligence technology.

Analysts Predicted Earnings for TSM

By the numbers presented in a Reuters report sourced from SmartEstimate gathered by LSEG, TSMC is projected to rake in a net profit of T$298.2 billion ($9.27 billion) when the third quarter wraps up. This number would mark a significant leap from the T$211 billion profit reported in the same quarter last year.

In a staggering show of its growth trajectory, TSMC recorded a 39% year-over-year revenue spike in September, hitting the T$251.87 billion mark.

Reasons Behind Analysts’ Optimism for TSM’s Q3

Analysts are turning heads towards TSMC due to its pivotal role as a primary supplier to tech giants deeply immersed in AI technology. Li Fang-kuo, Chairman of President Capital Management, emphasized this, stating, “Most of TSMC’s major clients, including Apple (AAPL), Nvidia (NVDA), AMD (AMD), Qualcomm (QCOM), and Mediatek, are set to unveil new products reliant on TSMC’s state-of-the-art process technologies.”

Moreover, TSMC is flexing its muscles with robust international expansion efforts, exemplified by the construction of three new facilities in Arizona with a hefty price tag of $65 billion. The company is also eyeing a strategic push into Europe to fuel its AI chip production ambitions.

During its Q2 earnings report, TSMC upped the ante, revising its capital expenditure forecast for FY24 to a range of $30 billion to $32 billion, a step above its earlier projection of $28 billion to $32 billion.

Should Investors Buy, Sell, or Hold TSM?

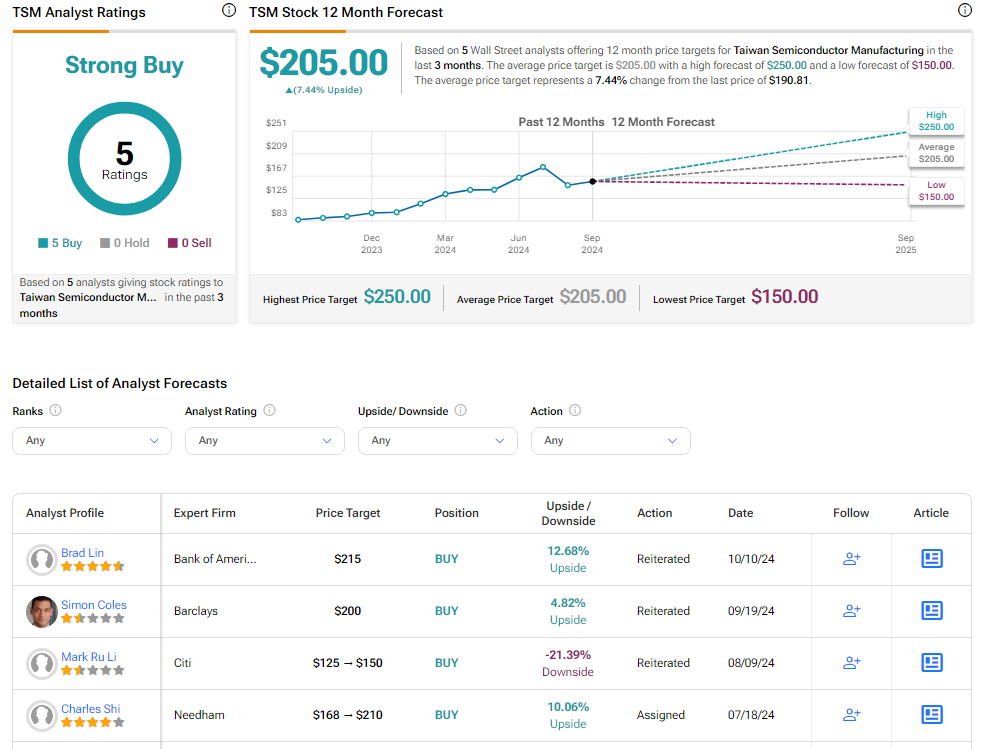

The consensus among analysts remains strongly tilted towards a bullish sentiment on TSM stock, reflected in a unanimous Strong Buy rating based on five solid endorsements. Over the past year, TSM has witnessed an astonishing surge of over 100%. The average TSM price target of $205 hints at a potential upside of 7.4% from its current levels.

For more insights into TSM analyst ratings, feel free to explore further.