The Allure of Undervalued Tech Stocks

When the winds of investment change and the market whispers tales of oversold stocks in the tech sector, wise investors listen. It’s akin to discovering hidden treasures in the vast expanse of the financial world.

One such treasure lies in the Relative Strength Index (RSI), a compass for traders navigating the tumultuous seas of stock movements. A stock is deemed oversold when the RSI dips below 30, signaling a potential opportunity for those with a keen eye for undervalued assets.

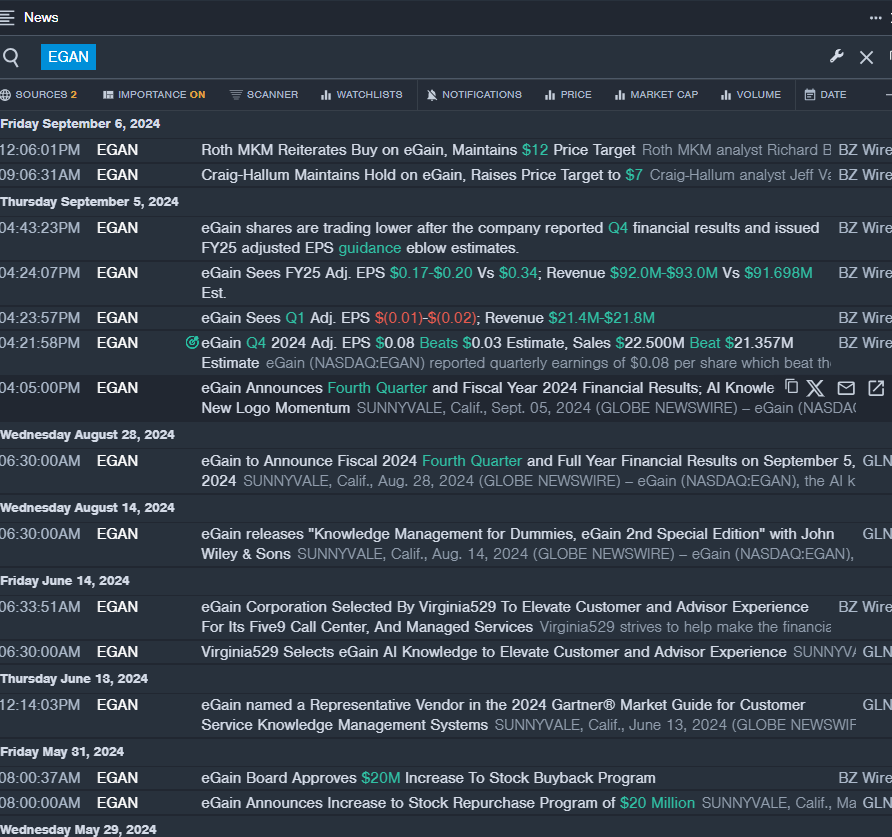

The Tale of eGain Corp – EGAN

- eGain Corp recently painted a picture of resilience amidst market turbulence. Despite reporting fourth-quarter results that fell short of expectations, the company’s CEO, Ashu Roy, remains optimistic about the growth prospects fueled by AI innovation.

- RSI Value: 25.80

- EGAN Price Action: The stock price of eGain dipped but showed signs of stability at $4.90 on Wednesday.

The Journey of Five9 Inc – FIVN

- Five9 Inc embarked on a voyage of revenue growth, surpassing market expectations in the second quarter of 2024. The Chairman and CEO, Mike Burkland, steered the ship to a yearly revenue milestone, proving the company’s resilience in a challenging market.

- RSI Value: 26.38

- FIVN Price Action: Five9’s stocks sailed to $27.33, belying the recent market turmoil.

The Legacy of RingCentral Inc – RNG

- RingCentral Inc recently bid farewell to its CFO but continued its journey with a commitment to excellence. Vlad Shmunis, the Founder and CEO, expressed gratitude for the departing CFO’s contributions, underscoring the company’s dedication to sustainable growth.

- RSI Value: 29.93

- RNG Price Action: RingCentral’s shares weathered the storm and closed at $28.00, hinting at a brighter future ahead.

As the sun sets on September, investors are left pondering the missed opportunities in the tech landscape. The key to success lies not in regret but in learning from the past, recalibrating strategies, and setting sail towards new horizons of financial discovery.