Analysts Unanimously Favor Amazon for 2024

Amazon.com, Inc (AMZN) is gaining significant attention in the first week of 2024 as a multitude of analysts have designated the e-commerce titan as a top pick for the year.

Rare Consensus on Wall Street

On Wednesday, five distinct analyst firms bestowed Amazon with the title of their top pick for 2024, an unusual occurrence that underscores the widespread enthusiasm for the company’s projected performance.

Analysts Behind the Endorsement

Some prominent firms that have marked Amazon as their best bet for the upcoming year include Goldman Sachs, Wells Fargo, BofA, Citi, Evercore, Berstein, Roth MKM, Baird, RBC Capital, and others.

Factors Driving Analyst Optimism

During a segment on CNBC’s “Squawk On The Street,” CNBC business and technology reporter Kate Rooney revealed the underlying rationales for such unanimous enthusiasm towards Amazon.

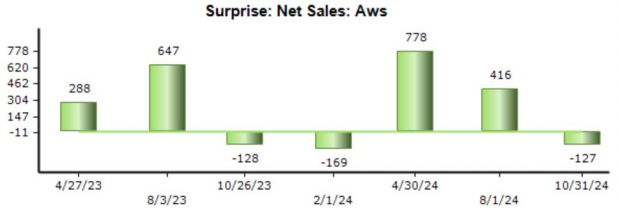

Revamped Growth of Amazon Web Services

Analysts have lauded the resurgence of Amazon Web Services (AWS) driven by heightened cloud spending and stabilized cloud revenue, which has been a consistent driver of optimism among analysts.

Underappreciated AI Exposure

Additionally, analysts have asserted that Amazon’s role in the forthcoming commercialization phase of AI is underrated, positioning the company as a leader in influencing the evolution of AI.

Operating Efficiency and Advertising Opportunity

Furthermore, analysts have underscored Amazon’s operational efficiency, which is anticipated to uplift gross margins. They have also mentioned the potential of advertising as a substantial contributor to the company’s top-line growth in 2024.

The ‘Everything Stock’

Wedbush has gone as far as dubbing Amazon the “everything stock” this week, a testament to the extensive faith in its multifaceted business model. Satori Fund even suggested Amazon could serve as a defensive play in portfolios during recessions, supported by its historical market share gains during economic contractions.

Read Next: Threat For Amazon? TikTok Planning Massive US E-Commerce Expansion With $17.5B Revenue Goal: Report

AMZN Price Action: Amazon shares have surged approximately 75% over the last year. As of Thursday afternoon, the stock was trading down 2.15% at $145.28.

Photo: Courtesy of Amazon.