Unlocking Potential in Financial Stocks: A Closer Look

Amidst the tumult of the financials sector lie hidden gems, offering a fertile ground for prudent investors seeking undervalued opportunities.

One key metric that stands out in analyzing potential growth is the Relative Strength Index (RSI). An RSI below 30 signifies oversold conditions, hinting at a potential price rebound in the near term.

Here’s an exploration of three noteworthy players in the financials sector, poised for a potential uptrend with RSIs near or below 30.

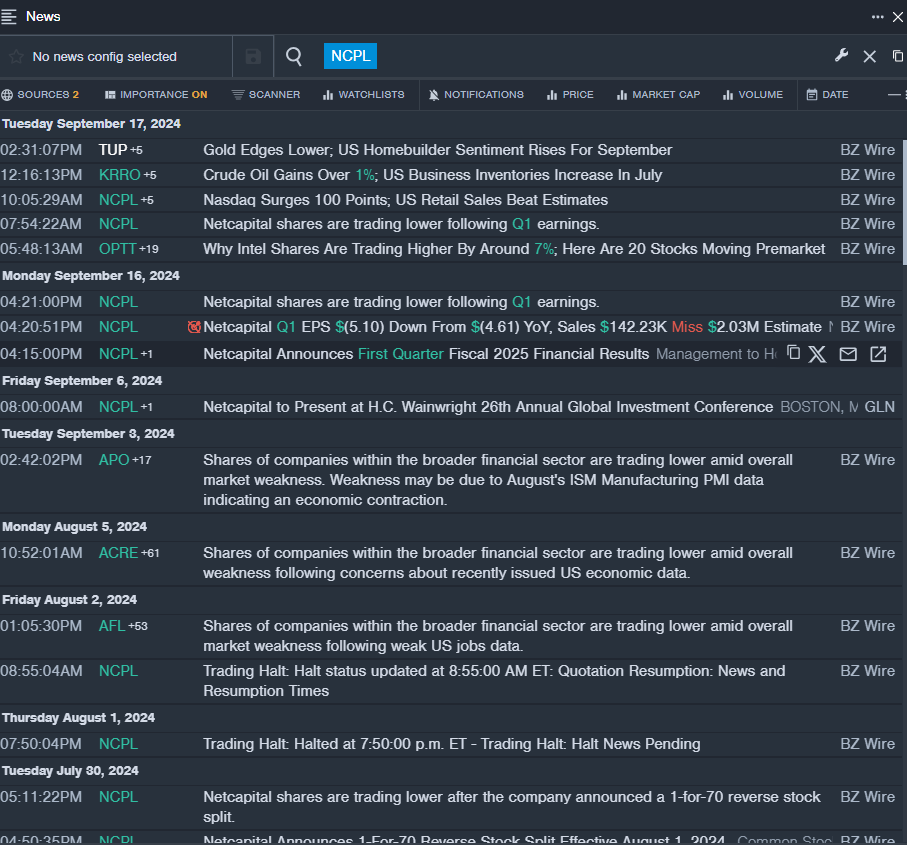

Netcapital Inc NCPL

- Netcapital Inc reported a challenging first-quarter loss of $5.10 per share on September 16. Despite this setback, CEO Martin Kay remains optimistic, stating that the company is positioning itself for future opportunities. The stock witnessed a significant decline of around 40% over the last five trading days and hit a 52-week low of $1.54.

- RSI Value: 29.24

- NCPL Price Action: Netcapital’s stock price closed at $1.63 on Thursday after a 5.2% decline.

Reliance Global Group Inc RELI

- Reliance Global Group shared an update on the pending acquisition of Spetner Associates on September 9, revealing a reduced cash payment requirement for the deal closure. The company’s stock experienced an 11% dip over the past five days, hitting a 52-week low of $2.12.

- RSI Value: 27.09

- RELI Price Action: Despite the recent challenges, Reliance Global Group’s stock closed at $2.45 on Thursday after a 5.8% decline.

Kaspi.kz AO – ADR KSPI

- Culper Research issued a report on Kaspi.kz AO on September 19, triggering a substantial 21% drop in the stock price over the last five trading days. The company’s shares hit a 52-week low of $85.02 amidst investor concerns.

- RSI Value: 18.65

- KSPI Price Action: Kaspi.kz AO’s stock concluded Thursday’s trading session at $99.81, witnessing a substantial 16.1% decline.