Alphabet: The Cash Cow Waiting to Milk Dividends

Alphabet, a pivotal player in the tech industry, holds the potential to transform into a cash-generating gem for investors – yet, it has refrained from sharing the wealth through dividends.

In the fiscal year 2023, Alphabet raked in a staggering $74 billion in net income, positioning itself as one of the top profit generators among the elite “Magnificent Seven.” With its robust financial standing, Alphabet stands out as a prime candidate for initiating dividend payouts, long overdue.

The Wealthy War Chest and the Dividend Dilemma

Alphabet boasts a substantial balance sheet, with a hefty $111 billion in cash reserves versus a meager $13 billion in debts – an enviable cushion unrivaled within the “Magnificent Seven” cohort. Despite returning capital to shareholders through buybacks, Alphabet remains one of the few non-dividend paying stocks among its peers.

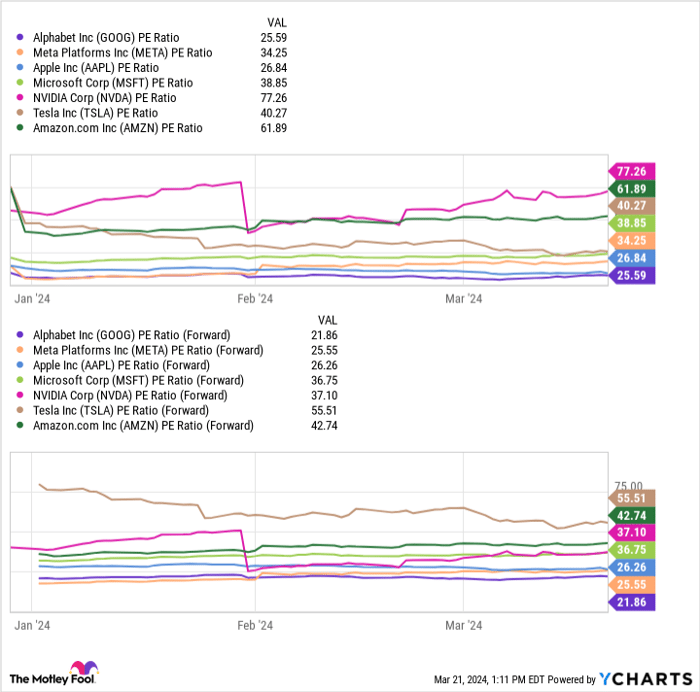

Arguably, Alphabet’s reluctance to pay dividends seemed justified, given its precedence in buyback largesse, fueled by its attractive stock valuation – the cheapest among the elite group. Nonetheless, adopting a dividend policy could edge Alphabet closer to a wider investor base, enticing dividend-centric funds.

The Dichotomy of a Dividend Decision

However, Alphabet’s management has been reticent about initiating dividends, partly due to concerns around the evolving AI landscape potentially disrupting its core search business. Amidst these uncertainties, Alphabet’s advancements in AI, notably the upgraded Gemini 1.5 large language model, highlight its proactive stance in harnessing futuristic technologies.

Despite the compelling narrative around Alphabet’s AI prowess, the company faces significant capital outlays to fortify its AI, Google Cloud, and broader technology capabilities. This aggressive investment cycle might delay the advent of regular dividends, mirroring the caution exhibited by fellow tech giant Meta Platforms.

Dividends: A Near-Future Possibility for Alphabet

Nonetheless, as Alphabet’s AI endeavors gain momentum and its innovative products garner market traction, the anticipation of dividends becoming a stalwart feature is not far-fetched. Despite a plausible delay in 2024, shareholders could potentially witness a gradual transition towards dividend payouts in the forthcoming years.

The Hunt for Hidden Gems: Unveiling Ten Exciting Stocks for Discerning Investors

Unveiling Ten Potential Market Titans

The Motley Fool Stock Advisor analyst team has pinpointed a selection of ten stocks poised to potentially deliver outstanding returns over the next several years. These carefully identified stocks encompass a range of sectors and exhibit qualities that hint at future success in the market.

Strategic Investment Insights

Stock Advisor aims to equip investors with a comprehensive investment strategy, offering expert advice on constructing a robust portfolio, regular insights from seasoned analysts, and two brand-new stock recommendations each month. The track record of the Stock Advisor service speaks for itself, having surpassed the S&P 500’s performance by a remarkable margin since its inception in 2002.

Witnessing the Rise of Market Dynamos

Among the stocks identified in the list of the top ten stocks, Alphabet, a tech giant, surprisingly did not make the cut. However, the stocks that did secure a spot are projected to showcase significant growth potential, promising substantial returns for investors looking to expand their portfolios.