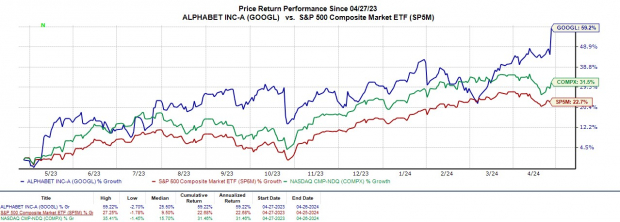

Alphabet’s (GOOGL) meteoric rise captivated markets during Friday’s trading session, propelled by a stellar first-quarter earnings report that exceeded all expectations. As the broader indexes flourished, Alphabet’s shares skyrocketed by over 10%, driven by the announcement of the tech giant’s inaugural dividend payout and a staggering $70 billion stock buyback authorization.

With GOOGL surging more than 20% year-to-date, let’s delve into the mesmerizing Q1 results and explore the opportune moment to partake in the resplendent post-earnings rally.

Image Source: Zacks Investment Research

Embarking on a Q1 Odyssey

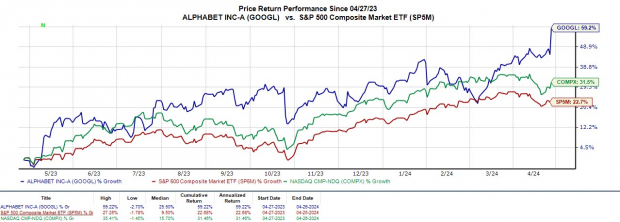

Alphabet’s Q1 earnings surged by 61% to reach $1.89 per share, a substantial leap from the previous year’s EPS of $1.17. This phenomenal performance surpassed the Zacks Consensus estimate by an impressive 27%. Furthermore, boasting a 16% increase in Q1 sales, soaring to $67.59 billion from $58.06 billion a year ago, Alphabet outshined earnings estimates by 2%.

Image Source: Zacks Investment Research

The standout results were fueled by Google Search, Cloud services, and robust advertising growth on YouTube. Highlighting its strategic positioning for the AI revolution, Alphabet showcased Gemini, a cutting-edge generative AI platform with a versatile understanding spanning audio, video, and textual domains.

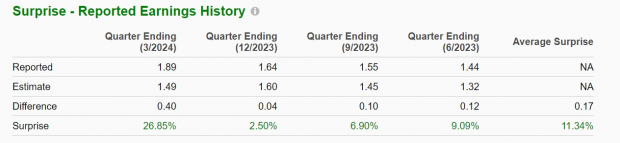

Significantly, Google Cloud’s revenue exceeded expectations by 3%, leaping 28% year-on-year to $9.57 billion, securing Alphabet’s place as the third-largest player in the US cloud computing arena, trailing behind Amazon’s AWS and Microsoft’s Azure.

Image Source: Zacks Investment Research

Market Dynamics & Fortunes Unfold

Alphabet’s groundbreaking decision to roll out a quarterly dividend of $0.20 per share, slated for June 17, spurred the company’s exhilarating rally. Fuelled by this announcement, Alphabet briefly breached the $2 trillion market cap threshold for the first time since 2021, sharing this rarefied air only with tech luminary giants like Apple (AAPL) and Microsoft.

Image Source: Zacks Investment Research

Looking Ahead with Alphabet

Alphabet’s Q1 testament cements expectations for sustained double-digit growth in revenues and profits through fiscal 2024. At present, GOOGL holds a Zacks Rank #3 (Hold), but anticipations are rife for a potential upgrade to a buy rating as earnings projections are poised to undergo an upward revision in the ensuing weeks.