Tesla vs. Rivian: The EV Showdown

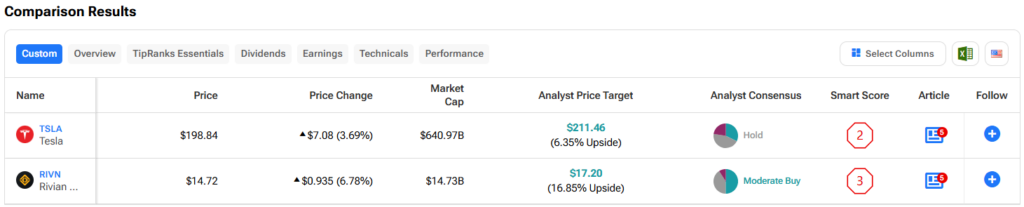

Upon analyzing two prominent EV stocks – Tesla (TSLA) and Rivian Automotive (RIVN) – through TipRanks’ Comparison Tool, divergent patterns emerge. Tesla glimmers with optimism while Rivian garners a more tempered view.

Renowned for its innovative vehicle line-up including the Cybertruck, Tesla stands out for its all-electric vehicles, solar energy solutions, and Supercharger network. In contrast, Rivian stakes its claim with the R1S and R1T electric SUV and pickup truck portfolio.

Recent market tremors have jolted both Tesla and Rivian, with Tesla marking a 20% slump year-to-date and Rivian’s stock plummeting by 37%. These plunges reflect broader EV market jitters amid fears of waning demand.

With Rivian yet to attain profitability, scrutinizing the price-to-sales (P/S) ratios between the two offers a window into their relative valuations. Tesla’s price-to-earnings (P/E) ratio also weaves in pertinent insights, painting a vivid narrative.

Tesla’s Fortunes: A Detailed Dissection

A glance at Tesla’s P/E ratio of 54.1x positions the stock at the lower band of its historical range, albeit with a forward P/E of 68.4x indicating anticipated earnings deceleration amid the EV market softening. The P/S ratio of 6.8x firmly places Tesla at a premium compared to Rivian, a differential justified by Tesla’s profitability.

Beyond its EV avatar, Tesla’s prowess shines in solar energy and storage realms, often overlooked by investors. Stellar figures from the second quarter reflect Tesla’s meteoric rise in energy storage deployment and revenue, juxtaposed against slight automotive revenue dips.

Noteworthy is Tesla’s enduring profitability in the automotive segment, even amidst pricing wars. Recent wins, like the billion-dollar energy storage contract in California, underscore Tesla’s growth trajectory, crowning it as a potent force in the EV landscape.

