Wall Street analysts are split on their opinions of Rivian (NASDAQ: RIVN) stock, with price targets ranging from $14 to $19. Currently priced at around $13, investors are left wondering about the near-term prospects of this electric vehicle (EV) company. One analyst, however, is standing firm on his outperform rating and $19 price target, foreseeing a remarkable 42% upside potential, the most bullish outlook on the market.

Is a 42% increase in Rivian stock a realistic possibility over the next year? Let’s delve deeper into the reasons behind this optimistic projection.

Future Projections for Rivian

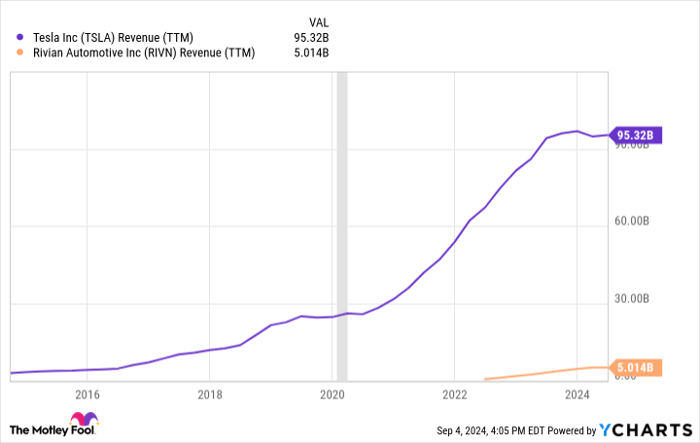

While predicting short-term stock movements may be challenging, forecasting the future trajectory from a business standpoint is a more achievable feat. Rivian, a company that has witnessed rapid growth, soared from minimal revenue to over $5 billion in just a few years. With the success of its luxury models, the R1T and R1S, targeting the high-end market, Rivian’s evolution mirrors that of Tesla’s initial strategy.

Following Tesla’s footsteps, Rivian is poised to introduce mass-market models like the R2, R3, and R3X, priced below $50,000. This strategic move is expected to expand Rivian’s market reach exponentially, propelling its revenues on a trajectory similar to Tesla’s journey from niche to mainstream markets.

Rivian’s upcoming models are scheduled for release in the first half of 2026, making the forthcoming year relatively quiet in terms of product launches. However, a significant catalyst within the next 12 months could be a game-changer for Rivian’s stock price, driving the optimism of the most bullish analyst on Wall Street.

Key Catalysts Driving Rivian’s Potential

Unlike Tesla, Rivian is currently grappling with negative gross margins, incurring losses with each vehicle sold. However, the tide is expected to turn soon, with Rivian’s management forecasting positive gross margins by the fourth quarter of 2024. The company has made substantial progress in reducing its per-vehicle losses from $33,000 to $6,000 over the past year.

Analyst George Gianarikas from Canaccord envisions this shift to profitability as a crucial turning point for Rivian, dispelling doubts about the company’s financial viability. The transition is anticipated to set the stage for the successful launch of Rivian’s mass-market models, driving scale and market penetration. If Rivian achieves positive gross margins this year, its future prospects for 2025 and beyond look promising, potentially undervaluing its current $13 billion market capitalization.

Should you Invest in Rivian Automotive?

Before diving into Rivian Automotive stock, investors should weigh their options. The Motley Fool Stock Advisor team recently unveiled their top 10 stock picks, excluding Rivian Automotive. These curated selections are projected to yield significant returns in the coming years, presenting lucrative growth opportunities for investors.

Reflecting on past successes, such as Nvidia’s inclusion in their recommended list in 2005, showcasing a colossal return on investment over the years, from $1,000 to $630,099, the Stock Advisor’s track record speaks volumes in providing valuable insights and recommendations.

With a focus on building robust portfolios, regular updates, and two new stock picks monthly, the Stock Advisor service has outperformed the S&P 500 fourfold since 2002. Amidst the volatile market landscape, informed investment decisions become paramount for sustainable growth and wealth creation.

*Stock Advisor returns as of September 3, 2024