Amazon: A Pandemic-Era Investment Powerhouse

Investors worldwide have kept a keen eye on Amazon – the colossal e-commerce entity that has captivated households globally with its Prime subscription service. As the unchallenged leader in U.S. online retail with a staggering 38% market share, Amazon has orchestrated a strategic network of distribution centers, vehicles, and aircraft to facilitate rapid and efficient delivery nationwide.

The onset of the COVID-19 pandemic witnessed a surge in online shopping, catching even Amazon off guard. Responding swiftly, the company made substantial investments in expanding its logistical capabilities. Last year, Amazon ascended to become the largest delivery company in the nation, surpassing established players like UPS and FedEx, underscoring its competitive advantage in the online retail realm.

Andy Jassy’s Strategic Vision for Amazon

America’s retail landscape, according to Amazon’s CEO Andy Jassy, is a vast expanse brimming with untapped possibilities. Jassy’s recent shareholder letter hinted at prospective long-term ventures, with a special emphasis on the surge in demand for same-day delivery services. Noteworthy is Amazon’s robust infrastructure boasting 58 same-day fulfillment facilities capable of slashing shipping readiness times to as little as 11 minutes for its top 100,000 products.

An intriguing prospect highlighted by Jassy is Amazon’s foray into the grocery market, a sector valued at over $900 billion in the U.S. wherein Amazon presently commands a meager 1% share. The expansion of same-day facilities alongside the envisaged deployment of delivery drones through Prime Air could potentially unfurl an entirely novel segment of the U.S. retail sector for Amazon to dominate.

The Deceptive Allure of Amazon’s Stock Prices

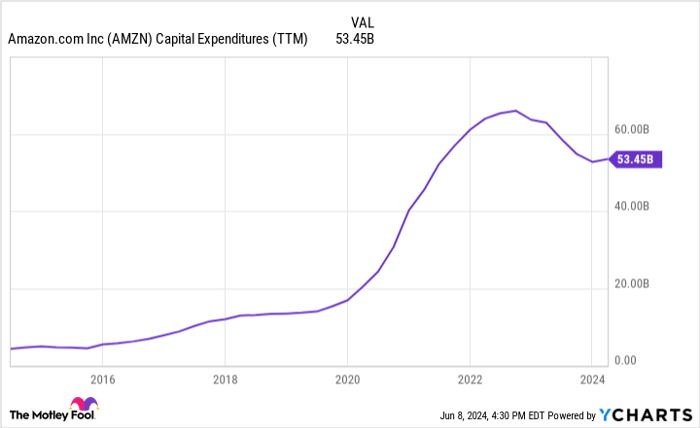

Despite Amazon’s stock soaring to record highs, portraying an illusion of steep valuation, a nuanced assessment reveals otherwise. The company’s enduring commitment to reinvesting substantial sums back into its operations for future growth presents a unique challenge in comprehending its true valuation.

In evaluating Amazon’s stock through the lens of its operating cash flow rather than traditional earnings metrics, a compelling narrative emerges. The graphs depicting Amazon’s price-to-cash-flow ratio illustrate that the stock might be more attractively priced than commonly perceived. With an exceptional return on invested capital averaging 10%, the unprecedented scale of Amazon’s recent investments could pave the way for prolonged earnings growth, particularly if the company succeeds in disrupting the grocery sector.

Navigating the Investment Landscape for Amazon

Before embarking on an investment journey with Amazon, it is prudent to consider a comprehensive evaluation of the market landscape. The esteemed analyst team at Motley Fool Stock Advisor recently unveiled their selection of the top 10 stocks poised for substantial returns in the foreseeable future – Amazon, unexpectedly, was not part of this elite group.

Reflecting on past success stories like Nvidia’s meteoric rise subsequent to its inclusion on a similar list in 2005, with a minuscule $1,000 investment back then translating to a staggering $740,690 return, sheds light on the transformative potential of strategic investments. The Stock Advisor platform empowers investors with a curated roadmap for success, complete with portfolio-building guidance, regular insights from analysts, and bimonthly stock recommendations that have significantly outperformed the S&P 500 since 2002.

It’s essential to tread cautiously in the investment realm, leveraging insights from reliable sources to navigate the complex financial landscape. Amazon’s journey, underpinned by relentless innovation and strategic foresight, exhibits a pathway laden with promise for savvy investors seeking to capitalize on the paradigm-shifting disruptions rippling through the retail sector.