As the countdown begins to Walmart’s Q1 earnings report on May 16, following a recent stock split aimed at inviting more retail investors, excitement is in the air. With a sharp focus on making the stock more accessible, Walmart’s performance will not only reflect its financial reality but also mirror current consumer shopping trends.

While Walmart preps for its earnings unveiling, the spotlight will also be on fellow retail giant Target whose earnings report is due next week. Given these dynamics, the question lingers – is now the opportune moment to consider Walmart’s stock?

Expectations for Q1 Performance

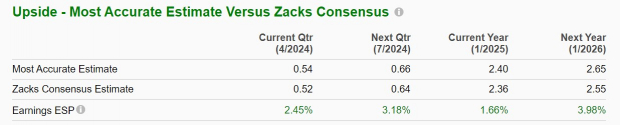

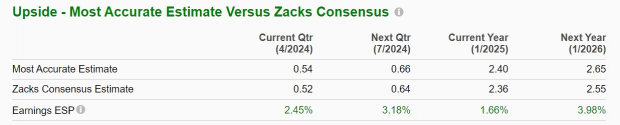

Zacks estimates anticipate a 6% increase in Walmart’s Q1 earnings, reaching $0.52 per share, with quarterly sales poised to rise by 4% to $159.33 billion. The Zacks ESP indicates a potential beat on earnings, with the Most Accurate Estimate placing Q1 EPS at $0.54, surpassing the Zacks Consensus by 2%.

Image Source: Zacks Investment Research

Interestingly, Walmart has impressively outperformed bottom line expectations in three of the last four quarterly reports, notably exceeding Q2 EPS estimates by 9% in February, coming in at $0.60 per share compared to the Zacks Consensus of $0.55 per share.

Image Source: Zacks Investment Research

Growth Trajectory & Future Projections

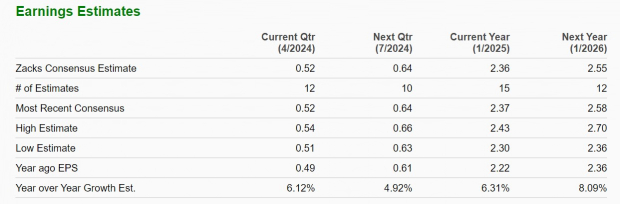

In terms of future prospects, Walmart’s annual earnings are forecasted to climb 6% in the current fiscal year 2025 and an additional 8% in FY26, reaching $2.55 per share. Total sales are expected to see a 4% uptick in FY25, with Walmart’s top line projected to grow another 4% in FY26 to $699.86 billion.

Image Source: Zacks Investment Research

Recent Performance & Market Valuation

Despite lagging behind the S&P 500’s growth over the past year, Walmart’s resilience as a defensive hedge in times of inflation has driven a commendable 18% increase in its stock value. Year to date, Walmart has surged 14%, outpacing both the benchmark and rival Target.

Image Source: Zacks Investment Research

In terms of valuation, Walmart is trading at 25.6X forward earnings, slightly higher than the S&P 500, but below Target. With a forward price-to-sales ratio of 0.7X, investors may find Walmart’s stock trading at attractive levels relative to the market.

Image Source: Zacks Investment Research

Final Thoughts

As we brace for Walmart’s Q1 report, the stock sits at a Zacks Rank #3 (Hold). While potential buying opportunities may loom on the horizon based on current valuations, long-term investors could still find value in Walmart’s stock at its current levels.