Seizing Opportunity Amidst Oversold Stocks

When exploring the dynamic world of the information technology sector, astute investors keenly observe oversold stocks like treasure hunters scouring a sunken ship for hidden gems. These undervalued companies, shunned by many in the market, often present savvy traders with a golden opportunity to acquire stocks with potential upside.

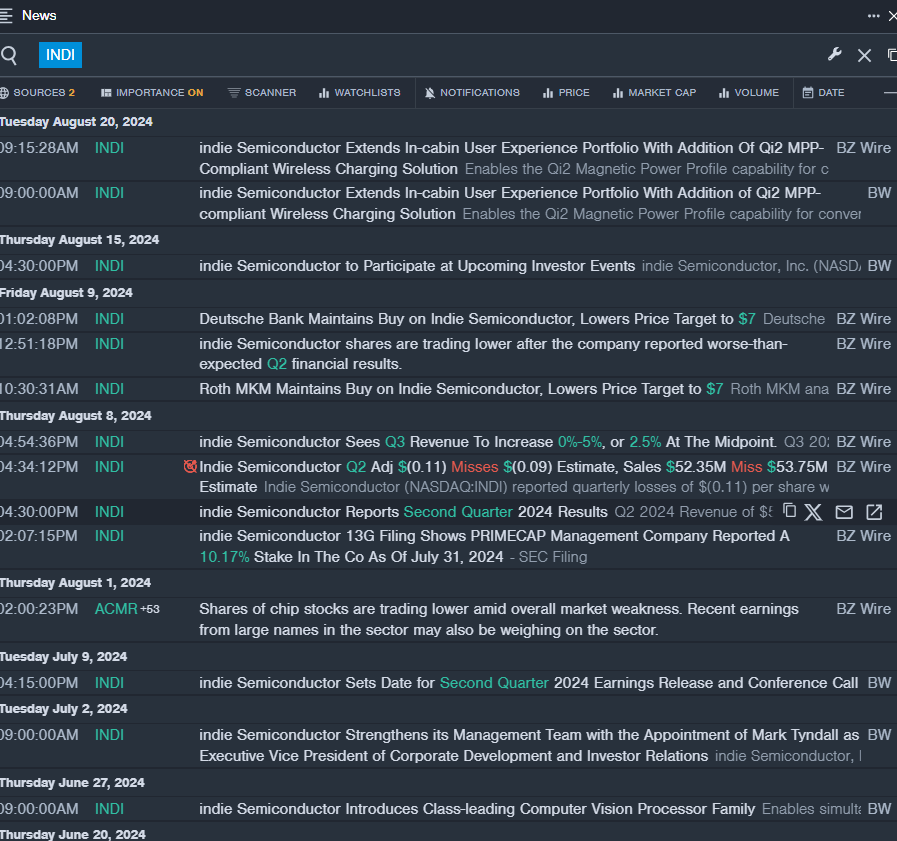

The Tale of indie Semiconductor Inc (INDI)

On a fateful August 8, indie Semiconductor Inc. plunged into the abyss of disappointing second-quarter financial results, sending shockwaves through the market. Despite the company’s valiant efforts to weather the storm in the challenging automotive market, its stock plummeted by an alarming 37% over the past month, eventually hitting a 52-week low of $3.79. The Relative Strength Index (RSI), a crucial momentum indicator, ominously lingered at a dismal 28.53, signaling distress in indie Semiconductor’s territory. A haunting echo of the company’s woes reverberated in the stock price, as shares spiraled downwards by 5.6% to rest at $3.89 by the day’s end.

Lost in the Shadows: Ouster Inc (OUST)

As the sun set on August 13, Ouster Inc. found itself ensnared in a web of disappointing second-quarter sales results, casting a shadow of uncertainty over its future. Despite the company’s valiant efforts to stay afloat in turbulent waters, Ouster’s stock descended into a perilous 46% decline over the past month, eventually striking a 52-week low of $3.67. The RSI, akin to a flickering lighthouse in a storm, dimly glowed at a disheartening 25.49, heralding potential danger ahead. Ouster’s stock, akin to a lost ship drifting at sea, tumbled by 3.3% to dock at $7.24 as the trading day drew to a close.

Whispers of Woe: Super Micro Computer Inc (SMCI)

On the ominous date of August 27, Super Micro Computer Inc. awoke to a chilling short report courtesy of Hindenburg Research, shrouding the company in a mist of uncertainty. The company’s shares, akin to a fallen angel, spiraled into a harrowing 36% decline over the past month, eventually plunging to a 52-week low of $226.59. The RSI, a silent harbinger of storms, remained languishing at a bleak 25.38, reflecting the turmoil brewing within Super Micro Computer. Like a runaway train hurtling down the tracks, SMCI shares careened down a steep 19% slope to a final resting place of $443.49 as the trading day drew to a close.