The Lingerie Giant’s Resilience Shines Through

Victoria’s Secret, listed on the NYSE as VSCO, caused ripples in the financial market with its recent announcement of better-than-expected results for the first quarter. The company revealed a narrower sales decline and a more robust adjusted operating income, leading to a surge in its stock price during extended trading hours.

Stock Performance and Strategic Gains

Following the disclosure, VSCO’s stock witnessed a remarkable uptick, making it one of the top gainers after hours, showing a strong increase of 8.3% to reach $20.14. Investors were pleased with the news of the company’s improved performance amidst challenging market conditions.

Positive Projections Defy Market Expectations

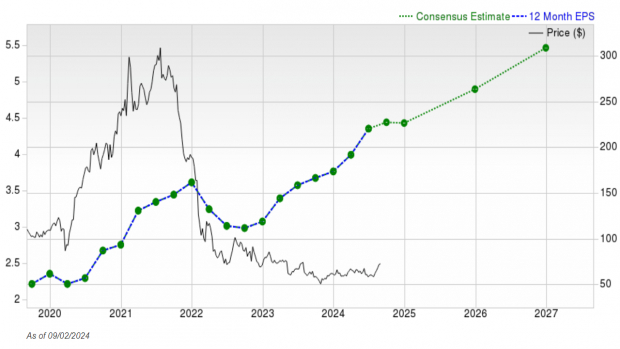

In its preliminary report, Victoria’s Secret adjusted its outlook, now predicting a 3% to 4% year-over-year net sales decline for Q1, a significant improvement from its initial estimate of 4% to 6%. Moreover, the adjusted operating income for the quarter is forecasted to be between $35 million and $40 million, surpassing the previously projected range of $10 million to $35 million.

CEO Martin Waters’ Optimistic Outlook

According to Victoria’s Secret CEO Martin Waters, the retail environment in North America posed challenges, characterized by intense competition and promotional pressures. However, Waters noted a positive trend in both physical stores and the digital segment of the business, with promising developments for the Victoria’s Secret and PINK brands.

Continued Struggle Amid Market Dynamics

Throughout fiscal 2023, Victoria’s Secret grappled with weakened demand in the lingerie market, particularly in North America, witnessing consecutive year-over-year sales declines. Despite these challenges, the company managed to infuse newness into its products and brand image, garnering a notable response from customers.

Cautiously Optimistic for the Future

Looking forward, CEO Martin Waters remained cautiously optimistic about the brand’s performance, highlighting a strong finish to the quarter, especially in April, which emerged as the most robust month. Improvements in customer traffic in physical stores and a surge in digital sales indicate promising growth prospects for the iconic lingerie retailer.

Forward-Looking Affirmation

Victoria’s Secret also reiterated its previously provided guidance for fiscal year 2024, underscoring its commitment to navigating the evolving retail landscape and sustaining its financial strength amidst market fluctuations.