As the world’s most valuable company, markets will be on edge for Apple’s fiscal third-quarter results on Thursday, August 1.

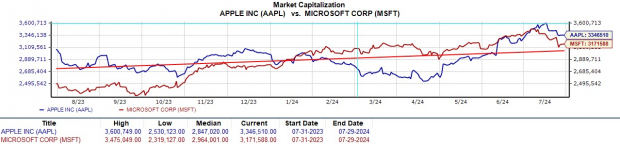

Surpassing Microsoft with a market cap exceeding $3.3 trillion, investors are pondering whether it’s prime time to delve into Apple’s stock as earnings anticipation heightens.

Image Source: Zacks Investment Research

Apple’s Q3 Expectations

From games to movie and music subscriptions, services revenue has been a cornerstone in buoying Apple’s strong top line. This segment includes Apple Pay, AppleCare, and the iconic app store; Q3 Services revenue is expected to leap by 13% to $23.99 billion.

In contrast, Product revenue, spearheaded by Apple’s flagship iPhone, is anticipated to decline to $60.06 billion compared to $60.58 billion in the corresponding quarter. Nonetheless, Q3 sales for Apple are still forecasted to escalate by 3% to $84.38 billion.

On the earnings front, Apple’s Q2 EPS is set to have a 6% uptick to $1.34 from $1.26 per share a year earlier. Interestingly, Apple has outperformed earnings projections for the past five quarters, with an average earnings surprise of 4.14% in its last four quarterly releases.

Image Source: Zacks Investment Research

Apple Intelligence

Wall Street is eager for insights into Apple’s strides in generative AI, focusing on personal intelligence systems for its iPhone, iPad, and MacBook. Apple is putting a ChatGPT-style generative AI tool dubbed “ASK” for AppleCare Support through its paces and revamping Siri, the digital voice assistant.

Apple has expressed its faith in the transformative essence of AI and its potential to set itself apart in the new tech era. Collaborating closely with Taiwan Semiconductor in this realm, Apple utilizes the M3 chip for its MacBook Air, which Apple hails as the premier AI-optimized consumer laptop with enhanced performance, including a potent neural engine.

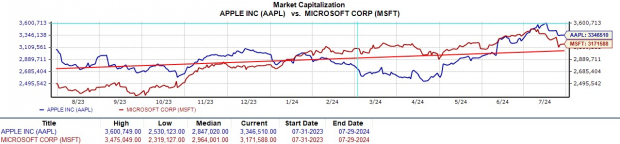

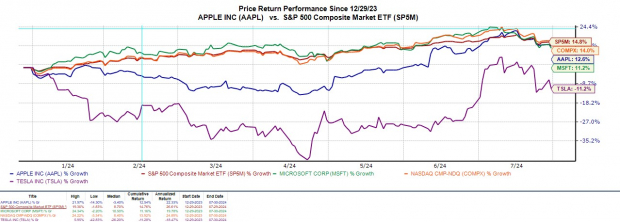

Year-to-Date Performance

Apple’s stock has enjoyed a decent uptick of +12% year-to-date, although it marginally trails broader indexes and most of its “Magnificent Seven” peers, excluding Microsoft and Tesla.

Image Source: Zacks Investment Research

Monitoring Apple’s Valuation

Analysis of one of Apple’s key fundamental valuation metrics reveals that AAPL currently bears a modest premium to the broader market at 33.1X forward earnings, compared to the S&P 500’s 23X. It’s notable that Apple trades below its decade-long high of 38.6X forward earnings but markedly above the 18.1X median.

Image Source: Zacks Investment Research

Key Takeaway

Prior to unveiling its Q3 report, Apple’s stock holds a Zacks Rank #3 (Hold). Meeting or surpassing quarterly projections may be pivotal for further upside in Apple’s stock, especially since its valuation hints at the possibility of more favorable buying prospects down the road.

Nevertheless, Apple is akin to a cash cow, possessing the means to expand and potentially capitalize on artificial intelligence, offering substantial rewards for long-term investors.