The Tesla Road Ahead: Price Targets Unveiled

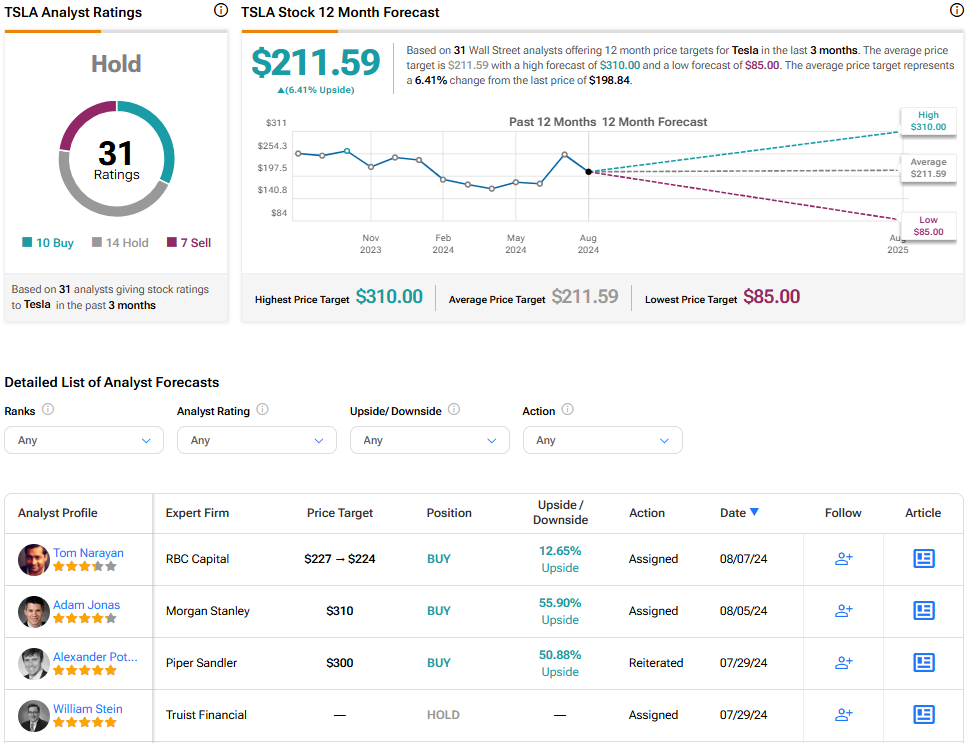

Analyst consensus on Tesla rings at ‘Hold’, with 10 Buys, 14 Holds, and seven Sell ratings. At an average price target of $211.59, a 6.4% upside beckons for Tesla’s stock, encapsulating the diverse sentiment swirling around the EV stalwart.

Keen to dive deeper into Tesla’s future? Explore more of the latest TSLA analyst ratings to glean a comprehensive understanding of the stock’s trajectory.

Rivian Automotive: An Odyssey Unfolding

Rivian’s dwindling P/S ratio, currently at 2.9x, epitomizes a downward trajectory since its normalization at 9.5x in March 2023. However, drawing comparisons with Tesla, the jury remains out on Rivian’s long-term potential, warranting a cautious approach until more clarity emerges.

Recent downticks in Rivian’s shares followed a second-quarter earnings miss, with escalating net losses painting a mixed picture. Despite the gloom, glimmers of hope emerge as management charts a course towards modest gross profits while adhering to production targets, albeit trimmed from previous benchmarks.

While optimism flickers on the horizon, Rivian’s road to GAAP profitability remains a distant quest. Tracking its financial voyage unveils a narrative steeped in promise, interspersed with caveats warranting discerning vigilance.

Rivian’s Path to Profitability in the EV Market

With Rivian’s lower-cost, second-generation EVs hitting the market amidst a wave of factory enhancements and vehicle redesigns, expectations are high for the firm’s journey towards financial prosperity. The overhaul, aimed at reducing material costs for these vehicles by a significant 45%, is a bold step in the right direction.

Rivian’s Drive Towards Profitability

Although Rivian has recently introduced its latest EV models, it remains premature to predict their success and whether they will meet the lofty expectations set for them. Looking ahead, the company anticipates achieving a gross margin of 25%, with an adjusted core profit margin in the high teens over the long term.

Despite these ambitions, Rivian’s ability to directly rival Tesla’s dominance remains uncertain. Tesla’s Cybertruck made headlines as the top-selling electric truck in the U.S. during the second quarter, outperforming Rivian’s R1T pickup, revealing the intense competition within the EV market.

Analyzing Rivian’s Stock Potential

Rivian Automotive currently boasts a Moderate Buy consensus rating based on recent analyst evaluations, featuring 12 Buy recommendations, eight Holds, and two Sell ratings issued over the past three months. At a price target of $18, the average forecast for Rivian’s stock suggests a potential upside of 22.3%.

For more detailed analyst ratings and insights on Rivian’s stock outlook, investors can refer to additional resources provided in the market analysis.

Evaluating the Future of Rivian and Tesla

While Rivian progresses towards financial stability, mirroring Tesla’s growth trajectory, its position as the next Tesla in the EV realm is far from assured. The adoption of a strategic business model, starting with high-end vehicles then transitioning to more affordable models to enhance profitability, showcases Rivian’s potential.

Despite Rivian’s promising advancements, Tesla remains a formidable force in the EV sector and a safer investment choice given its current market standing. Rivian may well garner a bullish sentiment in due course, but at its current valuation, the stock appears relatively high. Awaiting a more favorable entry point, characterized by reduced multiples, could pave the way for a more favorable investment outlook.

Investors are advised to conduct thorough research and due diligence before making any investment decisions.