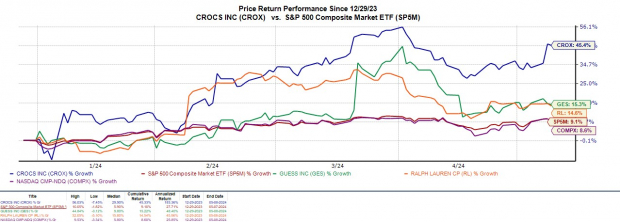

Crocs CROX stock has taken the limelight this earnings season by exceeding Q1 earnings projections with flying colors. The standout performance of this footwear and apparel giant has propelled its stock to surge over +40% so far this year, outshining major indices and industry counterparts like Guess GES and Ralph Lauren RL.

Given this remarkable feat, let’s delve into whether it’s prudent to hold or even consider purchasing Crocs shares post its impressive Q1 results.

Image Source: Zacks Investment Research

Robust Q1 Performance

Crocs has witnessed a compelling surge in brand growth, marking a 6% year-over-year rise in Q1 sales to $938.63 million. This figure not only surpassed estimates of $883.85 million by 6% but also showcased enhanced profitability, with earnings per share standing at $3.02 — reflecting a 16% increase from the previous year’s quarter and a decisive 34% beat on EPS estimates of $2.25.

Further strengthening its track record, Crocs has managed to exceed both revenue and earnings expectations for 16 consecutive quarters and has delivered an average earnings surprise of 17% in its last four quarterly reports.

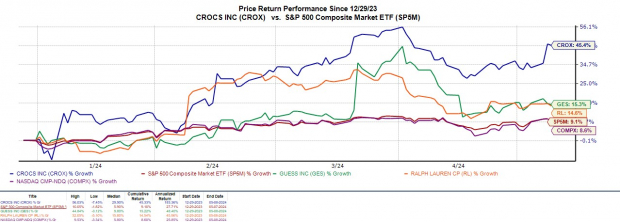

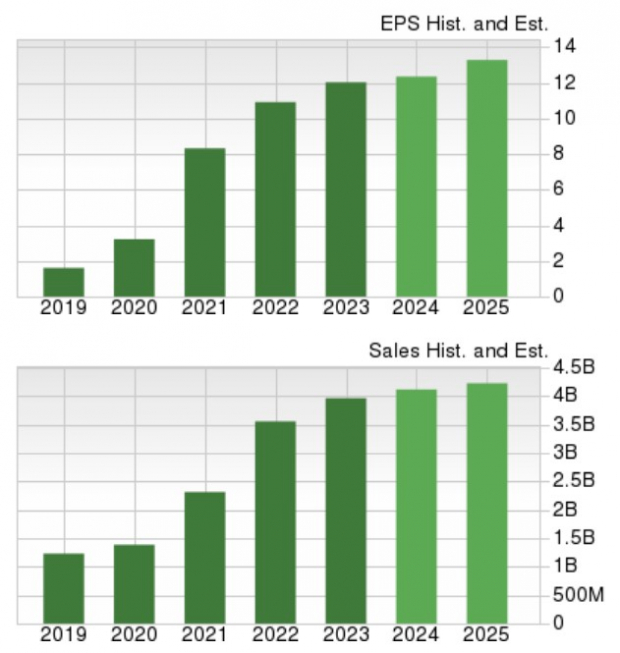

Image Source: Zacks Investment Research

Growth Trajectory & Future Outlook

As per Zacks estimates, Crocs’ annual earnings are anticipated to grow by 3% in fiscal year 2024 and are forecasted to further expand by 9% in FY25, reaching $13.56 per share. Total sales are expected to witness a 4% increase this year and are set to rise by an additional 6% in FY25 to $4.37 billion.

Image Source: Zacks Investment Research

Appealing P/E Valuation

Despite the significant year-to-date rally in Crocs stock, CROX still boasts a modest 10.9X forward earnings ratio. This stands at a slight discount compared to the Zacks Textile-Apparel Industry average of 12.5X, lower than Ralph Lauren’s 14.8X, and marginally higher than Guess at 9.1X.

Image Source: Zacks Investment Research

Final Thoughts

Presently, Crocs stock sports a Zacks Rank #3 (Hold). The company’s promising growth trajectory coupled with its attractive valuation might make holding on to CROX a rewarding decision, although investors might want to keep an eye out for potential buying opportunities after such a blazing start to the year.