Discovering diamonds in the rough can mean gold for investors, particularly when looking at oversold stocks in the health care sector.

RSI, a famed momentum indicator, points us to undervalued companies. When RSI dips below 30, it screams opportunity. So, who’s on the radar this time?

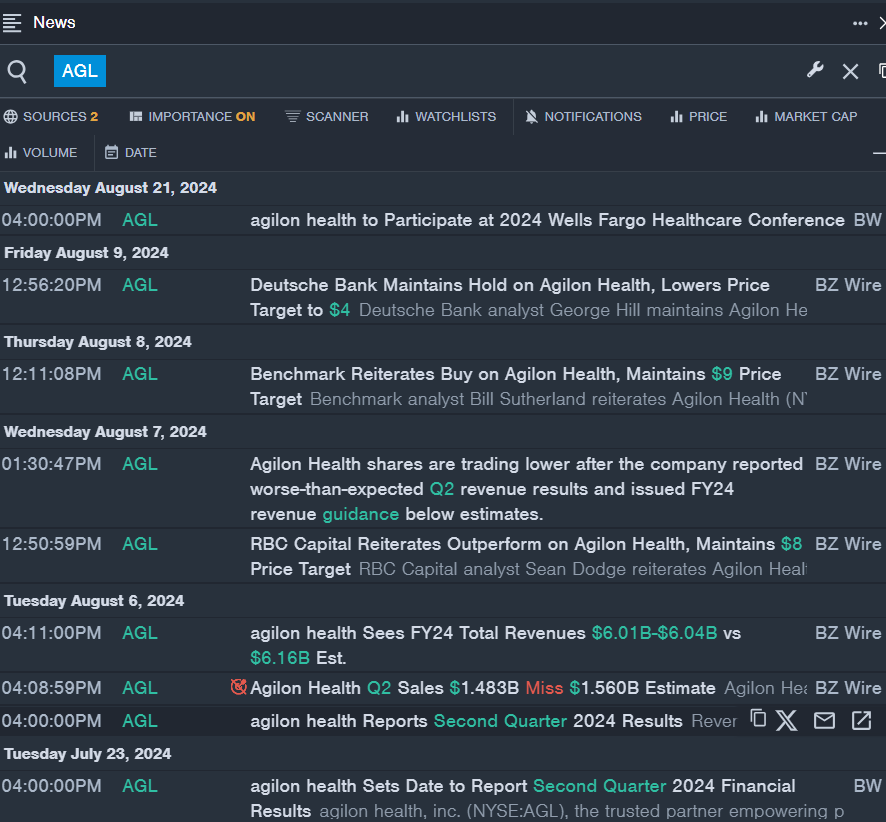

Agilon Health Inc AGL

- Agilon Health took a hit after an underwhelming Q2 revenue report. Despite the stumble, CEO Steve Sell is optimistic. With a 37% decline in stock value in the past month, Agilon Health has hit a 52-week low of $4.38.

- RSI Value: 27.10

- AGL Price Action: Shares closed at $4.38 on Monday, down by 2.2%.

Verrica Pharmaceuticals Inc VRCA

- Verrica Pharmaceuticals showed resilience with better-than-expected Q2 results. Their Phase 2 trial yielded promising data. Despite this, the stock took a 64% nosedive in the last month, touching a 52-week low of $2.53.

- RSI Value: 19.52

- VRCA Price Action: Shares closed at $2.57 on Monday, a drop of 8.9%.

ALX Oncology Holdings Inc ALXO

- ALX Oncology showed promise with a narrower-than-expected quarterly loss, prompting CEO Jason Lettmann to express optimism. Despite this, the company’s shares plummeted by 56% in the last month, reaching a 52-week low of $2.30.

- RSI Value: 28.48

- ALXO Price Action: Shares closed at $2.57 on Monday, marking a 7.5% increase.

When opportunity knocks, will you answer the door? These health care stocks, despite recent setbacks, may pave the way for potential portfolio recovery and gains. The journey of restoring health to ailing stocks is often rife with ups and downs, but those who stay the course could find themselves on the winning side of the market turmoil.