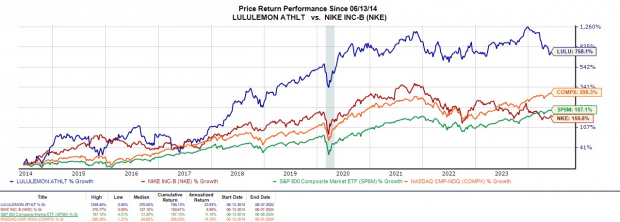

Amid concerns about a dip in consumer spending impacting apparel giants like Lululemon LULU and Nike NKE, Lululemon stood out by surpassing Q1 expectations. While both stocks faced a -8% decline over the past year, Lululemon’s robust growth potential remains intact, setting a promising tone in the market following its earnings success. Nike is expected to unveil its Q1 results later this month.

Considering LULU’s steep 37% drop since the beginning of the year, investors are contemplating whether now is the moment to purchase shares in the popular yoga-themed athletic brand known for its stellar historical performance.

Image Source: Zacks Investment Research

Q1 Performance & Revenue Forecast

Demonstrating resilient brand loyalty, Lululemon’s Q1 sales reached $2.2 billion, marking a 10% increase from the previous quarter and slightly exceeding estimates of $2.19 billion. Moreover, the Q1 EPS of $2.54 surpassed expectations by 7% and surged 11% from the same period a year ago. Notably, Lululemon has now surpassed earnings estimates for 16 consecutive quarters dating back to September 2020.

Image Source: Zacks Investment Research

For the upcoming quarter, Lululemon anticipates a revenue growth of 9%-10%, slightly higher than the current Zacks Consensus of 8.23% growth or sales of $2.39 billion (Current Qtr below). The company maintains its full-year revenue growth projection at 10%-11%, with expected growth of 11.53% (Current Year).

Image Source: Zacks Investment Research

Earnings Per Share Expectation

Zacks estimates indicate an 11% increase in Lululemon’s annual earnings for fiscal year 2025, projecting $14.14 per share compared to EPS of $12.77 in FY24. Additionally, the forecast shows a further 11% jump in FY26 EPS to $15.68.

Image Source: Zacks Investment Research

Summary

Despite lingering concerns about consumer spending slowdown, especially in premium apparel, Lululemon maintains a Zacks Rank #3 (Hold). The Q1 results of the company reaffirm an encouraging outlook on earnings. Furthermore, with LULU trading at a historically low P/E ratio of 22.9X since its IPO, long-term investors could potentially benefit from current levels, although future buying opportunities might be on the horizon.