Analyzing Netflix’s Dominance

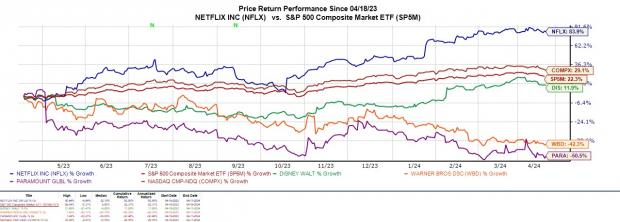

Financial scrutiny hones in on Netflix NFLX, particularly as the streaming behemoth with over 260 million users continues its reign without growth projections. Surging 26% this year, NFLX outshines Disney’s DIS at 25%, leaving competitors like Paramount Global PARAA and Warner Bros. Discovery WBD in the dust.

Q1 Earnings Expectations

As the market awaits Netflix’s Q1 report post-market on April 18, Zacks projects a sales upswing of 13% to $9.26 billion. Earnings could soar by 56%, potentially surpassing estimates given that Netflix has outperformed the Zacks Consensus.

Streaming Subscriptions Surge

Netflix towers over competitors with an anticipated 5.73 million new paid subscribers in Q1, marking a remarkable 227% jump from Q1 2023. Bolstering this, Netflix’s Q4 boasted a staggering 13.12 million paid additions, an impressive 48% above predictions.

Evaluating P/E Valuation

Traded at 36.2X forward earnings, Netflix now sits comfortably beneath its five-year high of 114.9X. With earnings projected to surge by 42% in fiscal 2024 and an additional 23% in FY25, NFLX stocks present an alluring investment opportunity.

Final Thoughts

Despite scaling past $600 per share this year, Netflix’s Zacks Rank #3 (Hold) beckons investor attention. As the company gears up to unveil its Q1 performance, exceeding expectations will be pivotal to solidifying Netflix’s trajectory of growth.