Stock Performance Overview

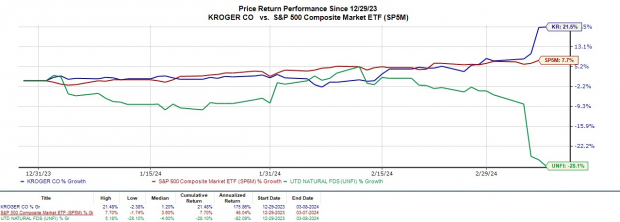

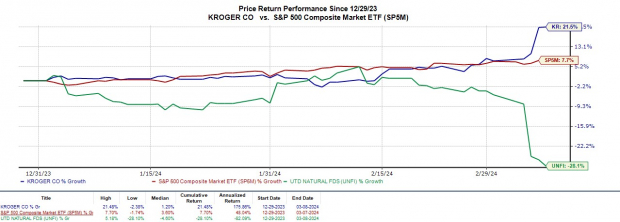

Value investors have their eyes on Kroger (KR) and United Natural Foods (UNFI), with both companies surpassing quarterly earnings expectations. Kroger, the grocery chain giant, and United Natural Foods, a leading organic food distributor, have been moving in opposite directions in terms of price performance but remain intriguing due to their solid business operations and reasonable valuations.

In stark contrast, Kroger’s stock is hitting a 52-week high around $55 per share, while United Natural Foods is currently at lows of $11 per share. This sets the stage for a comparison between Kroger’s strong year-to-date rally and the potential for a sharp rebound in United Natural Foods stock.

Image Source: Zacks Investment Research

Earnings Performance

Kroger’s stock saw a significant boost, rising by +10% after an impressive Q4 performance highlighted by lower supply-chain costs. The company reported fourth quarter earnings of $1.34 per share, marking a 35% year-over-year increase and beating expectations by 18%. Despite slightly missing sales estimates of $37.24 billion, Kroger’s quarterly sales of $37.06 billion still rose by 6%, showcasing the company’s consistent outperformance over the years.

Image Source: Zacks Investment Research

On the other hand, United Natural Foods’ fiscal second quarter results revealed earnings of $0.07 per share, surpassing estimates of $0.01. However, this figure was a decline from $0.78 per share in the previous year due to supply chain disruptions and other challenges. While Q2 sales of $7.77 billion slightly missed estimates and were down from the prior year, the company has managed to exceed earnings expectations in three of its last four quarterly reports.

Image Source: Zacks Investment Research

Valuation Analysis

Kroger’s stock, despite recent highs, remains attractively priced with a 12.7X forward earnings multiple, in line with the Zacks Retail-Supermarkets’ industry average and below the S&P 500’s valuation of 21.6X. Furthermore, the company offers a 2.09% annual dividend yield and the potential for an acquisition of competitor Albertsons (ACI), which has generated significant interest despite facing regulatory hurdles.

Image Source: Zacks Investment Research

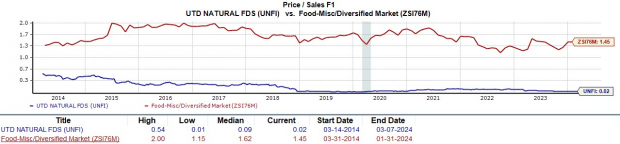

United Natural Foods’ stock presents compelling value, trading at just 0.02X forward sales, a substantial discount compared to the industry average and the broader market. With a forecasted 2% increase in total sales this year to $31 billion, the company’s stock starts to make a case for a rebound despite short-term challenges.

Image Source: Zacks Investment Research

Key Takeaways

With both companies exceeding earnings expectations and sporting a Zacks Rank #2 (Buy), Kroger and United Natural Foods stock show promise for continued growth. Investors should keep an eye on Kroger’s ongoing rally and the potential for a rebound in United Natural Foods’ stock, signaling potential opportunities in the market.