Artificial intelligence (AI) is writing the explosive growth story for most tech stocks. While the big players are always in the news, there are many overlooked and undervalued AI stocks that investors ought to pay attention to.

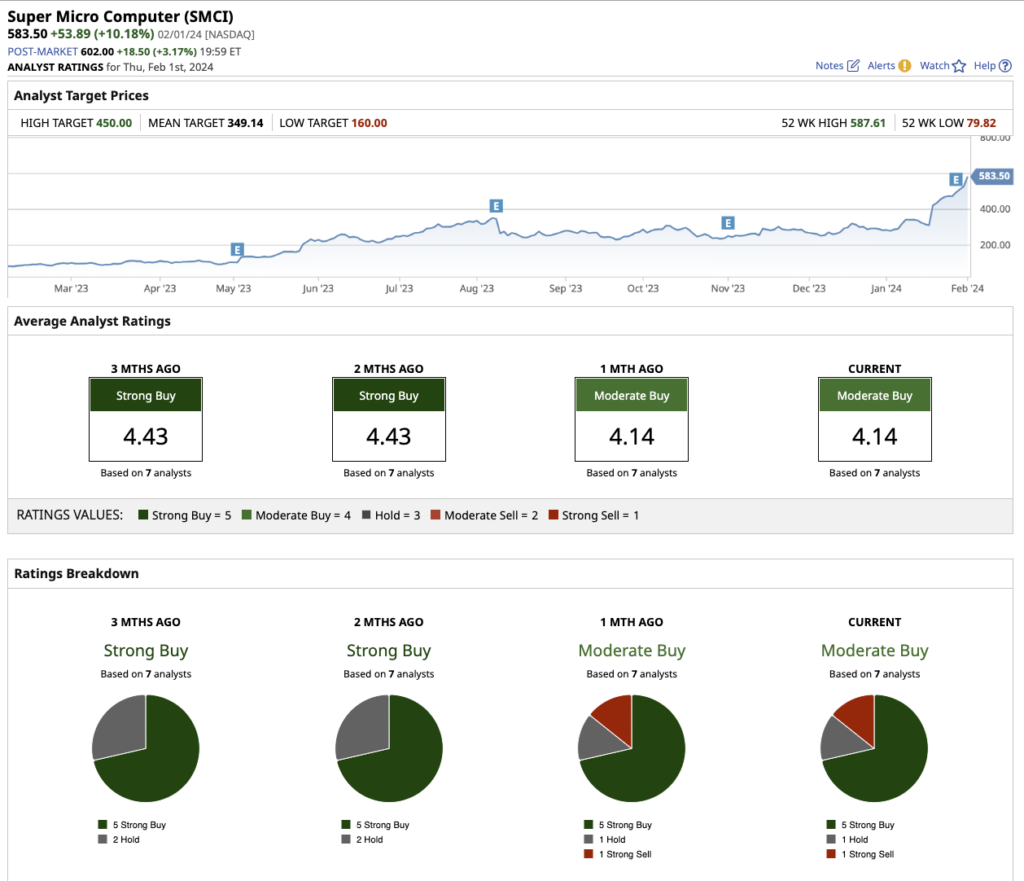

One such company is Super Micro Computer (SMCI), whose stock soared an eye-catching 246% last year, outperforming the Nasdaq Composite’s gain of 44.5%. This year alone, SMCI has already skyrocketed by a staggering 102%, surpassing the larger AI players, Nvidia (NVDA) and Advanced Micro Devices (AMD).

Super Micro Computer Reports a Blockbuster Q4

Super Micro Computer produces advanced computing systems that use parallel processing to complete complex tasks at unprecedented speeds. Valued at $31.1 billion, SMCI is smaller compared to giants Nvidia and Advanced Micro Devices, yet its efforts to capitalize on AI are rapidly driving its growth.

In its recent second quarter of fiscal 2024, total revenue of $3.66 billion increased a whopping 103.3% year-over-year, marking SMCI’s first quarter with more than $3 billion in revenue. The revenue growth led to a massive 71.5% increase in adjusted earnings per share to $5.59 in the quarter.

Super Micro Computer has partnered with AMD and Nvidia to use their graphic processors to expand its AI products. CEO Charles Liang discussed how the company’s AI rack-scale solutions, particularly based on Nvidia’s H100 processors, are in high demand.

Sky’s The Limit For SMCI Stock

SMCI is working to double the size of its current portfolio, with new platforms ready for high-volume production in the next few months. The company is also innovating its liquid-cooling technology so that these powerful AI platforms can run efficiently.

Management raised their fiscal 2024 guidance to a range of $14.3 billion to $14.7 billion, and analysts predict $14.46 billion in revenue for the full fiscal year 2024. Furthermore, analysts predict an 82.9% increase in adjusted EPS to $21.60 for the full year.

The Key Takeaway

Looking ahead, Super Micro Computer has promising prospects. While the stock has surged, it still remains undervalued for the explosive growth it could bring in the coming years. Now might be the right time to invest a small stake in the company before the stock becomes expensive.