Harmonious Gains: Spotify Soars in Q2 Earnings Report

Spotify Technology, known by its ticker symbol SPOT, made waves in the pre-market with its highly anticipated second-quarter earnings update. Despite a bearish trend leading up to the disclosure, the audio streaming giant soared past expectations, reporting earnings of 274 million euros ($298 million) and surpassing analysts’ projections on both the top and bottom lines.

Melodic Success: Growth Highlights for Spotify

Spotify’s stellar performance included a 14% increase in monthly active users (MAUs), touching 626 million users. Premium subscribers rose by 12% to 246 million, beating estimates by 1 million. The company’s advertisement-supported revenue also climbed by 13%, driven by its flourishing music streaming and podcast divisions.

At the close of Monday’s trading session, Spotify’s stock price stood at $295.45, edging up from Friday’s close. Subsequently, during pre-market trading on Tuesday, shares surged to $336, marking a substantial 14% growth.

The MUSQ ETF: A Symphony of Diversification

While Spotify is a dominant player in the audio-content industry, the MUSQ Global Music Industry ETF (MUSQ) offers investors exposure to a broader spectrum of the music sector. From YouTube Music under Alphabet Inc (GOOG) to upcoming players in the music ecosystem, MUSQ provides diversified access to various facets of the industry, including streaming, live events, and technology.

Unlike investing in individual stocks, MUSQ offers a consolidated approach by holding multiple assets, with Spotify making up a fraction of the ETF’s portfolio alongside other key players like Alphabet and Tencent Music Entertainment Group (TME).

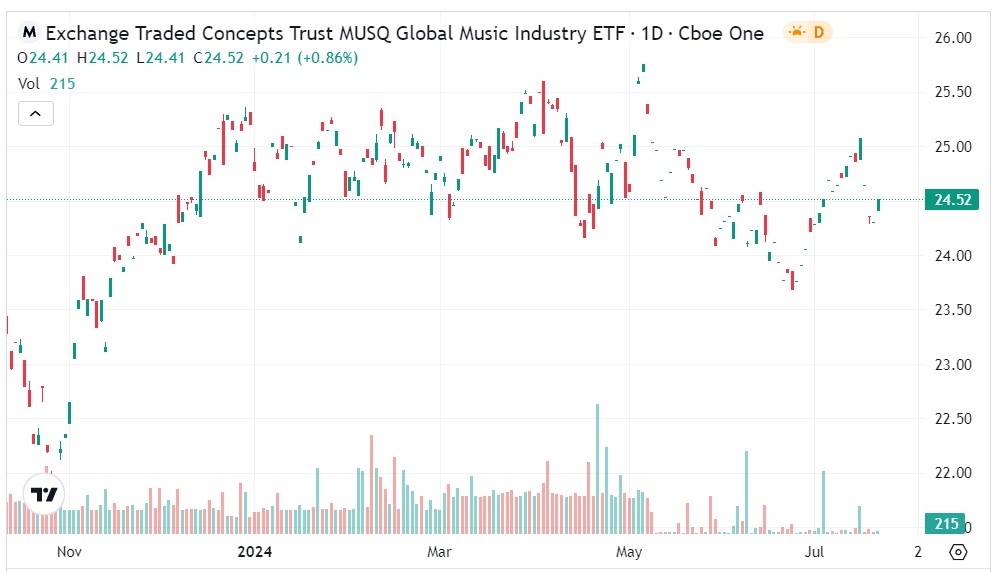

Charting Success: MUSQ’s Potential Upswing

On Monday, the MUSQ ETF closed at $24.52, showing a 1% gain from the previous session and demonstrating a potential reversal since hitting a recent low on June 24. With Spotify’s robust earnings driving market optimism, MUSQ could see an upward momentum in the near term.

- Given Spotify’s strong performance, a positive impact on MUSQ’s valuation is plausible.

- Although the ETF experienced a dip until late June, signs point to a potential U-shaped recovery, buoyed by Spotify’s success.

- MUSQ currently trades above key moving averages, indicating a healthy market sentiment among investors.

Image by javier dumont from Pixabay.