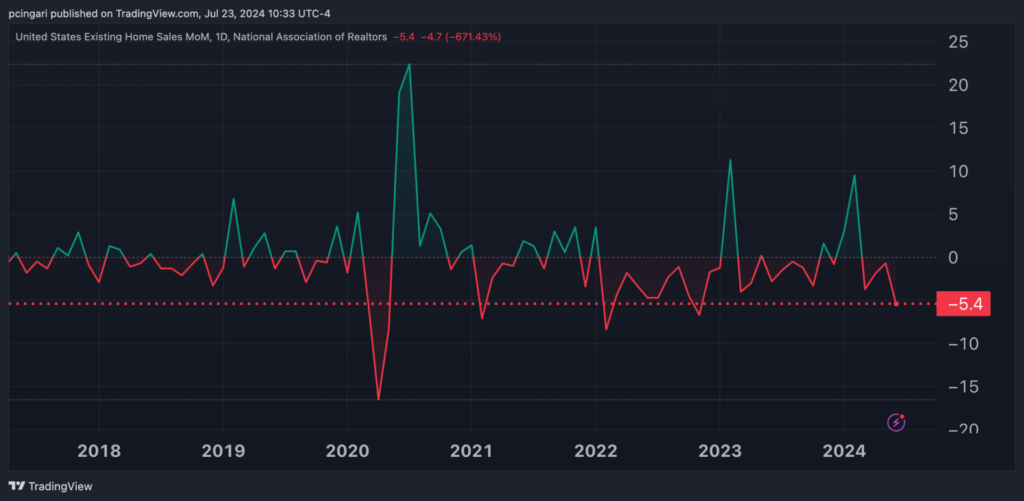

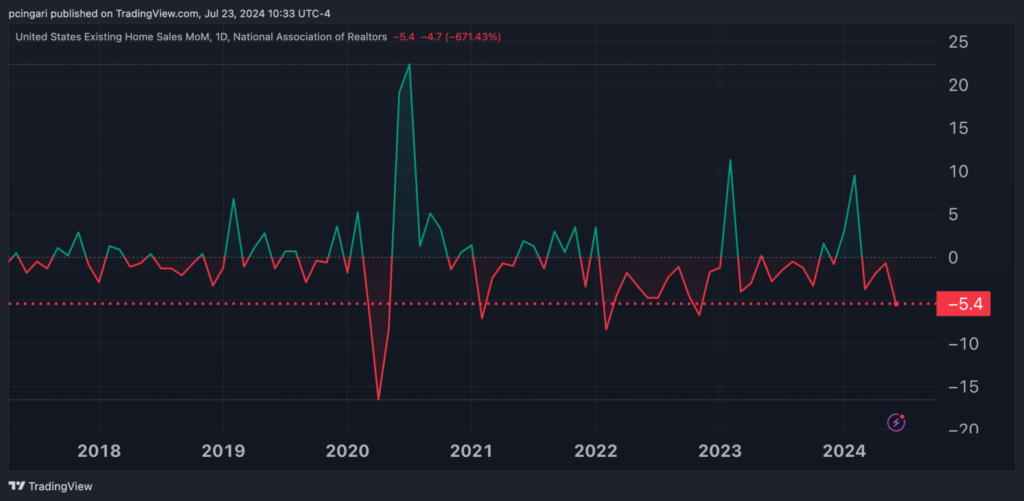

June 2024 marked a jarring turn for the worse in existing home sales across the United States, with a significant 5.4% freefall from May. This plummet, the most severe monthly decline since November 2022, reflects the deep uncertainty gripping potential buyers, largely fueled by sky-high median prices surging to unprecedented levels for the second month running.

The numbers tell the grim tale: transactions dwindled to 3.89 million units in June from 4.11 million in May, as revealed by the latest data from the National Association of Realtors (NAR). Year-over-year, the decline mirrors the same 5.4% drop.

The median price for existing homes of all types soared to an alarming $426,900 in June, a substantial 4.1% surge from $410,100 a year prior.

By the closing of June, the total housing inventory stood at 1.32 million units, marking a notable 3.1% uptick from May and a substantial 23.4% jump from the previous year (1.07 million). Unsold inventory availability is currently holding at a 4.1-month supply, an uptick from 3.7 months in May and 3.1 months in June 2023.

Chief economist Lawrence Yun from NAR emphasized the unfolding narrative: “We’re witnessing a gradual transition from a seller’s dominion to a market more favorable to buyers.”

“Properties are lingering longer on the market, and sellers are contending with fewer bids. Increasingly, buyers are demanding meticulous inspections and valuations, while the supply scenario is indubitably rising on a nationwide scale,” Yun expounded.

Diving Deeper: A Visual Representation of the 5.4% Home Sales Drop in June

Regional Perspectives

All corners of the United States experienced a dual narrative of sales downturns and price escalations.

- In the Midwest, existing-home sales nosedived by 8% in June compared to the previous month, culminating in an annual rate of 920,000 units, signifying a decline of 6.1% from the preceding year. The median price in the Midwest stood at $327,100, reflecting a buoyant 5.5% climb from June 2023.

- Southern states witnessed a 5.9% descent in existing-home sales from May, with an annual rate dropping to 1.76 million units in June, down by 6.9% from the previous year. The median price in the South jumped to $373,000, showing a modest 1.7% increase from the previous year.

- Western regions experienced a 2.6% dip in existing-home sales in June, amounting to a steady annual rate of 740,000 units. The median price in the West stood at $629,800, marking a 3.5% surge from June 2023.

- In the Northeast, existing-home sales slipped by 2.1% from May, settling at an annual rate of 470,000 units in June, culminating in a 6% drop from June 2023. The median price in the Northeast soared to $521,500, showcasing a significant 9.7% uptick from a year ago.

Buyer Trends and Mortgage Market

Dwellings typically lingered on the market for 22 days in June, a decline from 24 days in May yet an ascent from 18 days in June 2023, as per the latest Realtors Confidence Index.

First-time homebuyers comprised 29% of sales in June, a retreat from 31% in May but an upturn from 27% in June 2023. NAR’s 2023 Profile of Home Buyers and Sellers, unveiled in November 2023, disclosed that the annual share of first-time buyers was 32%.

Freddie Mac indicated that the 30-year fixed-rate mortgage stood at an average of 6.77% by July 18, a dip from 6.89% a week before and 6.78% a year earlier.

Cash transactions accounted for 28% of sales in June, unchanged from May and higher than the 26% noted a year ago. Individual investors or second home buyers, forming a substantial portion of cash deals, bought 16% of homes in June, aligning with figures from May but dropping from 18% in June 2023.

Distressed sales, including foreclosures and short sales, represented 2% of transactions in June, unchanged from previous months and the previous year.

Market Reactions and the Investment Landscape

The Vanguard Real Estate ETF, tracking real estate stocks, witnessed a meager 0.4% uptick on Tuesday, poised to wrap up the session at the loftiest levels since February 2023.

Key players driving the sector forward included Opendoor Technologies Inc., Compass, Inc., and eXp World Holdings, Inc., each enjoying gains between 3% and 3.5%.

On the other end of the spectrum, NexPoint Diversified Real Estate Trust, Office Properties Income Trust, and Alexandria Real Estate Equities, Inc., lagged behind, experiencing declines of 3.5%, 2.9%, and 2.6%, respectively.