A crucial tenet for astute investors entails shedding political biases and focusing solely on financial gains within the context of Wall Street. As Warren Buffett, the legendary value investor, highlighted back in 1994, fixating on political and economic speculations can be a costly distraction. Buffett’s words resonate with a timeless wisdom that disregards the noise of external forecasts:

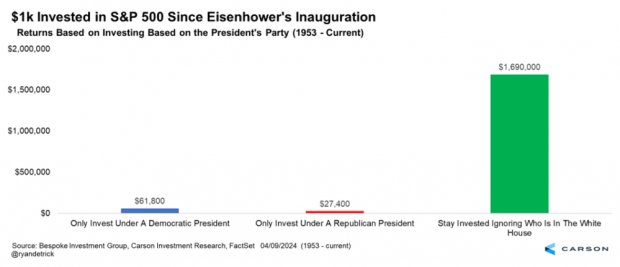

While past data indicates a slight market favoritism towards Democratic administrations since the 1950s, the reality is far more nuanced. The history of the U.S. stock market reveals a consistent upward trajectory irrespective of the political landscape. Opting to stay invested throughout both Republican and Democratic presidencies has been more profitable than picking sides.

In essence, it becomes apparent that the influence of the U.S. president on the market is far less substantial than portrayed by media sensationalism or political rhetoric. A glance at the long-term S&P 500 index chart confirms this reality.

The Interplay of Gridlock and Stock Performance

Unified government scenarios marginally benefit the Republican party based on data spanning from 1926 to 2023. However, a divided government under a Democratic President tends to yield the most favorable outcomes. Nevertheless, stocks exhibit a propensity for growth over time regardless of the prevailing power dynamics.

The Pre-Election Market Jitters

Highlighting historical seasonal trends, markets often exhibit trepidation during election seasons. On average, the latter parts of September and October in election years tend to witness lower stock performance as uncertainty looms.

Potential Stocks to Monitor Post-Election

Bitcoin, Cryptocurrency, and the Electoral Rumble

While Bitcoin’s performance remains robust under both Republican and Democratic leadership, a Trump victory could be a favorable scenario for Bitcoin and crypto enthusiasts. Trump’s evolving stance on the crypto industry, along with public affirmations at the Bitcoin Conference, positions him as a more crypto-friendly candidate.

From a regulatory outlook, Trump emerges as a preferred choice for the crypto community, yet neither major party exhibits a resolute approach to debt management. Such macroeconomic uncertainties could bolster assets like Bitcoin in the coming years.

Implications for Clean Energy Stocks

The realm of clean energy stocks appears more favorable under a Harris-led Democratic administration. Initiatives such as the Clean Energy for America Act and the Inflation Reduction Act championed by the Biden-Harris duo offer enticing incentives for companies like First Solar and Tesla. Conversely, Trump’s promises remain

Analysis of Immigration Policy’s Influence on Stock Market Performance

As the political landscape evolves, the impact of immigration policy on the stock market is gaining significant traction. Amidst this backdrop, examining the potential consequences on various stocks becomes paramount.

The Shift in Immigration Policy

The recent changes in immigration policy sparked by shifting political dynamics, notably Kamala Harris’ transitioning stance and Trump’s unwavering position, have set the stage for potential market volatility. A notable contender in this scenario is GEO Group, a company specializing in operating immigration detention facilities.

Market Watch on GEO Group

GEO Group stands as a pivotal entity to monitor as political promises and legislative alterations could significantly impact their operations and, consequently, their stock performance. Harris’ pledge to close immigration detention facilities could dramatically influence GEO Group’s fate, emphasizing the interconnectedness of policy decisions with market outcomes.

The Historical Context

While presidential elections historically demonstrate a weaker correlation with stock market returns than commonly perceived, historical data unveils insights for investors to make informed decisions. By delving into past trends, investors can navigate the uncertainties that accompany alterations in immigration policy, ensuring robust decision-making strategies regardless of the post-election scenario.

Capitalizing on Informed Decision Making

As investors navigate the complex interplay between political shifts and market performance, recognizing the subtleties of immigration policy’s impact on specific stocks such as GEO Group becomes imperative. By leveraging historical context and market observations, stakeholders can position themselves strategically to weather the turbulence and capitalize on opportunities that emerge amidst the political flux.