When it comes to deciding on investments, Wall Street analysts wield an outsized influence on the decisions of many investors. The financial media often amplifies the impact of these analysts’ ratings on stock prices. But should investors solely rely on these recommendations when it comes to stocks such as Celestica (CLS)? Let’s delve into the current sentiments from these analysts, question the efficacy of their guidance, and explore how investors can judiciously incorporate these insights into their investment strategies.

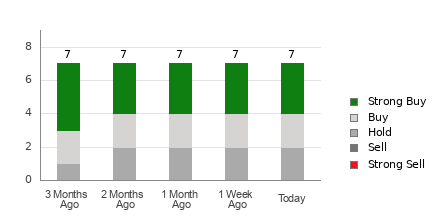

Celestica presently boasts an average brokerage recommendation (ABR) of 1.86, graded on a scale from 1 to 5 (ranging from Strong Buy to Strong Sell). This calculation derives from the collective recommendations given by seven brokerage firms. With an ABR of 1.86, Celestica hovers between the Strong Buy and Buy categories.

Among the seven recommendations that contribute to the ABR, three are tagged as Strong Buy and two as Buy. Collectively, Strong Buy and Buy endorsements constitute 42.9% and 28.6%, respectively, of all the recommendations received.

Analyzing the Brokerage Recommendations for CLS

While the ABR indicates a preference for investing in Celestica, relying solely on this metric for investment decisions might not yield optimal outcomes. Research indicates that brokerage recommendations have limited success in directing investors towards stocks with the most lucrative price appreciation potential.

Why is that? Analysts at brokerage firms often exhibit a strong positive bias towards the stocks they cover due to their employers’ vested interests. Our investigations reveal that brokerage firms assign five “Strong Buy” ratings for every “Strong Sell” recommendation they offer.

Thus, the recommendations from these institutions might not always align with the interests of individual investors, offering limited insights into a stock’s future price movement. It is advisable to utilize this information as a validation tool for personal analysis or alongside a reliable method that has a proven track record in predicting stock price movements.

Our proprietary stock rating system, Zacks Rank, stratifies stocks into five categories, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). With an externally audited performance history, the Zacks Rank serves as a credible indicator of a stock’s upcoming price performance. Therefore, cross-referencing the ABR with the Zacks Rank could provide a pragmatic approach to making profitable investment decisions.

Discerning Between ABR and Zacks Rank

While both ABR and Zacks Rank adopt a similar 1-5 grading structure, they are fundamentally distinct metrics.

The ABR hinges solely on brokerage recommendations and is typically expressed in decimal form (e.g., 1.28). Conversely, the Zacks Rank employs a quantitative model founded on earnings estimate revisions and is showcased in whole numbers ranging from 1 to 5.

Brokerage analysts frequently exhibit an overly optimistic bias in their recommendations. Their ratings often skew towards positivity, surpassing the fundamentals of their research due to their firms’ vested interests. In contrast, the Zacks Rank is driven by earnings estimate revisions, a factor strongly correlated with short-term stock price movements as per empirical evidence.

Moreover, the various Zacks Rank designations are systematically allocated across all stocks that analysts currently cover, ensuring a balanced distribution among the five ranks.

One crucial disparity between the ABR and Zacks Rank lies in their timeliness. While ABR data might lag in real-time updates, the Zacks Rank promptly reflects analysts’ revisions to earnings estimates, offering timely insights into future stock price movements.

Is Celestica (CLS) a Viable Investment Option?

Reviewing Celestica’s earnings estimate revisions, the Zacks Consensus Estimate for the ongoing year has remained static at $3.32 for the past month.

The persistent outlook from analysts on the company’s earnings trajectory, indicated by an unaltered consensus estimate, could serve as a plausible justification for Celestica’s performance aligning with the broader market trends in the near future.

Based on the magnitude of recent changes in consensus estimates and other pertinent factors related to earnings forecasts, Celestica presently holds a Zacks Rank #3 (Hold). To explore a comprehensive list of Zacks Rank #1 (Strong Buy) stocks, you can refer here>>>>

Considering the Buy-equivalent ABR for Celestica, it might be prudent to exercise a degree of caution.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%… an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Celestica, Inc. (CLS) : Free Stock Analysis Report