Financial giants have made a conspicuous bullish move on MicroStrategy. Our analysis of options history for MicroStrategy MSTR revealed 260 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 68 were puts, with a value of $5,924,510, and 192 were calls, valued at $14,870,105.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $2.0 to $530.0 for MicroStrategy over the last 3 months.

Insights into Volume & Open Interest

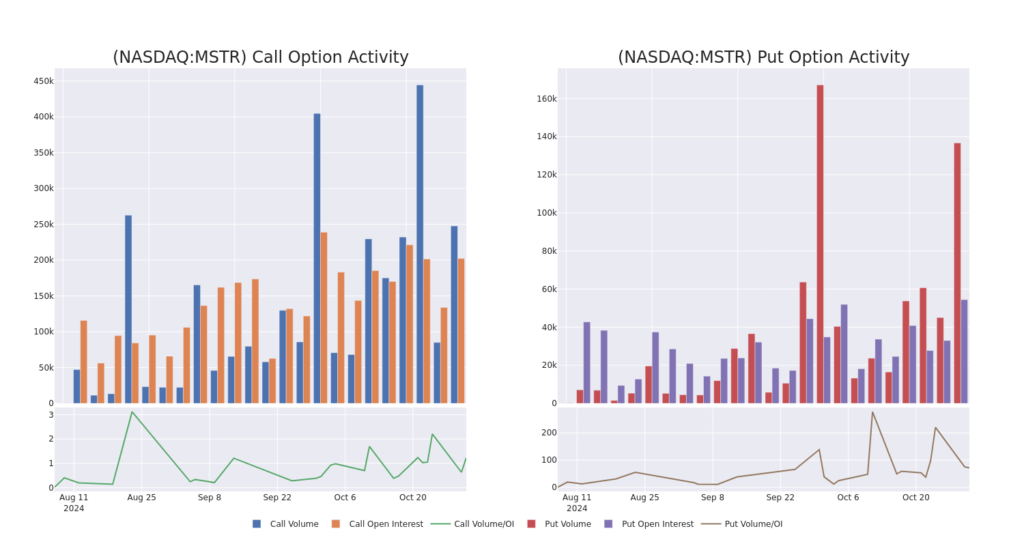

In terms of liquidity and interest, the mean open interest for MicroStrategy options trades today is 1148.51 with a total volume of 96,975.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for MicroStrategy’s big money trades within a strike price range of $2.0 to $530.0 over the last 30 days.

MicroStrategy Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSTR | PUT | TRADE | BULLISH | 01/17/25 | $245.6 | $244.9 | $244.9 | $470.00 | $391.8K | 0 | 16 |

| MSTR | CALL | TRADE | BEARISH | 01/15/27 | $96.55 | $90.8 | $92.6 | $330.00 | $250.0K | 73 | 27 |

| MSTR | PUT | TRADE | BULLISH | 12/06/24 | $150.8 | $149.7 | $149.7 | $375.00 | $209.5K | 0 | 14 |

| MSTR | PUT | TRADE | BEARISH | 12/20/24 | $39.05 | $38.7 | $39.05 | $240.00 | $195.2K | 1.6K | 119 |

| MSTR | CALL | TRADE | NEUTRAL | 01/15/27 | $115.9 | $110.1 | $112.7 | $240.00 | $146.5K | 413 | 22 |

About MicroStrategy

MicroStrategy Inc is a provider of enterprise analytics and mobility software. It offers MicroStrategy Analytics platform that delivers reports and dashboards and enables users to conduct ad hoc analysis and share insights through mobile devices or the Web; MicroStrategy Server, which provides analytical processing and job management. The company’s reportable operating segment is engaged in the design, development, marketing, and sales of its software platform through licensing arrangements and cloud-based subscriptions and related services.

Having examined the options trading patterns of MicroStrategy, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

MicroStrategy’s Current Market Status

- With a volume of 8,350,233, the price of MSTR is down -1.01% at $227.39.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 92 days.

Expert Opinions on MicroStrategy

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $275.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from BTIG continues to hold a Buy rating for MicroStrategy, targeting a price of $240.

* An analyst from Barclays has decided to maintain their Overweight rating on MicroStrategy, which currently sits at a price target of $275.

* An analyst from Bernstein has decided to maintain their Outperform rating on MicroStrategy, which currently sits at a price target of $290.

* Consistent in their evaluation, an analyst from Maxim Group keeps a Buy rating on MicroStrategy with a target price of $270.

* Consistent in their evaluation, an analyst from Canaccord Genuity keeps a Buy rating on MicroStrategy with a target price of $300.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for MicroStrategy, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs