Deciphering Wall Street Analysts’ Verdict on IonQ (IONQ)

Before delving into the heart of investment decisions, investors often heed the counsel of Wall Street analysts, hoping for a roadmap to guide their financial journey. Yet, do these analysts truly hold the magical key to the kingdom of profitable investments or are their musings akin to shadows dancing on the cave walls?

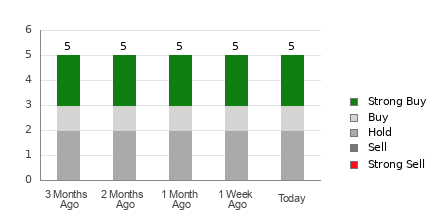

IonQ, Inc. (IONQ), the subject of this scrutiny, has found itself under the watchful eye of five brokerage firms, culminating in an average brokerage recommendation (ABR) of 2.00. This numerical depiction usually translates to a bullish “Buy” sentiment, with the lion’s share of recommendations falling into the Strong Buy and Buy categories, voicing a vote of confidence in the stock.

Peering into IonQ’s Brokerage Recommendation Landscape

As the ABR whispers sweet nothings of investment allure in the ears of prospective investors, caution beckons with a tale as old as time. History has shown that relying solely on brokerage recommendations might be akin to traversing desert sands with a faulty compass, leading astray more often than guiding.

Why the skepticism, you ask? The vested interests of brokerage firms in the stocks they cover often paint a rosier picture than reality warrants. For every whisper of “Strong Sell,” a choir of “Strong Buy” echoes fivefold, creating a dissonance that hardly harmonizes with the interests of retail investors seeking the path to financial growth.

The Tale of Two Metrics: ABR vs. Zacks Rank

While the ABR dances to the whims of brokerage recommendations, lurking in the shadows is the Zacks Rank, a metric hewn from the bedrock of earnings estimate revisions. Unlike the ABR’s flirtation with decimals, the Zacks Rank takes a firm stance in whole numbers, ranging from 1 to 5, guiding investors with a grounded voice of reason.

In an era where optimism reigns supreme, the Zacks Rank emerges as a beacon of rationality, painting a picture of the stock’s potential trajectory based on the troves of earnings estimate revisions, a true north for any investor seeking a compass in the tumultuous seas of the market.

Determining IonQ’s Investment Viability

Preceding the archaeological dig into IonQ’s investment potential, a pause is warranted. Earnings estimate revisions stand stagnant in the current winds, holding IonQ in the embrace of a Zacks Rank #3 (Hold), a testament to the murky waters ahead. While the siren song of a Buy-equivalent ABR rings loud, a prudent investor might choose to tread cautiously, lest they find themselves adrift in a tempest-tossed sea of uncertainty.

Embark on a Journey with Caution, not Passion

As the sun sets on the horizon of investment possibilities, IonQ’s fate hangs in the balance, a delicate dance of numbers and market winds. While the allure of a Buy-equivalent ABR beckons, mindful investors tread with the wisdom of the Zacks Rank’s sturdy guidance, lest they find themselves lost in the labyrinth of market dynamics.