When it comes to the health care sector, opportunities present themselves in the most unexpected places. The realm of oversold stocks beckons with the promise of undervalued companies just waiting to shine in the investment spotlight.

One of the primary metrics at play here is the Relative Strength Index (RSI). This indicator, akin to a wizard’s crystal ball, sifts through a stock’s strength on both its up and down days. A low RSI value, typically below 30, signals a potential buying opportunity, painting a vivid picture of a stock’s short-term performance prospects.

Let us delve into the realms of oversold stocks, where potential is ripe and fortunes await those who dare.

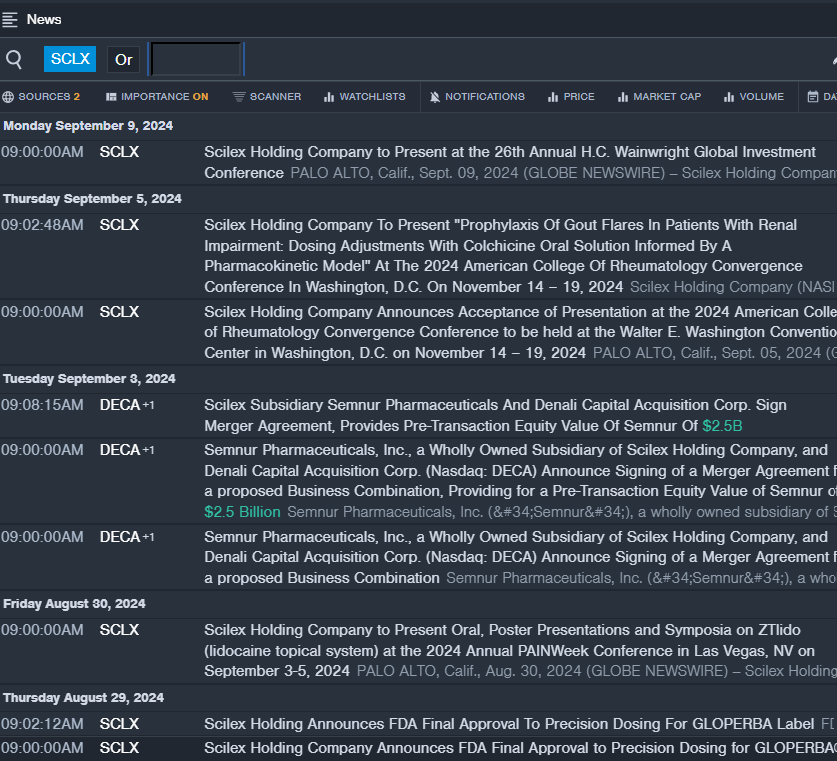

Exploring Scilex Holding Co’s Potential SCLX

- A recent FDA approval lit a spark in Scilex Holding Co’s world, shining a glimmer of hope on their precision dosing for GLOPERBA.

- RSI Value: 27.36

- SCLX Price Action: A slight dip saw the stock close at $1.02 on Monday, a mere hiccup on the journey to potential greatness.

Uncovering Patterson Companies, Inc.’s Challenges and Triumphs PDCO

- Patterson Companies faced some headwinds in their first quarter, with net sales feeling the weight of external factors. Despite the recent struggles, the company stands resilient with untapped potential.

- RSI Value: 26.32

- PDCO Price Action: Closing at $20.48 on Monday, Patterson Companies is a phoenix in the making, poised for a rise from the ashes.

Navigating the Path of AMN Healthcare Services, Inc. AMN

- AMN Healthcare Services braced for a storm with third-quarter revenue guidance that missed estimates. However, beneath the surface lies a tapestry of resilience and adaptability in the face of adversity.

- RSI Value: 27.11

- AMN Price Action: Despite recent setbacks, AMN Healthcare’s shares closed at $45.70 on Monday, hinting at a brighter tomorrow on the horizon.

In the world of health care stocks, volatility dances hand in hand with opportunity. As investors navigate the unpredictable seas of the stock market, these three companies stand as testaments to the ever-shifting tides of fortune.

With keen observation and strategic foresight, the potential for growth and prosperity shines through even the darkest of clouds. Stay vigilant, dear investors, for the journey ahead is fraught with challenges, but the rewards are as bountiful as the sun-kissed fields at dawn.