Alongside the formidable Amazon, Apple stepped into the limelight with an exhilarating earnings report, coinciding with a market surge following Fed Chair Jerome Powell’s reassuring stance on interest rates.

Surpassing expectations, Apple set ablaze its fiscal Q2 with record-breaking earnings per share of $1.53, a feat achieved through robust revenue marks in numerous international markets, outshining forecasts and marking growth from the previous year.

Apple’s consistent outperformance extends beyond its recent quarter. With a string of earnings surprises over the past year, the tech behemoth showcases a remarkable trend in surpassing estimates.

Image Source: Zacks Investment Research

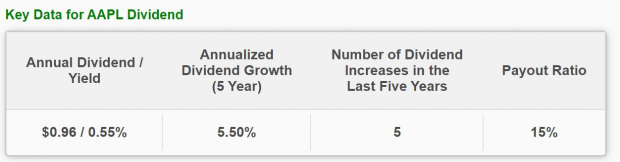

Expanding Dividends and Buybacks

Asserting its financial vitality, Apple initiated a substantial $110 billion share repurchase program paired with a 4% dividend boost. Such moves underscore Apple’s prosperity and commitment to shareholder value.

Image Source: Zacks Investment Research

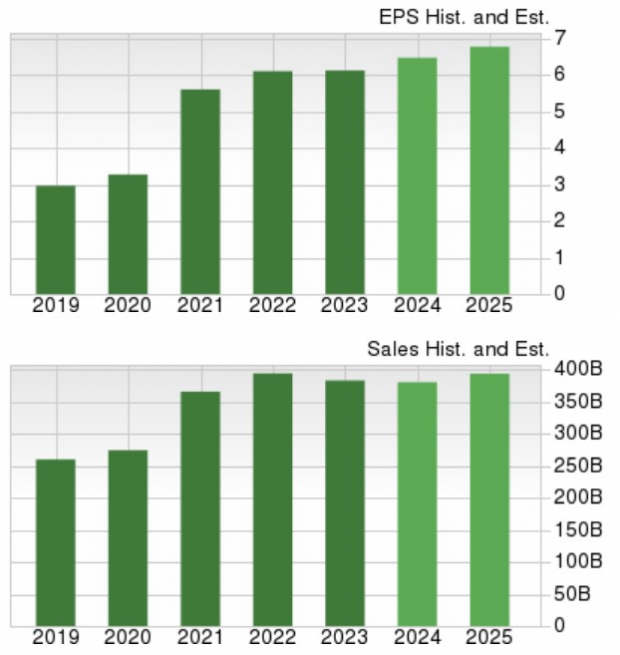

Forward Trajectory

Forecasts indicate positive momentum for Apple, with expected earnings growth in fiscal years 2024 and 2025. While sales figures may witness a temporary plateau, Apple’s strategic maneuvers position it for a revenue uptick in the coming years.

Image Source: Zacks Investment Research

Final Remarks

Apple’s stock currently sits at a Zacks Rank #3 (Hold), showcasing resilience amid regulatory uncertainties. With expanding global reach and promising financial outlook, Apple remains an intriguing prospect for investors, potentially poised for further growth.

Unmatched Returns in the Investment Sphere

Outshining other investment avenues, Bitcoin has displayed unparalleled profitability, delivering substantial returns in recent presidential election years: 2012, 2016, and 2020. Projections hint at sustained growth, promising continued investor appeal.

No guarantees exist in the investment realm, but historical data underscores Bitcoin’s impressive performance, a trend anticipated to persist. With Zacks predicting another surge on the horizon, the allure of digital assets remains compelling.