Understanding the nuances of Wall Street analysts’ evaluations is crucial for many investors navigating the stock market landscape. But do their recommendations truly carry the weight they profess? Let’s delve into the insights provided by the financial gurus in relation to PulteGroup (PHM) and examine the veracity of brokerage insights as a guiding compass in investment decisions.

Deciphering Brokerage Intel on PHM

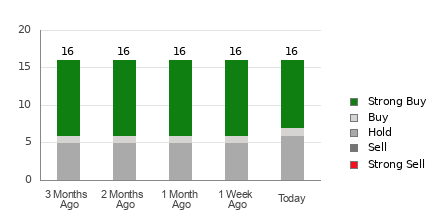

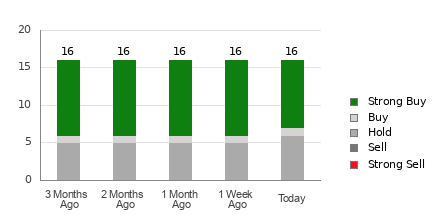

A comprehensive analysis reveals that PulteGroup currently flaunts an average brokerage recommendation (ABR) of 1.81, balancing between a Strong Buy and Buy on a scale encompassing Strong Sell to Strong Buy ratings. This score emanates from inputs provided by 16 brokerage firms, with a majority of nine Strong Buy recommendations comprising a significant 56.3% share, while another Buy recommendation constitutes 6.3% of the total.

The ABR nudges towards advocating a purchase of PulteGroup, yet solely relying on this metric for investment decisions might prove shortsighted. Research indicates that brokerage opinions oftentimes harbor a favorable bias towards the stocks they cover, crafting an outlook that may not necessarily align with the actual market trajectory.

Our investigation uncovers a prevalent trend where brokerage entities exhibit a propensity for issuing more optimistic ratings compared to unfavorable ones. For every “Strong Sell” endorsement, five “Strong Buy” tags emerge, showcasing a tilted playing field that may not resonate with the average investor’s strategy.

For a more robust evaluation mechanism, our validated stock rating tool – the Zacks Rank, segregating stocks into five distinct categories based on their potential performance, emerges as a reliable yardstick in the labyrinth of investment decisions.

Unveiling the Discrepancies: ABR vs. The Zacks Rank

While both Average Brokerage Recommendation (ABR) and the Zacks Rank are graded on a 1-5 scale, their underpinnings starkly contrast. The ABR hinges solely on brokerage pronouncements, often in decimal figures, while the Zacks Rank underscores a systematic approach leveraging earnings estimate revisions, denoted in whole number increments.

Brokerage analyst zest is frequently painted in shades of optimism due to institutional vested interests, casting a shadow upon the veracity of their recommendations. Conversely, the Zacks Rank leverages a robust earnings estimate revision model, illustrating a pronounced link between estimate trends and short-term stock price fluctuations.

Furthermore, the consistent application of Zacks Rank gradations across all stocks tethered to current-year earnings estimates bestows a harmonious balance absent in the ABR metrics. The real-time responsiveness of the Zacks Rank to dynamic market shifts stands in stark contrast to potential staleness that may ail the ABR conclusions.

Cracking the Enigma: Is PHM a Hidden Gem?

Surveying the earnings estimate landscape for PulteGroup, a noteworthy ascent of 2.1% in the Zacks Consensus Estimate for the ongoing year, culminating at $13.36, hints at a burgeoning optimism among analysts. This collective positive sentiment, bolstered by a mutual uptick in revised EPS forecasts, underpins PulteGroup’s Zacks Rank #2 (Buy) designation.

Commensurate with the recent upswing in consensus estimates and other pivotal earnings factors, PulteGroup emerges as a promising entity, poised to yield favorable returns in the forthcoming market cycles. Investors pondering over the investment viability of PulteGroup can find solace in the Buy-equivalent ABR metric, serving as a navigational beacon amidst the turbulent seas of market volatility.

Curious About A Hidden Semiconductor Stock? Click Here to Learn More!