Elon Musk’s acquisition of Twitter, now referred to as X, has proven to be a powder keg of controversy, with the rumblings growing louder as time progresses. The latest reports indicate that advertisers are contemplating significant cuts in spending on the social media behemoth.

Advertisers, it seems, are wary of X’s staunch stance on free speech, as concerns mount over their brands being associated with what they deem as “extreme content.” According to insights from analytics group Kantar, 26% of surveyed marketers are considering slashing their ad budgets allocated to the platform.

The brewing storm traces back to 2022 when Musk and a group of investors injected a hefty $44 billion to secure control of Twitter. While X touts a 99% brand safety rate verified by DoubleVerify and Integral Ad Science, only 4% of marketers deem it “brand safe,” which sharply contrasts with Google’s 39% approval rating in the same domain.

A Novel Avenue for X

Yet, X seems poised to combat the ad exodus with an innovative solution: a dedicated platform for video content consumption. Already in talks with prominent online video personalities like MrBeast, X is pivoting to a “video first” approach, potentially emerging as a formidable challenger to YouTube.

X’s CEO, Linda Yaccarino, has hinted at the platform’s evolution into a video-centric hub, a move that could be a game-changer. This strategic shift could pose a credible threat to YouTube, capitalizing on the unrest simmering among content creators on the Google-owned platform.

Assessing Tesla’s Future

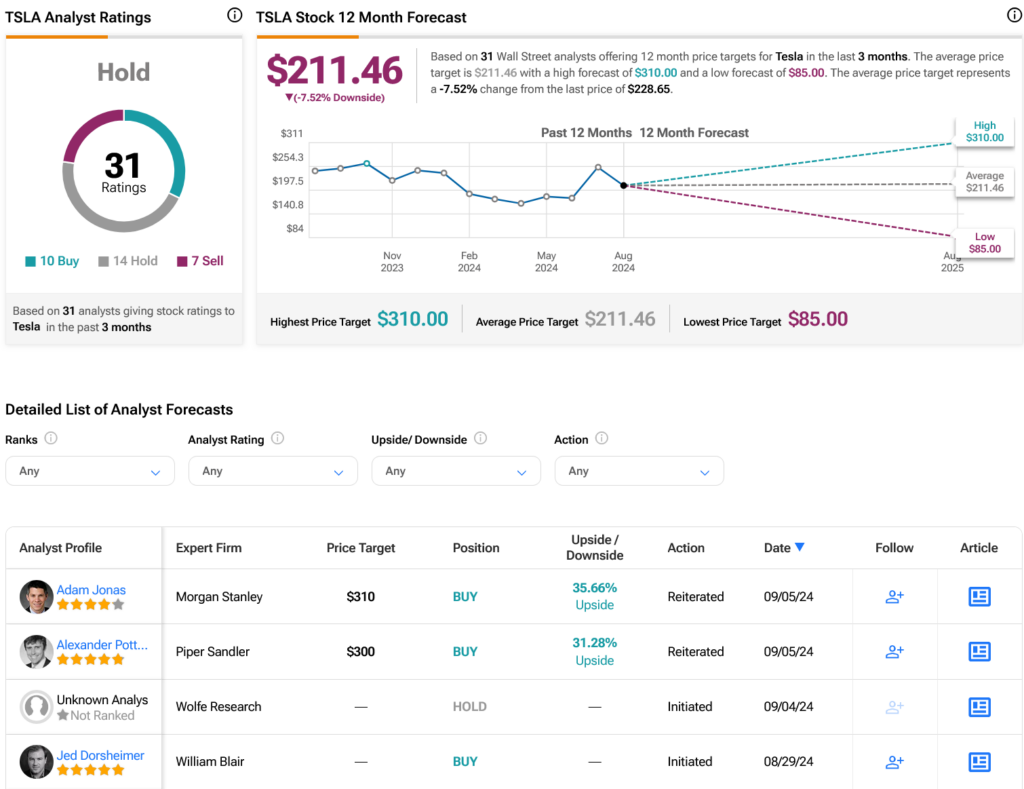

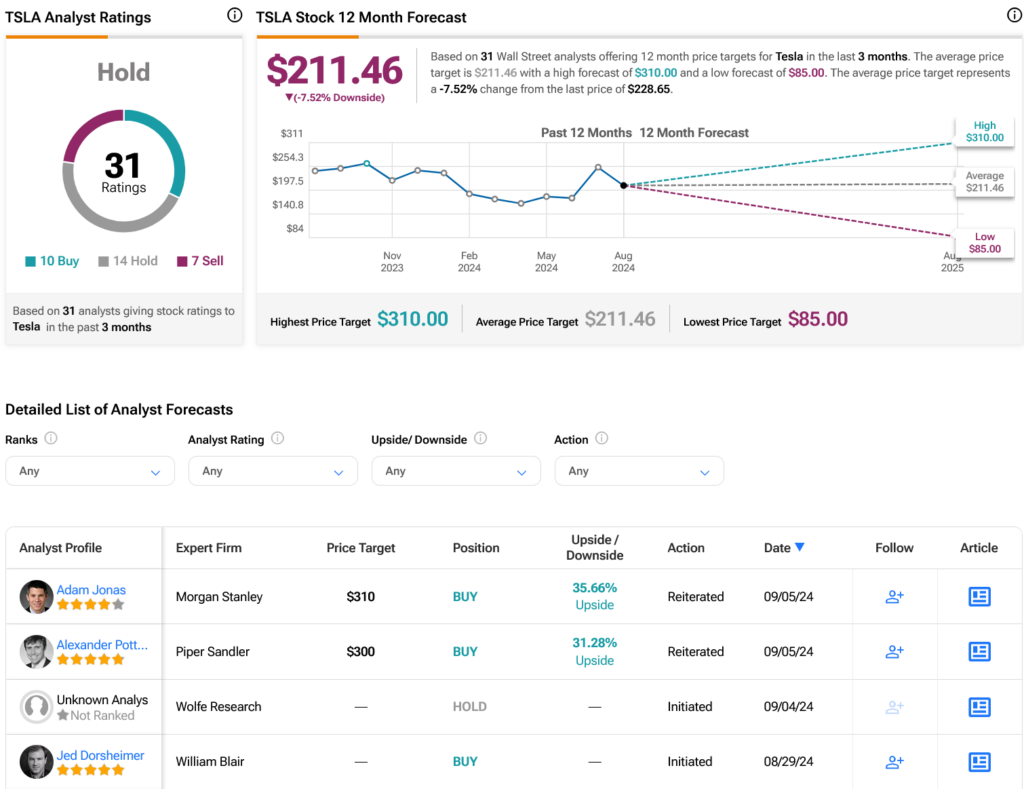

Turning to Wall Street, direct investment in X remains off-limits for the public due to its private status. However, investors eyeing Elon Musk-led ventures can turn their attention to Tesla (TSLA). Analyst sentiment on Tesla leans towards a Hold consensus, with 10 Buy ratings, 14 Holds, and seven Sells in the trailing three months.

Following a 9.26% dip in share value over the past year, Tesla’s average price target of $211.46 per share suggests a potential downside risk of 7.52%. This mixed bag of ratings underscores the nuanced outlook on the electric vehicle pioneer in the investment realm.

Explore additional TSLA analyst ratings here

For legal disclosures, refer to this link.