Market Dynamics and Tech Surges

The stock market has seen a dazzling rise in early 2024. The S&P 500 and Nasdaq Composite are touching unprecedented highs, indicating an unrelenting surge.

Driving these market gains are technological giants, with the “Magnificent Seven” stocks leading the charge in artificial intelligence (AI) innovation.

Nvidia’s Ascendancy and Financial Marvels

Within this tech elite, Nvidia (NASDAQ: NVDA) shines brightly. Since its inception in 1999, Nvidia has delivered an astronomical total return of 138,700%, turning a modest $1,000 investment into a staggering $1.4 million.

Despite this meteoric ascent, analyst C.J. Muse of Cantor Fitzgerald sees further room for growth, elevating Nvidia’s price target to $1,400, hinting at a 34% potential upswing.

The Thriving Core of Nvidia

Nvidia’s stronghold lies in its cutting-edge GPUs, powering a myriad of machine learning applications and large language models. The A100, H100, and Blackwell chips stand as pinnacles of GPU technology.

An exemplary testament to its dominance is Nvidia’s command of 80% of the market for AI-driven chips.

Financial Fortitude and Expansion

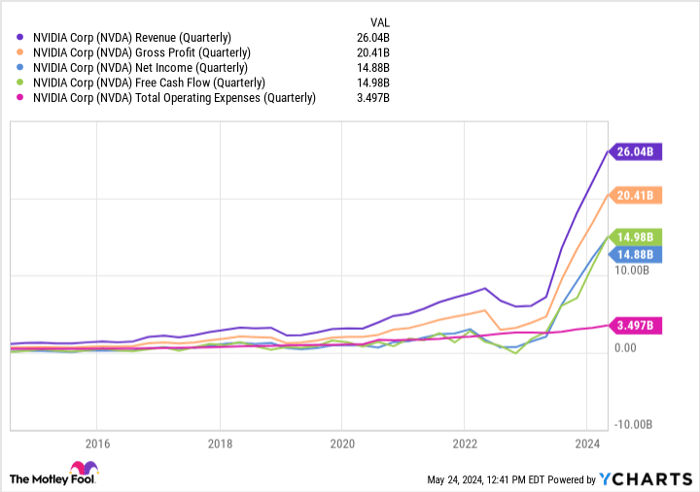

Despite escalating operational costs, Nvidia leverages its market supremacy to maintain robust pricing power. By aligning demand with supply, Nvidia not only sustains profitability but propels revenue growth.

As operational expenses soar, Nvidia’s revenue trajectory outpaces the impact on margins, expanding its gross profit margin and bolstering its financial strength.

Prospects and Potential Challenges

Though facing competition from rivals like Advanced Micro Devices and Intel, and the internal chip developments of tech behemoths like Amazon and Meta Platforms, Nvidia’s diversified portfolio and AI focus insulate it from immediate threats.

Embracing competition as a catalyst for growth, Nvidia’s strategic evolution from gaming-centric roots to AI leadership underscores its adaptability and resilience in the ever-evolving tech landscape.

Exciting Times Ahead for Nvidia: A Look at the Future Growth Potential

Nvidia Poised for Continued Success in AI Chips Market

The sky seems to be the limit for Nvidia as its stock is predicted to rise to an impressive $1,400 per share. However, this is just the beginning of the journey towards even greater heights. The company has firmly established itself as a leader in AI chips, a position that has translated into soaring profits, providing Nvidia with exceptional financial maneuverability to explore new avenues of growth.

Amidst the nascent stages of the AI revolution, Nvidia stands to benefit from long-term secular trends for years to come. Investors with a forward-thinking perspective may find it opportune to seize the moment and acquire shares of Nvidia at present. The company has already generated substantial wealth for many individuals, and its current growth trajectory hints at the dawn of a fresh wave of prosperity.

The Case for Investing in Nvidia

Contemplating an investment in Nvidia warrants a thoughtful evaluation. The analyst team at Motley Fool Stock Advisor has recently uncovered what they believe are the ten most promising stocks for investors to consider, and interestingly, Nvidia did not make the cut. Nevertheless, these selected stocks have the potential to yield substantial returns in the forthcoming years.

Reflecting on Nvidia’s inclusion in such a list back on April 15, 2005, unveils an astounding reality – an investment of $1,000 at that point would have burgeoned into a remarkable $677,040!* Such revelations underline the transformative power of strategic investments over time.

Stock Advisor offers investors a user-friendly roadmap to success, furnishing insights on portfolio construction, regular updates from analysts, and a pair of fresh stock recommendations each month. Noteworthy is that the Stock Advisor service has outperformed the S&P 500 by more than fourfold since 2002*.

Embracing the Potential of Nvidia and Beyond

As we navigate the complex landscape of investment decisions, Nvidia emerges as a compelling choice that signifies the intersection of innovation and growth. The unfolding narrative of Nvidia’s trajectory exemplifies the essence of forward-thinking in the realm of financial markets, where strategic moves today can pave the way for tomorrow’s success.

While the past achievements of Nvidia paint an inspiring picture, it is the untapped opportunities and uncharted territories that beckon investors towards a future brimming with promise. The path ahead may be adorned with challenges, but in the volatility lies the allure of potential rewards waiting to be seized.

Investors eyeing the tantalizing prospects of Nvidia are poised to embark on a journey defined by resilience, innovation, and the unwavering spirit of growth. The canvas of possibilities that Nvidia presents is not merely a snapshot of the present but a glimpse into a future where strategic investments may script tales of remarkable prosperity.