Deep-pocketed investors have adopted a bullish approach towards Dell Technologies, symbolized by DELL on the NYSE. Their strategic moves suggest a brewing storm that market players dare not overlook. Despite the shroud of mystery cloaking these investors, the monumental shifts in DELL’s options market herald imminent tremors rippling through its ecosystem.

A total of 49 remarkable options activities were unearthed today by Benzinga’s diligent scrutiny, an anomaly not to be dismissed lightly. The heavyweight investors seem to teeter on a seesaw of sentiment, with 44% tilting towards bullish inclinations and 36% casting wary bearish glances. In this high-stakes arena, 16 puts totaling $765,105 vie against 33 calls amounting to $3,389,894, painting a vivid picture of diverging expectations.

Predicted Price Range

Peering into the Volume and Open Interest metrics of these contracts, a distinct price corridor emerges, spanning from $90.0 to $200.0, where Dell Technologies is projected to oscillate in the imminent future.

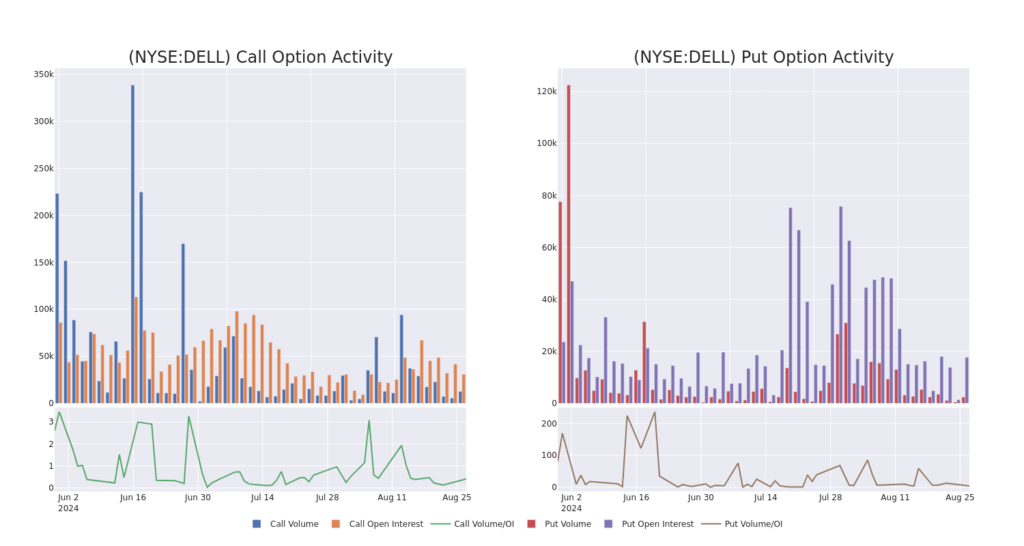

Volume & Open Interest Trends

Casting a discerning eye over liquidity and interest, the prevailing mean open interest for Dell Technologies options stands at 1520.06, with a cumulative volume of 15,152.00, underscoring the resounding resonance of market forces at play.

In a retrospective look encompassing the last 30 days, a snapshot captured within the following chart unveils the intricate dance of volume and open interest within a strike price spectrum ranging from $90.0 to $200.0, portraying the intricate tapestry of Dell Technologies’ varied options movements.

Dell Technologies 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DELL | CALL | TRADE | BEARISH | 12/20/24 | $11.4 | $11.1 | $11.2 | $120.00 | $1.5M | 558 | 1.3K |

About Dell Technologies

Dell Technologies stands tall as a prominent information technology vendor, specializing in elite hardware offerings for enterprises. Focused on premium and commercial personal computers and on-premises enterprise data center hardware, Dell commands a substantial presence in key markets such as personal computers, peripheral displays, servers, and external storage. Leveraging a robust ecosystem of partners, Dell navigates its sales journey with a heavy reliance on channel partners to bolster its market foothold.

Dell Technologies’s Current Market Status

- Amidst a trading volume of 5,019,578, DELL’s trading price registers a marginal 0.1% uptick, resting at $111.78.

- RSI indicators allude to a potential overbought scenario lurking beneath the surface.

- The eagerly anticipated upcoming earnings report is slated for release in a mere 2 days.

Expert Opinions on Dell Technologies

In a recent flurry of activity, 5 seasoned analysts unveiled their verdicts on Dell Technologies, converging on an average target price of $137.8.

Engaging in options trading inherently amplifies the stakes, infusing higher profit prospects tinged with commensurate risks. Astute options aficionados deftly navigate this perilous terrain through continuous education, strategic trade scaling, multi-indicator diligence, and unwavering vigilance over market fluctuations.