Financial giants have made a conspicuous bearish move on Cleveland-Cliffs. The analysis of options history for Cleveland-Cliffs (CLF) revealed 13 unusual trades.

Delving into the details, it was found that 38% of traders were bullish, while 61% showed bearish tendencies. Out of all the trades, 7 were puts valued at $636,740, and 6 were calls valued at $433,100.

The Forecasted Price Range

Based on the trading activity, it appears that significant investors are aiming for a price territory stretching from $8.0 to $22.0 for Cleveland-Cliffs over the recent three months.

Insights into Volume & Open Interest

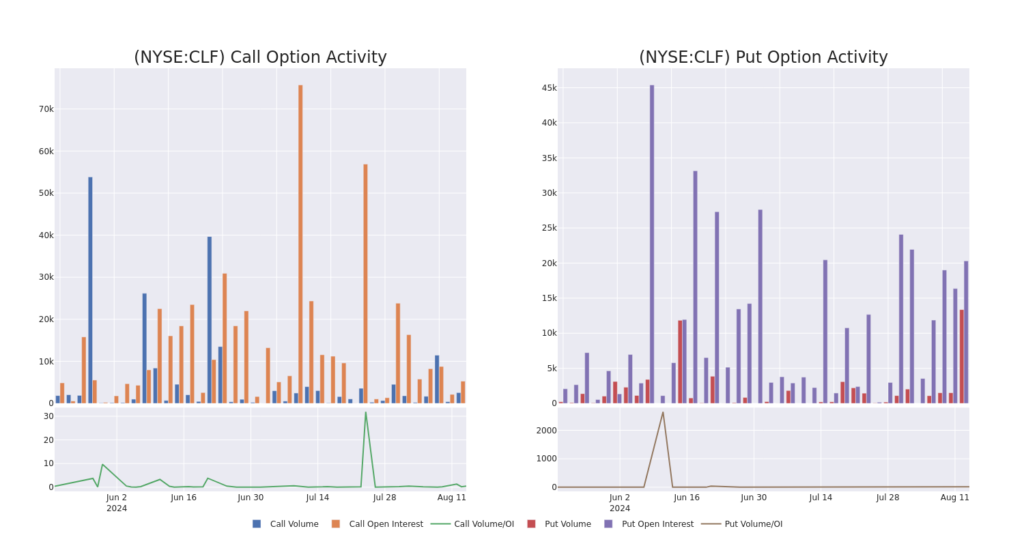

Regarding liquidity and interest, the mean open interest for Cleveland-Cliffs options trades today stands at 2325.36 with a total volume of 15,920.00.

Observing the chart below, we are able to follow the development of volume and open interest of call and put options for Cleveland-Cliffs’s significant trades within a strike price range of $8.0 to $22.0 over the last 30 days.

In-Depth Look at Cleveland-Cliffs Option Activity in the Last 30 Days

Analysis of the Largest Options Trades Observed

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CLF | PUT | TRADE | BEARISH | 10/18/24 | $0.35 | $0.31 | $0.35 | $11.00 | $315.0K | 863 | 9.0K |

About Cleveland-Cliffs

Cleveland-Cliffs Inc is a major flat-rolled steel producer and manufacturer of iron ore pellets in North America. The company, organized into four operating segments, operates through one reportable segment – Steelmaking. It serves a diverse range of markets and is a key supplier to the automotive industry in North America.

After a thorough review of the options trading surrounding Cleveland-Cliffs, a detailed examination of the company’s current market status and performance is warranted.

Current Position of Cleveland-Cliffs

- With a volume of 7,113,947, the price of CLF is down -0.23% at $13.0.

- RSI indicators suggest that the underlying stock may be oversold.

- The next earnings report is expected in 68 days.

Options trading presents higher risks and rewards compared to stock trading. Serious options traders carefully manage this risk through education, strategic trades, and market vigilance.

If staying updated on the latest options trades for Cleveland-Cliffs intrigues you, consider utilizing a service that provides real-time options trade alerts.