Investors eyeing the consumer staples sector have unearthed a trove of opportunity hidden within the realm of oversold stocks.

Within this sector, the Relative Strength Index (RSI) stands as a beacon, guiding traders towards undervalued gems poised for a potential upswing. This momentum indicator, comparing a stock’s strength on up days to down days, offers insight into short-term performance. An RSI below 30 is the magic number signaling an asset as oversold, as per market insights from Benzinga Pro.

Here, we navigate through the tumultuous waters of oversold stocks, where potential lurks beneath the seemingly dire surface.

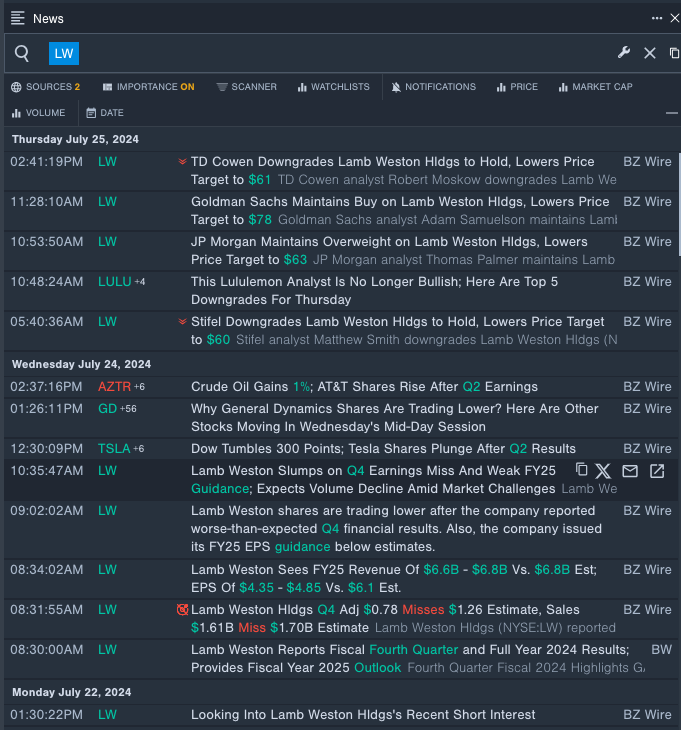

Lamb Weston Holdings Inc LW

- Lamb Weston Holdings Inc witnessed a rollercoaster ride on July 24, revealing weaker-than-anticipated fourth-quarter financial results and conservative guidance for FY25 earnings per share. The stormy seas ahead are acknowledged by Tom Werner, President and CEO, as the company foresees hurdles amidst changing global dynamics and softened demand. With a drastic 33% dip in its stock over five days and a 52-week low at $52.99, Lamb Weston’s ship is facing tumultuous waves.

- RSI Value: 15.59

- LW Price Action: Despite the turbulence, shares of Lamb Weston plunged 6% to close at $53.01 on Thursday, leaving investors clinging to hope amidst uncertainty.

- A beacon of hope in the form of Benzinga Pro’s real-time newsfeed guided investors through the dark clouds looming over Lamb Weston.

Boston Beer Company Inc SAM

- The tale of Boston Beer Company Inc unfolded on July 25, revealing disappointing second-quarter financial results that left investors parched for hope. With chairman and founder Jim Koch citing marginal improvements in gross margin and a bumpy depletion journey, the stock saw an 11% decline over the past month, docked at a 52-week low of $254.40.

- RSI Value: 24.15

- SAM Price Action: Despite the tempest, shares of Boston Beer meandered down by 0.5% to close at $270.52 on Thursday, as investors searched for the silver lining in the data storm.

- Charting the course ahead, Benzinga Pro’s tool cast light on the murky waters shrouding the fate of Boston Beer Company Inc.

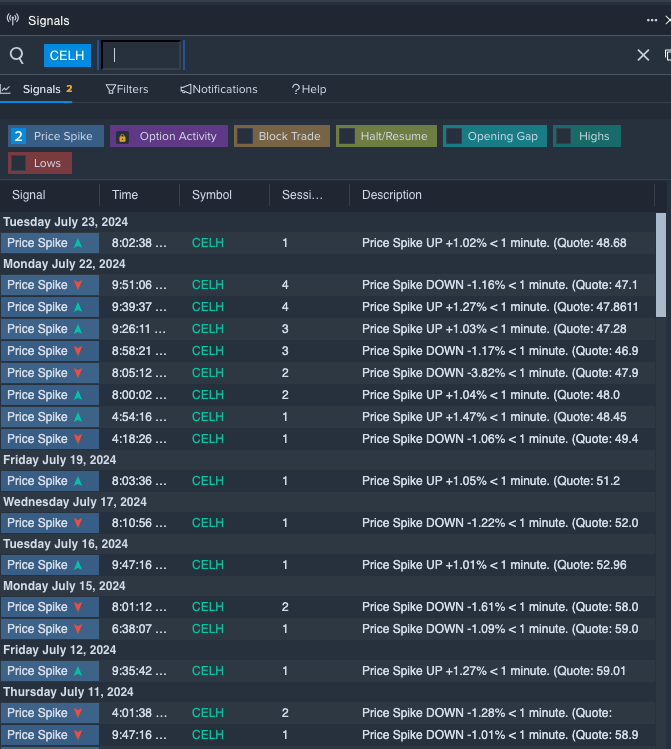

Celsius Holdings, Inc CELH

- Embarking on a voyage of uncertainties, Celsius Holdings, Inc faced the disheartening news on July 22, as B. Riley Securities maintained a Buy rating but slashed the price target. The turbulence led to an 18% decline in the stock over the past month, anchoring the share price at a 52-week low of $44.70.

- RSI Value: 29.12

- CELH Price Action: Offering a glimmer of optimism, shares of Celsius Holdings clawed their way up by 1.7% to close at $46.40 on Thursday, instilling hope in the hearts of investors amid the storm.

- Through the choppy waters, Benzinga Pro’s signals surfaced as a lighthouse, pointing towards a potential breakout in the horizon for CELH shares.

Read Next: