Investors frequently turn to analyst recommendations when considering stock transactions, but how much weight should one give these endorsements? Let’s explore Wall Street’s take on Alibaba (BABA) and delve into the reliability of brokerage endorsements as well as strategies for leveraging them.

Analyst Recommendations for Alibaba

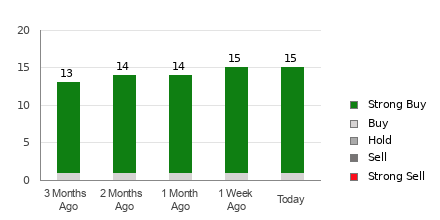

Alibaba currently boasts an average brokerage recommendation (ABR) of 1.27, reflecting 86.7% Strong Buy ratings from 15 brokerage firms. This score hovers between Strong Buy and Buy on the scale of 1 to 5 (Strong Buy to Strong Sell).

While the ABR advocates for acquiring Alibaba shares, it’s imperative not to base investment decisions solely on these figures. Research indicates that brokerage recommendations have a limited track record in guiding investors toward stocks with the most potential for price appreciation.

Brokerage firms often exhibit a predisposition to rate stocks positively due to their vested interests, as evidenced by the significant bias in “Strong Buy” over “Strong Sell” recommendations.

Here’s where Zacks Rank, a tool with an audited track record, comes into play. Utilizing the ABR in conjunction with the Zacks Rank can lead to sound investment decisions.

ABR vs. Zacks Rank

Although both ABR and Zacks Rank use a scale from 1 to 5, they represent distinct metrics. The former draws solely from brokerage recommendations, often displaying decimal values, while the latter hinges on quantitative analysis of earnings estimate revisions, reflected in whole numbers.

Research reveals that brokerage analysts, driven by their firms’ interests, tend to issue more favorable ratings than warranted, contrasting with Zacks Rank’s foundation in earnings estimate trends and correlated stock price movements.

Zacks Rank’s timely updates, driven by analysts’ earnings estimate revisions, ensure its relevance in predicting future stock prices, distinguishing it from the possibly dated ABR.

Is BABA a Sound Investment?

Alibaba’s earnings estimate revisions have registered a 3.1% decline over the prior month, resulting in a Zacks Rank #4 (Sell) for the stock. Analyst consensus points to a pessimistic outlook on the company’s earnings prospects, potentially sparking a near-term downturn in its stock value.

Therefore, it’s prudent to approach the Buy-equivalent ABR for Alibaba with caution, especially when juxtaposed with Zacks Rank findings.