Concerned about turbulent market conditions? Fearful of a financial tempest brewing both at home and overseas that could send stocks into a tailspin?

If so, this quintet of stocks may be your financial life vest. Sporting a robust yield of up to 7.3%, these stocks are steadfastly constructed to brave economic Armageddon. They are the “low beta” warriors capable of calming even the most jittery investor nerves. (Pass the beetroot juice!)

We shield ourselves from the bearish onslaught with hefty dividends and negligible betas. Beta gauges an investment’s volatility relative to a benchmark.

When a stock boasts a beta of 1, it matches the volatility of “the market.” Conversely, a beta of 0.5 implies only half the volatility of the S&P 500. In layman’s terms, if the market dips 10%, our losses would amount to a mere 5%.

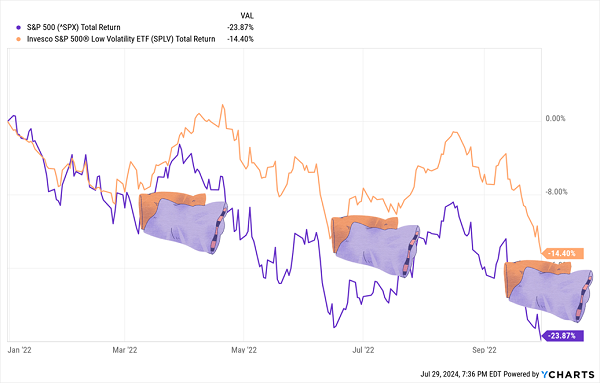

The true efficacy of this approach shines in tumultuous markets. Witness how low beta stocks outperformed the index as stocks tumbled in the annus horribilis of 2022:

Fortifying against Market Tumult

However, it’s vital to remember that while low volatility provides a shield against downturns, it may also cap the potential for upside gains. Therefore, our quest is to unearth the crème de la crème—companies that can mitigate downside risk, furnish substantial income, and pivot swiftly when the bulls come charging back.

So, let us delve into the realm of these five low-beta dividend darlings presently offering yields that outpace the market by 3 to 5 times.

1. Amcor: Packaging Potential

Amcor (NYSE:) (4.8% yield) may not fit the conventional low-beta mold. Nestled in the cyclical materials sector, Amcor stands as an outlier. Specializing in various packaging solutions—from food shrink bags to pharmaceutical blister packaging—the company caters to consumer and healthcare giants.

While consumer demand remains a crucial factor, Amcor’s diversified product portfolio helps mitigate the sector’s usual volatility tied to specific product categories.

After weathering a prolonged period of weakness due to lackluster consumer demand, AMCR shares are staging a recovery. Fueled by aggressive cost-cutting measures bearing fruit and volume improvements, the company is on an upswing.

2. Northwest Bancshares: Financially Steady

Northwest Bancshares (NASDAQ:) (5.7% yield) dances to its tune in the financial realm, projecting a defensive stance in a cyclical domain. Serving as the parent company for regional financial heavyweight Northwest Bank, with a network of 131 full-service community branches across multiple states, it embodies stability within the financial sector.

Despite operating in a cyclical arena, NWBI shines with robust capitalization and a low-risk loan profile compared to its regional peers. Offering the desired blend of resilience during market downturns and opportunistic gains during bullish spells.

3. Getty Realty: Stability Personified

Getty Realty (NYSE:) (6.0% yield) is a perennial entrant in my research purview. While growth prospects may not dazzle, Getty epitomizes the adage “boring is beautiful.” As a real estate investment trust (REIT) with a vast footprint of single-tenant retail properties nationwide, Getty’s tenant mix predominantly comprises convenience stores, ensuring a steady revenue stream.

Despite exposure to interest rate fluctuations and the specter of an EV-dominated future impacting its gas station properties, Getty stands tall. Resilient post a dividend cut in 2012, the REIT recovered and has consistently augmented payouts. Trading with a five-year beta of 0.92 and a one-year beta of 0.40, Getty exudes relative calmness amidst market turbulence.

4. Universal Corp: Stuck in Neutral

I harbor a desire to embrace Universal Corp (NYSE:), (6.1% yield). Nestled in the steadfast tobacco industry, it boasts a high yield and a diversified business model, shunning finished products in favor of tobacco supply.

Diversifying its portfolio over the years, with ventures like Universal Ingredients and Universal Enterprises, Universal Corp flaunts a low-volatility profile with a five-year beta of 0.79 and a one-year beta of 0.47.

Yet, signs of meaningful growth are elusive. Stagnant dividends and lackluster stock performance underline its unimpressive trajectory compared to broader market movements.

5. Omega Healthcare Investors: Sheltering Elders

Omega Healthcare Investors (NYSE:) (7.3% yield) operates as a triple-net REIT catering to… (Content truncated)

OHI: Navigating the Real Estate Investment Terrain

The Unsteady Path and Recent Resilience

Through financing and capital solutions to skilled nursing facility and assisted living facility partners, OHI has weathered turbulent times with a five-year beta of 0.96 and a one-year beta of 0.58, hinting at relative market wiggles quieter than anticipated.

During the COVID bear market, OHI, like many, experienced pronounced challenges with senior-related properties witnessing a surge in fatalities, deterring potential tenants. Compounded by a pre-existing supply surplus in senior housing, the sector faced a formidable test.

Though the aftermath of the pandemic has subsided, and OHI’s shares have surpassed pre-COVID levels, tranquility remains elusive, signaling persisting instability.

Shifting Tides and Positive Signals

In April, the Centers for Medicare and Medicaid Services (CMS) issued crucial staffing regulations for U.S. skilled nursing facilities, shedding light on underserved facilities. Senior housing, however, demonstrated growth in both occupancy and rates, alongside improving reimbursement standards for SNFs.

This juxtaposition appears to favor OHI and its sector counterparts, with overall outcomes leaning towards the positive side.

Analyze the Data, Follow the Trends

Observing OHI’s operational resurgence, recent months have witnessed a surge in its stock value. Principally, as a Real Estate Investment Trust (REIT), OHI significantly hinges on interest rate dynamics, with investor sentiment aligning closely with the Federal Reserve’s rate adjustments.

Pursuing Steady Gains and Secure Income Streams

In a realm influenced by Powell & Co.’s decisions, the interplay with market forces impacts OHI alongside its peers, necessitating a strategic approach to mitigate volatility.

Seeking dependable investments that provide stability, stocks and funds less reliant on headlines prove invaluable for long-term portfolio sustenance.

Striving for Financial Independence in Retirement

With retirement aspirations often entwined with financial security, an 8% dividend yield emerges as a compelling threshold for self-sustained income. Such returns can yield substantial monthly dividends to fortify one’s financial footing.

Eschewing the unpredictable for the comforting embrace of steady, monthly dividend payments can bolster individuals aiming to retire with a reliable income source.

The Path to Retirement Success

Embracing a meticulous approach to selecting investments, anchored in a blend of resilience and growth potential, can pave the way for a prosperous retirement free of financial stress. Pairing robust dividend yields with anticipated price appreciation ensures a robust nest egg capable of weathering market fluctuations.