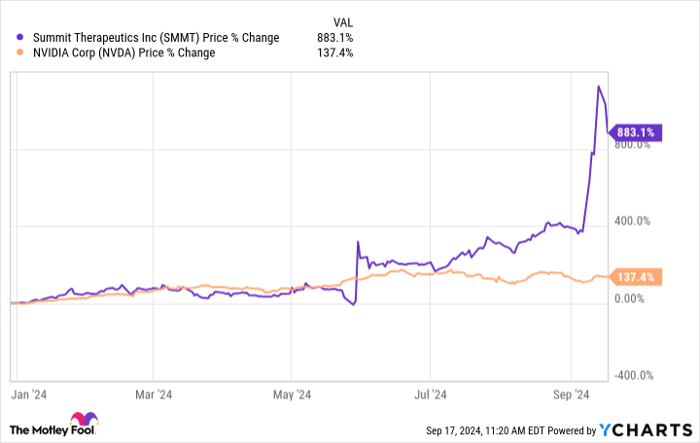

With the financial world abuzz over Nvidia’s exceptional performance this year, it may come as a surprise to many investors that the relatively unknown Summit Therapeutics has outshone the chipmaker. Summit’s stock price has skyrocketed by a jaw-dropping 900% year to date, leaving Nvidia’s 137% gain appearing almost lackluster in comparison.

So, what lies behind Summit Therapeutic’s meteoric rise, and is it still a wise investment opportunity? Let’s delve into this remarkable success story.

Challenging the Giant

Specializing in cancer medications, Summit Therapeutics owes its current success to significant advancements in its primary pipeline asset, ivonescimab. Originally developed by Akeso, a China-based company, Summit secured the rights to license the drug in various countries, including the U.S. Ivonescimab has already received approval in China for a specific type of lung cancer and has recently achieved remarkable results in a phase 3 clinical trial for non-small cell lung cancer (NSCLC).

In this trial, ivonescimab demonstrated a median progression-free survival of 11.14 months in comparison to Keytruda’s 5.82 months, the reigning standard of care in NSCLC. Furthermore, it reduced the risk of disease progression or death by 49% and boasted a similar safety profile to Keytruda. Summit claims that ivonescimab is the first drug to outperform Keytruda in a phase 3 trial for NSCLC.

Potential of Ivonescimab

Given that NSCLC accounts for a significant portion of Keytruda’s sales, ivonescimab, if approved in multiple key markets, could capture a substantial share of this revenue. Additionally, this drug is undergoing evaluation for other indications, including colorectal cancer, further expanding its potential market reach.

Are Summit Shares a Good Buy?

While Summit undeniably possesses a valuable asset in ivonescimab, its current market valuation of $17 billion, without a commercialized product, reflects heightened expectations. Consequently, investors face the risk of a drastic stock price correction if any setbacks occur with its leading candidate.

On a positive note, Summit’s financial runway seems secure, with $325.8 million in cash reserves as of the last quarter, extending its operations potentially until late 2025. Recent funding endeavors, following ivonescimab’s success, have further fortified the company’s financial position.

While Summit Therapeutics carries a degree of risk, the promising prospects of ivonescimab make it an appealing choice for biotech investors willing to weather the uncertainties. Continued positive developments could pave the way for substantial long-term returns.

Future Investment Considerations

Before making an investment decision in Summit Therapeutics, it’s essential to weigh all factors. Notably, the Motley Fool Stock Advisor team, renowned for its stock recommendations, recently highlighted ten stocks with potential for significant returns, excluding Summit Therapeutics from their list. Past instances, such as Nvidia’s monumental growth post-recommendation, underscore the power of strategic investment choices.

The Motley Fool’s Stock Advisor service, with a track record of surpassing S&P 500 returns, offers a roadmap to investment success. The potential to uncover lucrative opportunities underscores the importance of prudent investment strategies and informed decision-making.

Explore the 10 recommended stocks and contemplate the historical successes and potential future gains while considering Summit Therapeutics as part of your investment portfolio.

*Stock Advisor returns as of September 16, 2024