The Significance of Core PCE Data

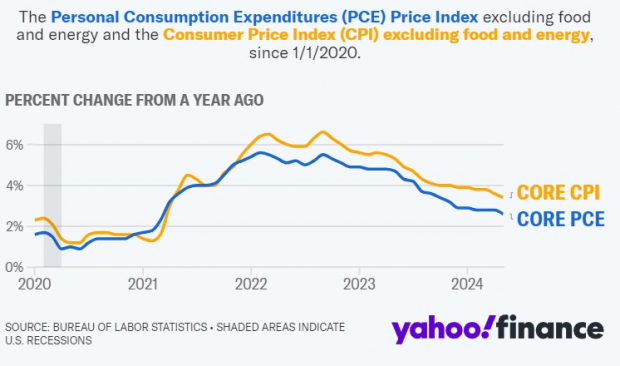

The Personal Consumption Expenditures (PCE) Price Index serves as a barometer for the evolving landscape of consumer spending and price changes in the U.S. economy. Particularly, the Core PCE metric, excluding volatile elements like food and energy, offers the Federal Reserve valuable insights into inflation trends.

Positive Economic Indicators

May witnessed a welcome deceleration in Core PCE, with a modest 0.1% increase compared to April’s 0.3%, marking the slowest annual rise in three years at 2.6%. Although exceeding the Fed’s 2% inflation target, this data presents an optimistic outlook for the economy and stocks.

Stocks Poised for Growth

Against the backdrop of cooling inflation, investors are eyeing companies positioned to thrive in a favorable economic environment. Here are three top stocks showing promise:

Nvidia (NVDA)

As inflationary pressures ease, the technology sector stands to benefit, with Nvidia leading the charge in AI chip production. Despite a modest post-split performance, Nvidia boasts a Zacks Rank #1 (Strong Buy) and favorable earnings estimates, indicating potential upside in the future.

Amazon (AMZN)

Amidst a stable inflationary landscape, e-commerce behemoth Amazon has seen a substantial stock surge this month, reflecting market optimism. With a Zacks Rank #3 (Hold) and impressive year-to-date gains, Amazon remains a compelling choice for investors.

Bank of America (BAC)

Banking institutions like Bank of America can capitalize on increased loan volumes and deposits in a subdued inflation environment. With a Zacks Rank #2 (Buy) and attractive valuation compared to peers, Bank of America’s solid fundamentals make it an appealing option for investors.

Final Observations

With core PCE data reflecting a positive shift in the economic landscape, stocks like Nvidia, Amazon, and Bank of America warrant attention as potential performers in the upcoming quarter.