Unveiling Recent Options Trading Activity in Coinbase Global

Today, the winds of change are blowing in the world of options trading as deep-pocketed investors show a bullish tilt towards Coinbase Global (COIN). In the financial realm, it’s a drumbeat that echoes loudly – and prudent market observers are listening intently. The whispers from within Benzinga’s database hint at major ripples in the force.

Our keen eyes spotted a curious surge of 20 conspicuous options moves in Coinbase Global today, a drumroll that hints at something brewing beneath. These market-shifting maneuvers, a medley of 9 puts worth $380,114 and 11 calls totaling $467,971, paint a vibrant mosaic of the market’s sentiment.

Cracking the Price Code

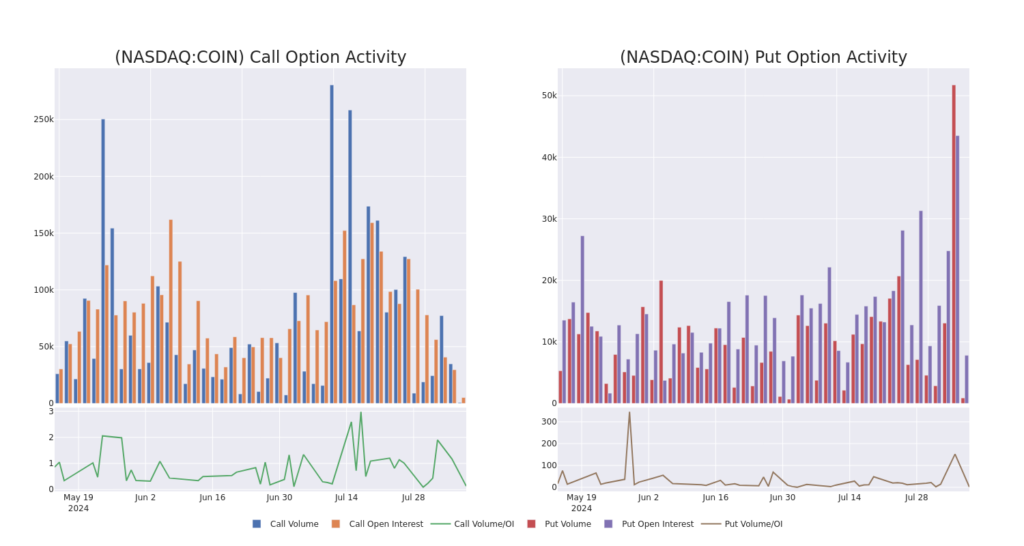

Perusing through the trading volumes and Open Interest figures paints a vivid picture of the battleground within a price band of $100.0 to $350.0, mirroring the company’s evolution over the past quarter. The tides are shifting, and the market players are positioning their pawns accordingly.

Unveiling Volume & Open Interest Dynamics

Analyzing the ebb and flow of volume and open interest is akin to deciphering the whispers of a stock’s soul. Investors spelunking through the data for Coinbase Global’s options in the $100.0 to $350.0 strike price range over the last month unveil a tapestry of intrigue and strategic maneuvering.

Snapshot of Coinbase Global’s 30-Day Options Volume & Interest

Decoding the Significant Options Trades

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COIN | PUT | SWEEP | BEARISH | 08/09/24 | $3.85 | $3.8 | $3.85 | $182.50 | $107.8K | 247 | 223 |

Delving into Coinbase Global’s Realm

Stepping into the cryptic world of Coinbase Global, one is met with a tale that started way back in 2012. Much like a seasoned voyager navigating through turbulent waters, the company prides itself as the stalwart beacon of safety and regulatory compliance in the tempestuous seas of cryptocurrency trading. From retail investors to institutional behemoths, Coinbase acts as the fulcrum, enticing all to dance with the volatile muse of digital currencies.

Scanning Coinbase Global’s Current Market Posture

- Volume dances to a rhythm of 1,575,406, nudging the stock price up by 5.33% to $188.44, a symphony of ascent in these turbulent times.

- RSI values whisper a tale of neutrality, a precarious balancing act straddling the tightrope between ascension and descent.

- The next earnings concerto is a mere 84 days away, a drumroll that portends suspense and intrigue for the eager market audience.

Insightful Analyst Musings on Coinbase Global

Like minstrels at a royal court, 5 esteemed industry analysts take their turns composing sonnets of wisdom for Coinbase Global, with an average target price chorus of $276.2 resonating through the coliseum.

- Canaccord Genuity steps back a pace, shifting their tune to Buy with a melodic $280 price foretold.

- HC Wainwright & Co. persists with their bullish serenade, holding firm at Buy with a lyrical $295 in mind.

- Citigroup’s bardic rhyme waxes lyrical, upgrading Coinbase Global’s saga to Buy, with $345 as the final crescendo.

- Goldman Sachs pens a ballad of neutrality, maintaining a steady gaze on Coinbase Global with a $215 aria.

- B of A Securities keeps their stance, holding a Neutral rating aloft, setting sights on a $246 arc.

Navigating the tempestuous waters of trading options is akin to captaining a ship through a stormy sea – treacherous yet enticing. Savvy sailors brave the waves with knowledge in their arsenal, adjusting their sails to the beckoning winds of change. As the wheel of fortune turns, stay attuned to the dancing shadows of Coinbase Global with Benzinga Pro as your compass, guiding you through the tumultuous tides of the market with keen insight and timely alerts.