Seizing Opportunities Amidst Market Volatility

In the world of investing, amidst the whirlwind of market volatility, lies an opportunity to uncover hidden gems—stocks that have been overlooked, ignored, or underestimated. The consumer staples sector is currently a goldmine for those seeking to buy into undervalued companies. By delving into the oversold stocks within this sector, investors can potentially unearth treasures primed for growth.

Decoding the RSI Indicator

The Relative Strength Index (RSI) is a powerful momentum indicator that compares a stock’s strength on upward price movement days with its strength on downward price movement days. This comparison offers traders valuable insights into how a stock may perform in the short term. Typically, when the RSI dips below 30, an asset is deemed oversold, signifying a potential buying opportunity.

Exploring the Top Two Oversold Stocks

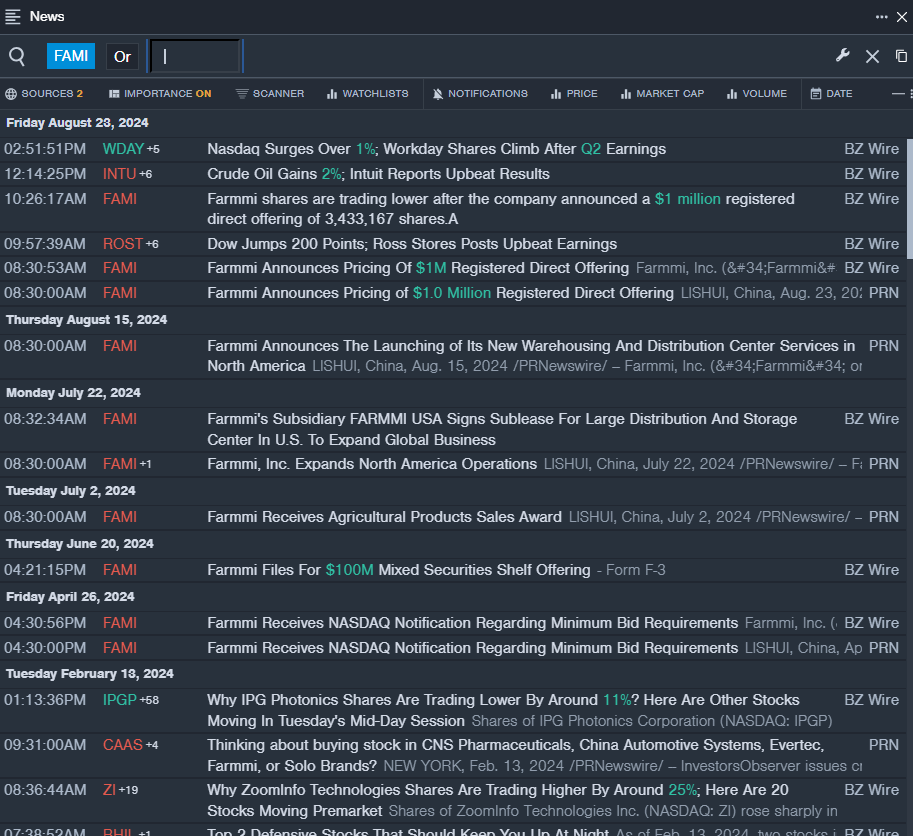

Farmmi Inc (FAMI)

- Recently, Farmmi Inc made waves in the market by announcing a $1 million registered direct offering of shares. The company’s stock plunged approximately 61% in the last month, hitting a 52-week low of $0.17.

- RSI Value: 29.98

- FAMI Price Action: Farmmi’s shares tumbled by 5.1% to close at $0.22 on a recent trading day.

elf Beauty Inc (ELF)

- In a recent development, Piper Sandler analyst Korinne Wolfmeyer reevaluated elf Beauty Inc, maintaining an Overweight rating while adjusting the price target. The company’s stock witnessed a downturn of around 30% in the past month, hitting a 52-week low of $88.47.

- RSI Value: 28.33

- ELF Price Action: elf Beauty’s shares slipped by 0.7% to finish at $112.43 most recently.

Amidst these fluctuating tides of market sentiment, astute investors see beyond the surface and discern the potential for these overlooked stocks to soar to new heights. The key lies in recognizing the hidden value obscured by short-term fluctuations and embracing the long-term growth prospects that these opportunities present.