As the Q4 earnings season gradually comes to a close, it has been marked by a series of delightful surprises, propelling key indexes to unprecedented highs. However, within this positive trend, a select group of companies—beyond the typical ‘magnificent 7’—have outshined and demand closer scrutiny. These companies are Palantir (NYSE:), Arm Holdings ADR (NASDAQ:), and Super Micro Computer (NASDAQ:), each experiencing a meteoric rise following their robust Q4 results in terms of EPS and sales.

With the market relentlessly testing new all-time highs, the pressing question arises: have these stocks reached their zenith? In this deep dive, we will examine the stellar performances of these companies and assess if they still present compelling investment prospects, or if their recent gains have peaked.

Palantir: The Meteoric Rise

Palantir, the intelligence and defense software company, stands out as one of the stocks that has surged the most since the release of its latest financials. At the close of Wednesday’s trading session at $25.17, PLTR had surged an astonishing 50.6% post-results, published after the market’s closure on February 5. Notably, the stock spiked over 30% the day after reporting, fueled by a whopping +100% year-on-year EPS growth that surpassed expectations.

While the quality of the results is undeniable, there are clear signals suggesting that Palantir’s shares may now be overpriced. The InvestingPro fair value of the stock, consolidating various recognized financial models, rests at $15.83, a considerable 37% below the current market price. Analysts, while slightly more upbeat with an average target of $18.63, similarly perceive the stock as significantly overvalued.

Arm Holdings: A Lofty Ascent

Arm Holdings, a prominent chip and semiconductor company, has witnessed a commendable surge in its share price following the unveiling of its financials on February 7. At the close of trading on Wednesday at $126.4, the Arm Holdings stock had climbed an impressive 64%. However, it is essential to note that the stock has retraced from its peak of $164 on Monday, a level at which the impact of the results translated to a remarkable +112% surge.

The valuation models signal that the recent ascent has largely exhausted the stock’s potential. With fair value pinned at $79.23—37.3% below the current price—professional analysts are equally cautious, pegging an average target of $94.52, indicating a downside risk of over 25%. The ProTips also accentuate the high level of several of Arm Holdings’ valuation ratios.

Super Micro Computer: A Phenomenal Performance

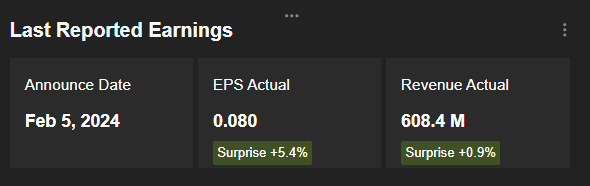

Between the release of Super Micro Computer’s financials on January 29 and the market’s close on Tuesday, the stock experienced only a single decline (a mere -0.66%). Ending yesterday’s trading at $880.55, the stock had skyrocketed by over 77% since the release. The company not only surpassed EPS and sales expectations but also demonstrated robust year-on-year growth.

Considering the scale of the gains posted post-results, some of which have already corrected, purchasing Super Micro Computer shares at the current price would undoubtedly be mistimed.

The Era of Tech Stock Momentum: Reaping Profits and Assessing Risks

As Palantir, Arm Holdings, and Super Micro Computer demonstrate meteoric market performance with their robust financial results, investors are savoring the sweet fruits of tech stock momentum. The extraordinary bullish response to their earnings has propelled their share prices to dazzling heights, offering a tantalizing glimpse of potential returns. Alas, even the sturdiest trees never reach the sky, and the lofty valuations of these stocks suggest a looming correction on the horizon. Yet, beneath the surface, the currents of the market may be signaling a shifting tide, as macroeconomic projections appear increasingly grim in the wake of unexpectedly scorching US economic data unveiled earlier this week.

Valuation and Predictions

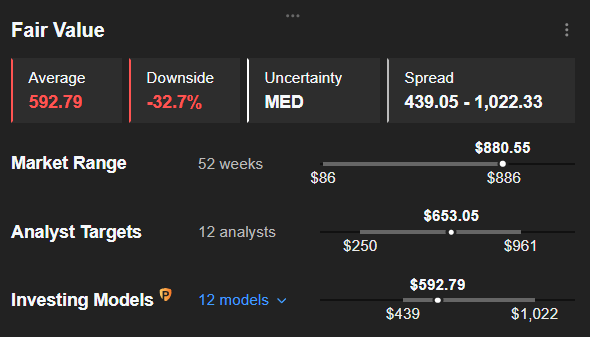

Despite the fervent optimism surrounding these tech darlings, there are inklings of concern rippling through the market. Projections of the fair value of Super Micro Computer stand at $592.79, indicating a potential downturn of 32.7%. However, it’s noteworthy that one valuation model pegs the stock at $1022, a staggering 16% above Wednesday’s closing price. This duality exemplifies the pervasive uncertainty clouding the market’s outlook.

SCMI Fair Value

Source : InvestingPro

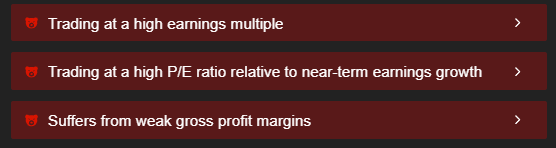

Intrigue mounts when delving into the intricate web of insights offered by InvestingPro. While the ProTips service raises red flags about Super Micro Computer’s low gross margins, it also unravels the tapestry of strengths underlying the company, as highlighted by a snippet from Bullish Tips.

SCMI ProTips

Source: InvestingPro

Highlighted in this duality is the essence of Super Micro Computer’s stock—a robust yet delicately poised asset. It is a veritable tightrope walk, where the pursuit of potential gains treads hand in hand with the looming specter of risk.

On the Brink of Volatility

However, while the allure of these technology marvels is undeniable, the murmurings of an imminent correction are growing louder. Their valuations are stretched taut, akin to an archer drawing an arrow to its limit, hinting at an imminent release. This titillating prospect comes at a time when the once-rosy macroeconomic picture is increasingly muddied, with the recent release of fervent US economic data casting a long and ominous shadow over the horizon.

Therefore, investors are faced with a conundrum. Should they bask in the glow of their current profits, or exercise caution in the face of looming uncertainties? The decision rests on a precipice, akin to a tightrope walker contemplating the leap of faith to the other side, mindful of the thrilling yet treacherous journey ahead.

A Word of Caution

Yet in this tantalizing market, caution is the watchword. Super Micro Computer presents a solid front, but its valuation whispers a disquieting tale, one that advises prudence in the pursuit of further investments. The allure of potential profits must be weighed against the specter of an impending correction, lurking like a ravenous wolf at the gates of the market.